Saturday, February 27, 2010

Tsunami Watch in Hawaii

Update: Previous link is buffering. Another live webcam here: http://bit.ly/arJKP1

A lot of the webcams are struggling with the web traffic.

Watching the tsunami watch on Hawaii news here http://bit.ly/c1f6R4

Maybe if we’re watching for it, it won’t happen. Lets hope that there are no tsunamis.

Saturday Randomosity

- This weekend finds market sentiment firmly in the huh-I’m-not-sure camp. $$ This week’s II survey results see the “Correction” camp shrink from the multi-decade high of 39.7% to 35.6%. The bulls now take the lead with 41.1% and the bears trail with just 23.3%. To put this in perspective, it is higher than the Bull/Bear low we saw at the start of this month but it is not as high as we saw in January. So middle of the road, basically - and unfortunately, without much edge.

- In general, I think investing based on taxes makes for lousy returns. However, that isn’t stopping folks from fearing higher taxes in the near future and changing their investment strategies. Getting ready for higher taxes:

The Great Tax Dodge is under way already.

The how and which of tax increases are still unclear. But there is no question about the if: Higher taxes are coming.

Fearing that tax-code changes could slam fortunes large and small, investors aren't sitting still. In the first three weeks of February, they poured twice as much money into tax-free municipal-bond funds as into all foreign-equity funds combined. At Fidelity Investments and Charles Schwab Corp., account holders are converting taxable Individual Retirement Accounts into tax-free Roth IRAs at quadruple the pace of last year. And more executives are passing on deferred compensation in favor of cash today, tax experts say.

(Picture is of Carrie Underwood)

- I used to be in 1st place in my fantasy basketball league. Two off-again, on-again injuries and one bad trade later, I’m in 4th place and losing 7-1 this week to the #1 team. Ouch.

I see a bunch of links (on a daily basis) to the latest Paul Krugman columns. Bleh. I don’t even bother reading them. I just think that he is in constant spin mode for his political points of view. More power to him, and maybe he’s the greatest thing since Cheez Whiz, but no thanks. Pass.

I see a bunch of links (on a daily basis) to the latest Paul Krugman columns. Bleh. I don’t even bother reading them. I just think that he is in constant spin mode for his political points of view. More power to him, and maybe he’s the greatest thing since Cheez Whiz, but no thanks. Pass.- How to Stay Awake During Obama Speeches: Play Bullshit Bingo.

- Mustard seeds for deflation. When I look at the coming deflationary cycle, the pending growth of wage deflation plays a very integral part of that deflationary cycle. I'd like to highlight some thoughts on where/why we will see wage deflation to provide a visual of why wage deflation is inevitable.

- Did you read that up to 23,000 folks in Brevard County Florida will lose their jobs after space shuttle retirement. Ouch.

- Fannie Mae reports $15.2 billion loss. Heck, I spent almost that much at a Kings game recently. Have you seen the prices at the arenas? Fannie Mae reported a net loss of $15.2 billion in the fourth quarter of 2009 ... For the full year of 2009, Fannie Mae reported a net loss of $72.0 billion...

Verizon on the Black Box

More Black Box fun with $VZ. Here is Verizon on the Black Box daily. I don’t own any but have been thinking about it. I’ve been watching this one in anticipation of cracking into $T’s iPhone monopoly. Who hasn’t? Interesting below $30ish, eh?

I wanted to show the Oops in November 2009. The Black Box is never to be used as a trading system. It’s just another opinion. It also is not a system that buys break outs. It tries to pick bottoms or inflection points. It gets them wrong from time to time, because predicting the future is risky business no matter what kind of Black Box you use. (I want to say this with every chart, just to emphasize).

Verizon on the Weekly looks pretty murky, though. After the Black Box gave a sell signal in October of 2007, it hasn’t given a buy. I would surmise that the constant anticipation and rejection of iPhone availability is hampering an attempt to move to the upside. And now we have to wonder about Apple’s iPad, too. Is Apple going to forever be in harmony with ATT or will they branch out to other carriers?

I’ve received some feedback on the recent Black Box entries. Thank you for the comments. I have fun looking at stocks and sharing my thoughts. Technology makes the world go ‘round.

Friday, February 26, 2010

Finally a Friday!

Friday. Last trading day of February. 401(k) adds ready to pile in? $$ At least for the first few days, eh Norm Fosback?

Friday. Last trading day of February. 401(k) adds ready to pile in? $$ At least for the first few days, eh Norm Fosback?- “It’s gold, Jerry! Gold!” Kim Yu-Na.

- UCLA beat Oregon State, but the Pac-10 is pretty weak heading into March Madness.

- Former Governor Jerry Brown wants to take a look at the books of health care companies. The California state attorney general's office said Thursday that it had subpoenaed financial records of California's seven largest health insurance companies as part of an investigation into whether they illegally raised customer premiums and denied payment of legitimate claims.

- Hello, can of worms. What’s the goal? To put price controls on health insurance? Gee, price controls always work, eh?

- Price controls create man-made disasters. (An article after the 2008 flooding in Iowa).

