Thursday, October 30, 2014

Monday, October 27, 2014

$TWTR - Twitter Crash!

$TWTR - Twitter stock crashing after earnings this afternoon. I follow this one and facebook as they both seem to take a lot of my online time.

Sunday, October 19, 2014

IBD Top 50 Stocks Strategy – 10/19/2014

Here is the latest on the IBD 50 stocks investing strategies vs. $SPY

Despite the crazy hair-pulling volatility, the IBD 50 portfolios outperformed the broad index this week. For the week, there were 32 stocks up and 18 stocks down for the IBD 50.

ATHM led the IBD 50, up 18.19% for the week. The biggest loser for the IBD 50 was LAD, down 12.84%.

The IBD 50 portfolios total return since 2/8/2014 are underperforming the SP500. For anyone expecting a bounce or a rally into the end of the year, what outperforms from here? Will the strategies continue to lead the way in the direction the market is heading?

The portfolio is sold at the closing price Friday night, and rebalanced into the make-up of the IBD top 50. Dividends are excluded from total returns.

Trading costs $706.45.

The IBD monthly strategy is mixed versus the SP500.

The portfolios concentrated in fewer holdings are performing better than the more diversified portfolios. Only the IBD 5 has a positive return at this time.

The IBD 50 has 7 gainers and 43 losers.

ATHM is the top performer for the IBD 50, returning 12.31%. The weakest stock in the IBD 50 so far is SLCA, losing 24.28%.

Trading costs $149.25

I will assume a $9.95 trading cost to sell last week’s or last month’s portfolio, and $9.95 to buy the new weekly or monthly portfolio. (Imagine the costs of doing this with individual stocks, compared to using Motif. Note that Motif limits the size of portfolios to 30 stocks).

The Top 25 holdings are listed at at Motif Investing. (A check as of 3/31/2014 shows that the ability to view all holdings is limited to Motif members and IBD subscribers).

None of the above strategies are a recommendation to buy or sell stocks. These are model portfolios constructed for entertainment only.

This is the IBD portfolio performance since 2/8/2014. Each portfolio begins with $10,000 and then invests an equal amount in the top 5, 10, 25 and 50 IBD stocks at the closing prices on Friday for the weekly model, and at the closing prices on the last trading day of the month for the monthly model. Since IBD changes the make up of their top stocks daily, this will only rebalance on Fridays or end of month. It is assumed that trading costs are $9.95 to “buy” a model portfolio, and $9.95 to “sell” a model portfolio. Thus, each weekly or monthly rebalance out of the previous portfolio and into the new portfolio costs $19.90. Daily changes in the IBD 50 or stock rankings are not considered. Changes in IBD’s overall market views are not considered. Stop loss orders or other market timing strategies are not considered. The value for SPY is based on buying 2/8/2014.

Based on a blog entry from Paladin Money. See Investors Business Daily for more information on the IBD 50. See Motif Investing for their IBD Top 25 portfolio, and the ability to construct your own portfolio of stocks.

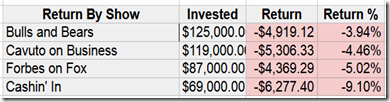

Fox Business Block Gurus Update – 10/19/2014

Here is an update on how the Fox Business Block gurus are doing year to date compared to the indices (excluding dividends). This return is based on investing $1000 per weekly stock pick at the closing price Friday night.

Here is an update on how the Fox Business Block gurus are doing year to date compared to the indices (excluding dividends). This return is based on investing $1000 per weekly stock pick at the closing price Friday night.

Larry Glazer has only made one pick, F (Ford). He lead the league for awhile, but that company has taken a hit lately.

Rich Karlgard has also made just one pick, INTC (Intel).

Ben Stein makes a rare appearance near the top of the list. The index trackers seem to be holding up better than individual stocks, and Ben tends to stick to picks that track a market index or are at least widely diversified.

It doesn't surprise me to see Gary B. Smith and Gary Kaltbaum near the top of the list. I've often thought that those two seem to be the most consistent. Maybe this kind of study is confirming my gut feeling.

Charles Payne "tends to" pick volatile stocks. As the market trends strongly in one direction or another, his picks have a little extra beta to the upside or downside. One of his picks in April, $GTAT, went bankrupt. That’s a -100% return for this study.

At some point, I will go over each guru's best and worst picks. Maybe during a lopsided Thursday Night Football game. (As if we haven't had enough of those...)

Nothing shocking here. My suspicion was that the Cashin' In gurus would underperform the other gurus, and that most all of the gurus would underperform the SP500 (SPY).

Wednesday, October 15, 2014

Panic at the Disco

$SPY $QQQ - buying some stuff near the lows. Did some this morning already.

Tuesday, October 14, 2014

Market Thoughts!

