Ugly day in the market. It’s a ways for the QQQQ to get to the 200dma, but I’m wondering if there’s a big gravitational pull in that direction from here. Looks about $40, right? Yeah, that’d make a lot of folks unhappy. Including me!

Ugly day in the market. It’s a ways for the QQQQ to get to the 200dma, but I’m wondering if there’s a big gravitational pull in that direction from here. Looks about $40, right? Yeah, that’d make a lot of folks unhappy. Including me!- I was hoping for more of a bounce to lighten up on, but now I’m not sure if we’ll get it. We’re heading to the end of the month where dollar-cost averaging starts through the first few days of February. Maybe that’ll float the averages up a bit. (Yes, should’ve acted last week. Doh).

- Hey Tiger, maybe I need to go to a Bull Market Addict treatment facility. Whaddya think?

- $AAPL craters on the day after announcing the iPad. Talking with folks at work, I don’t think it’ll be a big hit until later. Maybe version 2. Maybe an addition of support for Flash.

- I’m still looking forward to the next iPhone. Two months left until I can upgrade! When will Apple announce their next iPhone???

- President Obama will announce his jobs stimulus plans tomorrow. A $5000 tax credit for each new hire and a reimbursement of the Social Security tax businesses pay on the increase in their payrolls this year. (Capped at $500K). And companies can’t lay off 20, and then hire 10 to get the bennies!

- $AMZN earnings surprise to the upside! Amazon CEO Jeff Bezos highlighted the success of his company's Kindle electronic reader. "Millions of people now own Kindles," he said in a prepared statement. "We sell 6 Kindle books for every 10 physical books."

- Yeah, well we shall see how the iPad affects that going forward, Mr. Bezos.

- $MSFT profit soars with Windows 7. "Exceptional demand for Windows 7 led to the positive top-line growth for the company," said Peter Klein, chief financial officer at Microsoft. "Our continuing commitment to managing costs allowed us to drive earnings performance ahead of the revenue growth." Hey, I like Windows 7 so far on my new Dell. Say, I wonder how earnings will be for PC makers, eh?

Thursday, January 28, 2010

Fugly Thursday

Wednesday, January 27, 2010

State of the Union/iPad Randomosity

The market actually held up better today. It is extremely oversold as we close on the end of the month and the beginning of the next, when 401k adds are typically dollar-cost averaged into the market. I remain 100% long, but watching the QQQQ just below the 50dma. Go North!

The market actually held up better today. It is extremely oversold as we close on the end of the month and the beginning of the next, when 401k adds are typically dollar-cost averaged into the market. I remain 100% long, but watching the QQQQ just below the 50dma. Go North!- My first reaction to the iPad is… BIG IPHONE! Reading around blog comments, I think folks are a bit skeptical. First, no webcam. Second, one-app at a time operating system (no multi-tasking). Third, high price if you add 3G and (yet another) monthly data plan. Finally, it doesn’t make phone calls.

- I think the iPad will be a hit. Like the iPhone, I’ll probably wait a generation or two before jumping in. I have an iPhone, so I don’t feel an urge to splurge on another portable device at this time. I’m looking forward to what the next generation of iPhone will contain, as I’m eligible for an upgrade soon!

- So, will $AAPL stock go up or crater on this thing? Hmm…

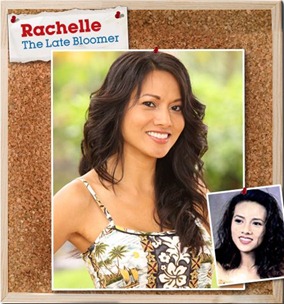

- The picture is of Rachelle from High School Reunion. Rachelle feels like she missed out on a lot in high school. She blames her controlling boyfriend, who she says didn't give her much of a chance to freely interact with her classmates. After high school, she married Liko, a former boxer who was undoubtedly the toughest guy in the graduating class of '89. After 16 years Rachelle decided she had enough. She's coming to her 20-year reunion newly divorced, looking to experience some of the things she missed and possibly take a chance at whatever romance comes her way.

- I listened to part of the State of the Union before my DVR demanded that I change the channel to one of the two shows I planned on recording. So I watched Psych instead. But I did hear about an hour of Obama.

