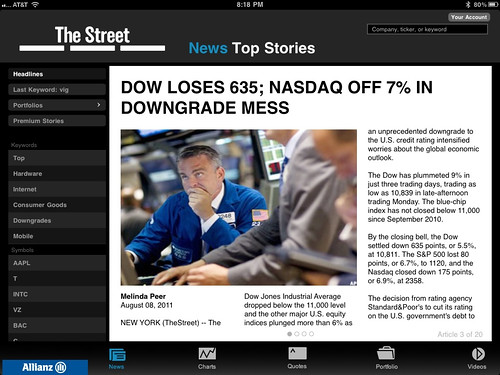

I added some $VB at the close, just to average down and give the latest trade a chance to bounce and level out. But it could just be catching a falling knife.

At least the VIX was green, eh?

Moves this big feel like capitulation, as if everyone is throwing in the towel and going to the beach. "Just get me out!"

The reason du jour? Worries about global economic slowdown, debt, etc. It's as if all the worries of the past few months all colluded together for this one big day -- or for the last two weeks. Remember the rallies we had where it didn't matter? Followed by the sell-offs where it did matter? We bounced back and forth all year long until this week, where the buyers didn't show up to take us back up to the top of the range. We fell. We fell through the bottom, and with the 200dma broken, the sellers picked up steam.

Where from here?

My strategy is always the same. I look for a trading range and divergences at bottoms or tops. Combine that with historical trends, the calendar, and sentimental nonsense, and I'll continue to do what has worked for me more often than not. I talk about what I do on the Audioboos. It just never feels good when I miss a call!

But it happens. Of course it does.

Overall, I think the market is worried about economic growth slowing. The really bad news is that the federal and local governments are hurting for revenues, and this won't help schools. This comes at a time where companies are worried about their tax rates, health care costs, and regulations. Where does growth come from at this point?

Rather than wax too pessimistic, I'll just restate that I added longs and more beta today. I'm still a believer in America and the future, even if growth is at a slower pace than we'd like.

My black box isn't saying much, and the other indicators aren't looking good, but I will look for and anticipate the next long and high-beta opportunity. I don't think it's all over. The market will continue to fluctuate and provide opportunities to grow a portfolio.

***

Meanwhile, the new puppy seems oblivious to the huge rise in the VIX today and seems more concerned about the flocks of geese flying overhead.

It’s a little underwhelming, considering the market activity since May. And today’s action was a bit underwhelming, but price is the ultimate indicator.

It’s a little underwhelming, considering the market activity since May. And today’s action was a bit underwhelming, but price is the ultimate indicator.