$SPY - The stock market has been in correction mode the last couple of weeks, and where the heck have I been! I am partially in cash and waiting for someone to ring a bell at the bottom of the correction.

$SPY - The stock market has been in correction mode the last couple of weeks, and where the heck have I been! I am partially in cash and waiting for someone to ring a bell at the bottom of the correction.

BEST STRATEGY EVER!

But seriously, I have had a watch list ready for the last few weeks with stocks I have been wanting to buy. I may have missed a few at yesterday’s lows. But I do think that the bull market is still on. I started adding to some positions Thursday and Friday, and plan to continue here and there. I would love to see a big gap down early in the morning and a reversal through the day.

Here are a few bullet points.

- The Federal Reserve: Tapering ends soon and the Fed flooding the country with cash ends! I believe this has made the rich richer, going into stocks and real estate. Of course, this has also helped the economy as a whole. Today, a Fed Head said that the Fed would be willing to revisit Quantitative Easing if the economic numbers stalled out. “Data Dependent” is the new phrase that pays.

- Ebola: We don’t know how bad that is or will be down the road. It is scary. I think this impacts travel stocks. So things like airlines, cruise ships, and travel related companies are going to struggle. Folks are buying out Hazmat suits! Every sneeze seems to halt an airline. With a long incubation period, this could continue to keep folks scared for a while.

- Russia: The Ukraine crisis is on Page 2 these days, but the impacts from Russian mischief are impacting Europe and world economies. Heck, i remember early on when I tried to play Russian stocks for a bounce and hoped there would be a quick resolution. It drags on and on. I’m out of those stocks, by the way.

- Europe: See above. Germany is tanking, for goodness sakes.

- Goofy Stocks: I’m looking at you, $GPRO and $MBLY. But there are also biotechs and other companies that either have IPO or ramped up without much if any earnings.

- Oil: Falling oil prices are a positive impact on all of us. The less we spend on gasoline, the more money we have to spend on other things. (Like hazmat suits). The oil boom in the US is having a huge impact on world oil markets. Combine that with declining demand due to slowing world economies, and prices have been falling.

- US Election: Every four years, there seems to be a stock market correction and then a powerful rally into the next year, that coincides with the US mid-term election. The reasons for the correction differ from cycle to cycle, but it seems to happen no matter what.

Posted by muckdog at 10:03 PM View Comments

Labels: Dallas Cowboys Cheerleader, ebola, federal reserve, spy

Saturday, October 11, 2014

Update – The IBD Top 50 Stocks Strategy

Here is the latest on the IBD 50 stocks investing strategies vs. $SPY

Another bad week for the IBD 50 portfolios. Yuck!

When the stock market is in an uptrend, the IBD 50 portfolios outperform. When the stock market is heading south, the IBD 50 portfolios do much worse. There is no surprise what happened here this week. For the week, there were 0 stocks up and 50 stocks down for the IBD 50.

XRS led the IBD 50, declining 1.17 for the week. The biggest loser for the IBD 50 was EMES, down 21.89%.

The IBD 50 portfolios total return since 2/8/2014 are now underperforming the SP500. For anyone expecting a bounce or a rally into the end of the year, what outperforms from here?

The portfolio is sold at the closing price Friday night, and rebalanced into the make-up of the IBD top 50. Dividends are excluded from total returns.

Trading costs $686.55.

The IBD monthly strategy is underperforming the SP500.

The portfolios concentrated in fewer holdings are performing better than the more diversified portfolios. Only the IBD 5 has a positive return at this time.

The IBD 50 has 2 gainers and 48 losers.

AAP was the top performer for the IBD 50, returning 1.93%. The weakest stock in the IBD 50 so far is SLCA, losing 27.02%.

Trading costs $149.25

I will assume a $9.95 trading cost to sell last week’s or last month’s portfolio, and $9.95 to buy the new weekly or monthly portfolio. (Imagine the costs of doing this with individual stocks, compared to using Motif. Note that Motif limits the size of portfolios to 30 stocks).

The Top 25 holdings are listed at at Motif Investing. (A check as of 3/31/2014 shows that the ability to view all holdings is limited to Motif members and IBD subscribers).

None of the above strategies are a recommendation to buy or sell stocks. These are model portfolios constructed for entertainment only.

This is the IBD portfolio performance since 2/8/2014. Each portfolio begins with $10,000 and then invests an equal amount in the top 5, 10, 25 and 50 IBD stocks at the closing prices on Friday for the weekly model, and at the closing prices on the last trading day of the month for the monthly model. Since IBD changes the make up of their top stocks daily, this will only rebalance on Fridays or end of month. It is assumed that trading costs are $9.95 to “buy” a model portfolio, and $9.95 to “sell” a model portfolio. Thus, each weekly or monthly rebalance out of the previous portfolio and into the new portfolio costs $19.90. Daily changes in the IBD 50 or stock rankings are not considered. Changes in IBD’s overall market views are not considered. Stop loss orders or other market timing strategies are not considered. The value for SPY is based on buying 2/8/2014.