- The funniest part of the State of the Union was when President Obama said he was going to freeze spending… next year. Was that one or two hand claps and guffaws by all? The other funny thing was when Obama mentioned the climate change “science,” and Pelosi, Biden and Obama himself all seemed to snicker. Yeah, it’s a money-grabbin’ scam. Snicker.

- There, I said it.

Saturday, January 23, 2010

3 Months of Gains Wiped Out in 3 Days

Jim Cramer says President Obama is “creating a one-man bear market.” Enough already. We know that he's anti-business. We know that he doesn't seem to understand the private sector. We know that he gets huge support from unions, particularly from state and local government unions. We know this. We know that he may not even use this moment of incredible jeopardy for Ben Bernanke's Fed re-up as a chance to "tack right," precisely because that would be pandering to the Massachusetts' Republicans, whom he obviously hates.

Jim Cramer says President Obama is “creating a one-man bear market.” Enough already. We know that he's anti-business. We know that he doesn't seem to understand the private sector. We know that he gets huge support from unions, particularly from state and local government unions. We know this. We know that he may not even use this moment of incredible jeopardy for Ben Bernanke's Fed re-up as a chance to "tack right," precisely because that would be pandering to the Massachusetts' Republicans, whom he obviously hates.- Of course, Jim Cramer said predicted a big rally the previous week with a Scott Brown win. Former Barack Obama supporter Jim Cramer on Friday said the stock market would have a huge rally if Scott Brown defeats Martha Coakley in Tuesday’s special senatorial election in Massachusetts.”I think investors who are nervous about the dictatorship of the Pelosi proletariat will feel at ease, and we could have a gigantic rally off a Coakley loss and a Brown win,” said Cramer.

- A little bit of this, a little bit of that.

- Ouch. It happened fast. 3-months of stock market gains wiped out in 3 days of furious selling. Big volume, lots of distribution. I can’t blame anyone for reducing some stock exposure. For the first time in a while, I am considering rotating out of some of my longs into cash or at least lower-beta positions.

- Listening to Bob Brinker as I type, and he’s really supporting Ben Bernanke for another term and blasting Senators who are not supporting the Federal Reserve Chairman. You know, Boxer, Feingold… etc. I agree. Bernanke should be reappointed. But a lot of those politicians are up for re-election and grasping at some sort of populist position that can boost their polling numbers!

- Haven’t watched Caprica, yet.

- Yikes, tornado warning in the Bay Area (Contra Costa county).

- Looks like there is a break in the stream of constant rain storms here in Sacramento. I’m going to try and get outside for a bit and survey the storm damage!

Wednesday, January 20, 2010

Stock Market Swoons

The stock market swooned, but came back quite a ways before the close. It’s difficult to look at the positives on a big down day, but coming back from the brink isn’t too shabby. Yes, there are reasons to be concerned with common topping action, wide point swings, and negative divergences. We are also seeing more stocks closing below moving averages. But I’m not giving up yet. If this is the big one, then I think we’ll see more attempts at a rally on light volume.

The stock market swooned, but came back quite a ways before the close. It’s difficult to look at the positives on a big down day, but coming back from the brink isn’t too shabby. Yes, there are reasons to be concerned with common topping action, wide point swings, and negative divergences. We are also seeing more stocks closing below moving averages. But I’m not giving up yet. If this is the big one, then I think we’ll see more attempts at a rally on light volume.- Maybe the selling was because of Scott Brown winning. Anyone? Or, selling the news of Scott Brown winning. Anyone?

- So, do I need an excuse for a Michelle Rodriguez picture? In Avatar, just like in Lost, they killed her off. Poor Anna Lucia.

- I posted this on my Amplog and Twitter, but forgive me for repeating the story on Michelle Obama’s war on childhood obesity. I think it’s great. Well done, first lady! The initiative will involve the federal government working with local officials and leaders in the business and non-profit sectors, she said, to provide more nutritious food in schools, allow more opportunities for kids to be physically active and give more communities access to affordable, healthful food.