Based on a blog entry from Paladin Money. See Investors Business Daily for more information on the IBD 50. See Motif Investing for their IBD Top 25 portfolio, and the ability to construct your own portfolio of stocks.

The Fox Business Block Gurus Update

Here is an update on how the Fox Business Block gurus are doing year to date compared to the indices (excluding dividends). This return is based on investing $1000 per weekly stock pick at the closing price Friday night.

Rich Karlgard has also made just one pick, INTC (Intel). This should be interesting this week as the company reports earnings on Tuesday. Semiconductors had a bad week!

It doesn't surprise me to see Gary B. Smith and Gary Kaltbaum near the top of the list. I've often thought that those two seem to be the most consistent. Maybe this kind of study is confirming my gut feeling.

Ben Stein and Adam Lashinsky "tend to" (but not always) pick diversified index ETFs, large mutual funds, or Berkshire. It doesn't surprise me to see their results close to the SP500, but underperform due to expenses and fees of their holdings.

Charles Payne "tends to" pick volatile stocks. As the market trends strongly in one direction or another, his picks have a little extra beta to the upside or downside.

At some point, I will go over each guru's best and worst picks. Maybe during a lopsided Thursday Night Football game. (As if we haven't had enough of those...)

Sunday, October 05, 2014

Update – The IBD Top 50 Stocks Strategy

Here is the latest on the IBD 50 stocks investing strategies vs. $SPY

I’ve been tracking the IBD 50 stocks since February. When the stock market is in an uptrend, the IBD 50 portfolios outperform. When the stock market is heading south, the IBD 50 portfolios do much worse. This past week was a prime example of the latter. If the stock market reversed at the end of the week and is heading higher, then guess what’s going to happen to the IBD 50 stocks? Zoom! For the week, there were 20 stocks up and 30 stocks down for the IBD 50.

ALXN led the IBD 50 with a return of 6.16% for the week. The biggest loser for the IBD 50 was SLCA, down 14.31%.

The IBD 50 portfolios total return since 2/8/2014 are mixed versus the SP500. The portfolios containing a higher number of stocks tends to perform closer to the SP500, while the portfolios concentrated in fewer stocks tend to be more volatile!

The portfolio is sold at the closing price Friday night, and rebalanced into the make-up of the IBD top 50. Dividends are excluded from total returns.

Trading costs $666.65.

The IBD monthly strategy is a mixed bag compared to the SP500.

The portfolios concentrated in fewer holdings are performing better than the more diversified portfolios. Only the IBD 5 is outperforming the SPY at this time.

For the first few days of October, the IBD 50 has 21 gainers and 29 losers. The portfolios with more holdings are holding closer to the SP500, while the concentration in fewer high-flyers have taken more of a hit. But the latter has also outperformed since I started tracking the strategies.

ALXN was the top performer for the IBD 50, returning 7.33%. The weakest stock in the IBD 50 so far is SLCA, losing 13.04%.

Trading costs $149.25

As I have been reading reviews of investing and rebalancing into model portfolios, the trading costs of rebalancing weekly or monthly is often discussed. Going forward, I will list the “in and out” rebalancing costs for each strategy. I will assume a $9.95 cost to sell last week’s or last month’s portfolio, and $9.95 to buy the new weekly or monthly portfolio. (Imagine the costs of doing this with individual stocks, compared to using Motif. Note that Motif limits the size of portfolios to 30 stocks).

The Top 25 holdings are listed at at Motif Investing. (A check as of 3/31/2014 shows that the ability to view all holdings is limited to Motif members and IBD subscribers).

None of the above strategies are a recommendation to buy or sell stocks. These are model portfolios constructed for entertainment only.

This is the IBD portfolio performance since 2/8/2014. Each portfolio begins with $10,000 and then invests an equal amount in the top 5, 10, 25 and 50 IBD stocks at the closing prices on Friday for the weekly model, and at the closing prices on the last trading day of the month for the monthly model. Since IBD changes the make up of their top stocks daily, this will only rebalance on Fridays or end of month. It is assumed that trading costs are $9.95 to “buy” a model portfolio, and $9.95 to “sell” a model portfolio. Thus, each weekly or monthly rebalance out of the previous portfolio and into the new portfolio costs $19.90. Daily changes in the IBD 50 or stock rankings are not considered. Changes in IBD’s overall market views are not considered. Stop loss orders or other market timing strategies are not considered.

Based on a blog entry from Paladin Money. See Investors Business Daily for more information on the IBD 50. See Motif Investing for their IBD Top 25 portfolio, and the ability to construct your own portfolio of stocks.