- Speaking of, I need to lay off the cookies. Man, double trouble having a cold (thus not exercising) and eating junk food. C’mon, Muck!

- Did you read about Keith Olbermann’s attack on Scott Brown? Is there a lost and found somewhere that has a bucket of Olbermann’s marbles? There has to be a line somewhere between being funny and snarky versus just plain mean and obnoxious.

- Sarah Palin on Bill O’Reilly’s show is kind of weird. I dunno. She’s doing movie reviews as I type. I guess that’s a good place for her to be.

- Amazon’s Kindle hiking royalties to 70%. Is this the smartest move ahead of whatever kind of tablet PC Apple is launching?

- Rex Ryan says the Jets aren’t afraid to compete with the Colts. I hope he realizes that Curtis Painter will not be playing at QB this weekend for the Colts.

Tuesday, January 19, 2010

The Massachusetts Miracle Randomosity

- Scott Brown declared the winner in MA. I think people like checks and balances. MA is one of the most left-leaning states in the union, and they went Republican. Hooray for checks and balances. Nice move, folks. Of course, the Democrats still have a big majority. This at least puts the filibuster in play now and then.

- Of course, now the Republicans will make the mistake of believing that this is a mandate for the Tea Party (or whatever). I don’t think so. This is a mandate for checks and balances, and against one-party rule.

- The stock market rallied today! Anticipating a Scott Brown win, or bouncing back from last week? Either way, nice to see the bump. I remain long, but wary of a sell off at any time. I haven’t positioned my portfolio for a correction, yet. Still think we have a shot at upside, so hanging on.

- Saw Avatar yesterday at the IMAX. It was pretty good. Maybe a little letdown because the film won the award for 2009 and I went in with high expectations. But it was good. I don’t think it was necessary to see in 3D, though. It was mostly disorienting to me. LOL.

Sunday, January 17, 2010

Brett Favre - Pants on the Ground

LOL, Fox has been running this commercial almost non-stop since American Idol was on last week. Now, Brett Favre carries the tune to "new heights."

Friday, January 15, 2010

TGIF Randomosity!

The picture is of a Korean “racequeen,” maybe trying to check tire pressure. Look at the stock market pressure today, and it looks like we have a leak. Despite Intel’s good news last night, the market seems to be reacting to mounting loan losses reported by JP Morgan (at least that’s what the Yahoo Finance page says). Rising loan losses in JPMorgan Chase & Co.'s consumer bank business and a disappointing reading on consumer sentiment sent investors rushing from stocks Friday.

The picture is of a Korean “racequeen,” maybe trying to check tire pressure. Look at the stock market pressure today, and it looks like we have a leak. Despite Intel’s good news last night, the market seems to be reacting to mounting loan losses reported by JP Morgan (at least that’s what the Yahoo Finance page says). Rising loan losses in JPMorgan Chase & Co.'s consumer bank business and a disappointing reading on consumer sentiment sent investors rushing from stocks Friday.- Analysts worried about “peaking” earnings in Intel. While J.P. Morgan's Christopher Danely cited "truly impressive results," he pointed to signs that company's margins and earnings appeared to be "peaking." "Although we believe Intel is executing flawlessly, we are seeing several signs of a peak in the stock in terms of gross margins and earnings," Danely wrote.

- $145B in bonuses? That’s why people are ticked off.

- CPI tame. The consumer price index increased 0.1% in December, down from a 0.4% advance in November. This is the lowest rate since July and is slightly below expectations of a 0.2% rise. The core CPI -- excluding food and energy costs - also rose 0.1%, a tick more than the unchanged reading in November but in line with expectations of economists surveyed by MarketWatch.

- But Starbucks is raising prices. Starbucks is raising prices on certain drinks by as much as 35 cents in large U.S. markets and in Canada as part of what the coffee chain calls its "normal course of business."

- Staying home sick today, making it a long weekend. Slept in until 10am!

Thursday, January 14, 2010

The Flu and Cold Edition

I had some concern for the market earlier this week as the Nasdaq led the decline and seemed the weakest. But I haven’t been motivated to do much until earnings reports come in and investors react. I think today’s after earnings on Intel could be good news for bulls.

- Intel Corp. on Thursday posted a huge jump in fourth-quarter profit, topping Wall Street estimates, as the world's biggest chipmaker saw higher sales for PC processors. Shares of the Santa Clara, Calif.-based chip company rose more than 1% in after-hours trading, after rising more than 2% in regular trading.

- If you can help Haiti, help. Skip the Friday latte and send the $5 to Haiti.

- President Obama proposes a bank fee: Launching a populist salvo at Wall Street in an election year, President Barack Obama on Thursday proposed a special 10-year fee on large financial companies to repay taxpayers for the "extraordinary" assistance they got to keep the economy from collapsing in late 2008. How this works is that the banks raise their fees to consumers to pay this bill, and the bonuses still get handed out. The taxpayers pay twice.

- If I had only known! Baidu goes up 5% on the Google-China flap.

- Democratic negotiators acceded to union demands for a scaled-back tax on high-end health-insurance plans, exempting union contracts from the tax until 2018, five years beyond the start date for other workers. Just my opinion, but if we’re going to have a universal health care system, shouldn’t everyone participate? Why are we excluding union workers from chipping in?

- JP Morgan reports tomorrow! Watch the financials!

- Picture is of Bones’ Michaela Conlin, who plays Angela Montenegro.

- Yes, still under the weather. I’ve been going to work this week as there is so much to do. But I left early today and napped for 4 hours. Taking tomorrow off to sleep in. Maybe I’ll sleep all day!

Monday, January 11, 2010

Indicators: Wall Street vs. Main Street

I found this a well-written piece on how market technitions view the economy versus people working from 9-to-5.

For months now, there's been considerable debate about whether the U.S. economy is on the road to recovery.

Bulls point to the massive monetary and fiscal stimulus that's been pumped into the economy, the sharp rebound in share prices, and the relative improvement in certain indicators as a reason for optimism.

Bears -- like me -- note the persistent negative sentiment on Main Street and in many corporate boardrooms, the steady increase in foreclosures, personal bankruptcies, and the ranks of the long-term unemployed, and the numerous imbalances -- including still-very-high levels of public and private debt -- that remain unresolved.

So who's right?

Read the rest.

I think the stock market looks forward while people tend to reflect on the past an project that same pattern forward.

Sick Day Randomosity

I get the feeling the market is hanging in there in front of earning season. I’m stating the obvious, but we’ll have to see how stocks react. I remain 100% long for now.

I get the feeling the market is hanging in there in front of earning season. I’m stating the obvious, but we’ll have to see how stocks react. I remain 100% long for now.- China’s exports increased 18% in December.

- Monday night… Heroes… Ali Larter. So you know.

- President Obama going after Wall Street bonuses. It’s a shame that companies don’t exercise more common sense here, rather than forcing the heavy hand of government.

- Harry Reid’s comments on Barack Obama? Yes, if a Republican had sad that, they’d be marching him off to the gallows. I don’t know if I support “turnabout is fair play” here. President Obama says he’s not offended.

- New York has banned smoking and trans fats. Now they’re going after salt. Yeah, lets paraphrase a Beach Boys song here, “Fun, fun, fun, til the government takes your t-bird away.”

- Sarah Palin joins Fox! Who didn’t see that one coming?

- In fantasy football, my picks all play each other in the coming weekend. I will lose half my team!

- I haven’t been watching Heroes in real time. Instead, using streaming Netflix to catch up. I’m almost done with the first half of the season!

- Yesterday’s 51-45 Arizona win over Green Bay? Defense wins championships!

- Home sick today. Slept until 11am and wearing down quickly.

Friday, January 08, 2010

Friday Night Randomosity

I see California is requesting billions from the US or else we’re kicking the poor and the mentally disabled out on the streets! “It's time to enact long-term reforms that will change the way the most populous state and the federal government work together," Mr. Schwarzenegger said. He and state legislative leaders plan to visit Washington to lobby for bailout money. White House budget officials weren't available for comment on the governor's request. Request, ransom demand, whatever - lets not argue the semantics. You get the idea. Looks like the White House budget officials were planning on how to make the money drop.

I see California is requesting billions from the US or else we’re kicking the poor and the mentally disabled out on the streets! “It's time to enact long-term reforms that will change the way the most populous state and the federal government work together," Mr. Schwarzenegger said. He and state legislative leaders plan to visit Washington to lobby for bailout money. White House budget officials weren't available for comment on the governor's request. Request, ransom demand, whatever - lets not argue the semantics. You get the idea. Looks like the White House budget officials were planning on how to make the money drop.- The jobs report today? Sure, more job losses. His agenda altered by the Christmas bombing attempt, President Barack Obama pivoted back to the domestic economy on Friday, promoting new U.S. spending to create tens of thousands of clean-technology jobs. I think this should’ve been on his agenda MONTHS if not a YEAR before the Christmas bombing attempt. Oh, and he mumbled something about “green jobs.” Or clean technology jobs. Or clean energy jobs. Something like that. You know the drill, make a speech every once and awhile and hope it all goes away. In between bombings, I guess.

- Well, the IMAX theater is sold out tomorrow for Avatar. How bad is the economy really?

- Even with the jobs news, US stocks hit 15-month closing high. The DOW, anyways. SP500 is at October levels. I remain 100% long and trying to avoid the itchy trigger finger to sell stocks. I don’t see a reason to panic out yet.

- Thank God the President won’t pre-empt the first episode of the season finale of Lost. Rassmussen polls had the Democrats losing the Senate and House in 2010 if Obama dared cross Lost fans. But White House press secretary Robert Gibbs assured viewers Friday that he "doesn't foresee a scenario in which millions of people that hope to finally get some conclusion in 'Lost' are pre-empted by the president." Maybe Gibbs should’ve prefaced that with the bad news being more folks are losing their jobs, but the good news is that it doesn’t mean they have to miss Lost.

- Yes, Lost’s Yunjin Kim pictured.

- That’s it. I hope you have your fantasy football playoff entries in!

Wednesday, January 06, 2010

Wednesday Thoughts

- Not too worried or excited about the first few trading days of 2010. I think the news flow is okay. I don't see anything technically that makes me feel concerned or giddy with excitement. Just status quo and remaining 100% long. I don't see a reason to change anything yet.

- I think the new Google phone could be just as popular as the 2009 Palm Pre! Look, everyone loves the iPhone and the reviews for the Google phone are mixed at best.

- Work. Busy. 2010 gone wild already!

Sunday, January 03, 2010

2010 Guru Predictions

Want to see the 2010 picks and predictions from the Fox Business Block gurus? Here are the stocks, 12/31/2009 closing prices, and market predictions for 2010.

Bulls and Bears

Gary B. Smith: MA up 50% ($255.98 Tobin Smith: SYNA up 75% ( $30.65) Pat Dorsey: APOL up 50% ($60.58) Eric Bolling: C up 100% ($3.31) Cavuto

Patricia Powell: CAKE ($21.59) Gary Kaltbaum: TEVA ($56.18) Adam Lashinsky: BG ($63.83) Forbes on Fox

*Pending* (haven’t watched it yet)

Cashin’ In

Jonathan Hoenig: DOW 11,250 and HIT ($30.68) John Bradshaw Layfield: DOW 9,500 and RIMM ($67.54) Wayne Rogers: DOW 11,600 and PGJ ($24.10) Jonas Max Ferris: DOW 11,000 and NOK ($12.85) Tracy Byrnes: DOW 12,000

Transcript on Fox News on Monday. I’ll update the Forbes on Fox picks as soon as I can.

There you go. If you page back a few entries, you'll see how they did in 2009. And also my thoughts for 2010.

The January Effect

Do you want to read about the "January effect?". Here is an article about it.

"If the first five trading days of January are up, the end of January will usually be up and the correlated end of the year is usually up," says Ray Harrison, Principal of Harrison Financial Group in Citrus Heights, Calif.

Link

FWIW!

2010 Thoughts

Heading into 2010, I believe there are a few things to keep an eye on. We’re still early in the economic recovery, so I expect an upside bias to the stock market. But history shows that mid-term election years tend to see a market correction followed by a big rally. Wage growth will still be tough. I think state and local governments will be surprised on the upside by 2009 tax returns come the April filing, and that will relieve some of their deficit issues. But states are still dealing with high unemployment. I expect unemployment to creep down as companies begin to hire folks in anticipation of steadier growth ahead.

I think the economic recover will be slow but steady. So I’m looking for a return in the SP500 of about 10%. Not going out far on the limb.

As for my portfolio, I remain 100% long but will watch closely for the mid-term correction to lighten up in anticipation of more attractive prices and a rally into year-end.

Saturday, January 02, 2010

2009 Gurus in Review

Lets review the Fox Business Block stock pickers' picks for 2009. Here I listed them back on January 2, 2009 and now with their results.

Bulls and BearsNothing really surprises me about these picks and results. 2009 was a fantastic year. There were a few clunkers in there, but overall the winners did very well. I guess we avoid Hoenig's and Roger's picks from Cashin' In, eh?

- Gary B. Smith: Fannie Mae (FNM: $.76 to $1.18)

- Tobin Smith: Quanta Services, Inc. (PWR: $19.80 to $20.84)

- Pat Dorsey: WellPoint (WLP: $42.13 to $58.29)

- Eric Bolling: Google (GOOG: $307.65 to $619.98)

Cavuto

Forbes on Fox

- Patricia Powell: 3M Co. (MMM: $57.54 to $82.67)

- Charles Payne: Apple (AAPL: $85.35 to $619.98)

- Adam Lashinsky: Walgreen (WAG: $24.67 to $36.72)

- Matt McCall: iShares High Yield Corporate Bonds (HYG: $76.01 to $87.84 - not including dividends)

Cashin' In

- Evelyn Rusli: URS Corp (URS: $40.77 to $44.52)

- Jack Gage: Energizer (ENR:$54.14 to $61.28)

- John Rutledge: Apple (AAPL: $85.35 to $210.73)

- Victoria Barret: salesforce.com (CRM: $32.01 to $73.77)

- Jonathan Hoenig: Tokyo Stock Exchange REIT Index (JRE: $21.70 to $18.80)

- Wayne Rogers: Abraxis Bioscience (ABII: $65.92 to $40.55)

- Jonas Max Ferris: WADDELL AND REED FINANCIAL (WDR: $15.46 to $30.54)

Oh, and what did I predict?

My prediction? I think that the policy of the Fed and stimulus spending from the Obama administration will lead to a rebound in the economy later this year or in 2010. But that will start to show up in stocks in 2009, as the market starts to discount the future. I think it's possible that we retest the 2008 lows once again, but that a new bull market will begin. The first year gains from the bull market will be substantial, so I'm predicting a 20% rise in the SP500 in 2009.

Blindfolded monkeys throwing darts at squirrels in the forest and all.

Coming up... 2010 predictions! But that's for tomorrow as I watch football. I am in three leagues, and made it to the championship in two of them. I think because of the coaches benching players, one league is lost. The other is more in play. But overall, I'm not sure why I'm in leagues that play their championships in week 17. This has happened more than once where teams are scrambling for garbage players to replace the studs that got them to the championship game.

2009 Performance

The headlines say that from 2000-2009, investors did poorly. But here is a great column from the NY Times that suggests otherwise.

For Savers, It was Hardly a Lost Decade

If you invested $100,000 on Jan. 1, 2000, in the Vanguard index fund that tracks the Standard & Poor’s 500, you would have ended up with $89,072 by mid-December of 2009. Adjust that for inflation by putting it in January 2000 dollars and you’re left with $69,114.

But that is not how most real people invest. They don’t pour everything they have into just one type of asset and then add nothing to it for 10 years. Instead, they buy stocks of all sorts, and bonds and perhaps other things, too. And many millions of them dutifully add more money regularly, usually into a retirement account that they won’t touch for longer than a decade.

For those people, it was not a lost decade at all. Even those who started with a low six-figure balance could have doubled their total savings in the last 10 years.

How?Well! I left a cliffhanger! But the answer is diversification and steady dollar-cost investing month after month. Read the link and realize that nobody every invested all their money at the exact top or exact bottom. It's a long journey that requires dedication, patience, and sometimes, looking the other way.