- I’m going to show more Black Box charts. None today, as nothing much has changed. The Black Box says to stay out of the market. I’m still long, though.

Thursday, February 25, 2010

Thursday Night Randomosity

The market had a real chance to hurt the bulls, but the late day rally was positive. $$

The market had a real chance to hurt the bulls, but the late day rally was positive. $$- Marketwatch blamed job losses and European debt. Investors received evidence of just the opposite as the Labor Department said that weekly jobless claims unexpectedly surged last week by 22,000 to 496,000, their highest level in over three months.

- CA faces over a $20B deficit. Meanwhile, in more important matters, the Assembly passed a bill declaring a cuss-free week. Amid the ongoing — and occasionally tense — debate over how to clean up California's budget mess, lawmakers have taken time out to tidy something else almost as unmanageable: our language. This morning, the Assembly approved a ceremonial resolution turning the first week of March into "Cuss Free Week."

- I work for a living, so I missed the health care summit. Looks like everyone agreed to disagree, and it’s off to raise some funds for the November elections!

- More oil in North Dakota! We need the stuff. Drill baby, drill.

- I think the top 24 in American Idol are some of the worst ever. But they all sing way better than I can. Liked Ellen initially, but now she seems out of place.

- I feel bad for the family and friends of the person killed training the Killer Whale. It is a wild animal, you know. I generally feel sad for caged up animals. I’m glad they’re sparing the orca. "We have every intention of continuing to interact with this animal, though the procedures for working with him will change," SeaWorld wrote in its blog Thursday.

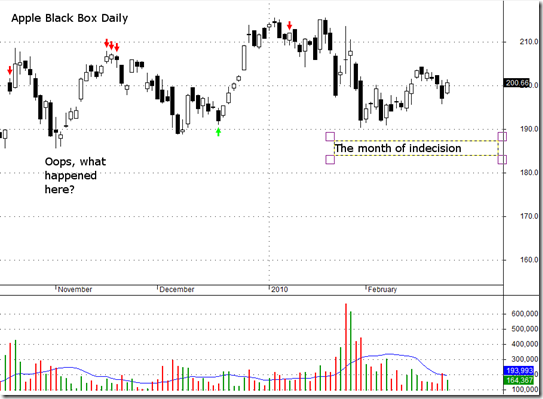

Apple on the Black Box

Lets poke some fun at my Black Box trading system with $AAPL stock! $$ Remember, this is not trading advice. It is more a showcase of things that affect my thought process. For better or for worse…

- Here is $AAPL on the Black Box daily:

- Here is $AAPL on the Black Box weekly:

- The weekly looks a bit ominous.

- No green arrow, but I think there’s a buy signal on her.

Wednesday, February 24, 2010

Toyota Stock Thoughts

I don’t know if $TM is keeping any secrets, but it seems as if the government is raking the company over the coals. Is the stock a buy? $$

I don’t know if $TM is keeping any secrets, but it seems as if the government is raking the company over the coals. Is the stock a buy? $$- The first car I bought was a Toyota Corolla. It was my “go mobile.” I even bought the hatchback (ooh, sexy Muck!) so I could throw my bike in there and take off for the mountains or coast for some cycling. It was extremely reliable and I rarely spent any money to fix the darn thing. Was it the sexiest car on the planet? Did I have race queens lining up in costumes loving me by proxy through my hot car? No.

- Why is the US government after $TM? Is this because Toyota isn’t a union shop? Is this because the US owns General Motors? Is this because this is an election year and politicians are grabbing at straws trying to gain your vote come November?

- I haven’t watched Glenn Beck (not pictured) today (or ever, actually), but I know folks who are big fans and emailing me what Glenn Beck had to say. I don’t know the scope of his words in their entirety, or if I’m reflecting his views correctly, but he seems to think it’s a big government plot to discredit the car company.

GLENN: Isn't congress the owner with the American people of Toyota's two big competitors?

GLENN: So isn't this like the board of directors of General Motors calling Toyota to testify in front of them on television and demanding that they explain why their cars are so bad?

- Yeah, well it’s all priced into the stock, efficient markets and all. So lets look at the Black Box view of the $TM chart!

- I think Toyota will get interesting the closer it gets to $60. If the Congress keeps the pressure on and the overall market is weak, it could get near there. Of course, with employment near 10%, maybe car companies have some room to fall even without recalls. But, I don’t think people who like Toyota’s are suddenly going to go buy an American car.

- Oh, my first car met its demise when somebody drove into my 8-year old car and rendered it completely useless.

- Yes, another race queen picture.

Zig Zag Wednesday

- It is rough being long or short with the market being undecided. $$

- Gut feeling is that the market isn't done going down. I thought yesterday's whoosh lower would be the start of something bad. But here we are moving back up.

- I'd watch what Bernanke does over what he says. But today he is saying that rates will remain low.

- The Senate passes a $15B jobs bill. At the rate the govt spends money, that $15B will create about a dozen temporary jobs that pay about $40K a year. The rest of the $15B will just disappear....

Sunday, February 21, 2010

Weekend Snacking Randomosity (and Charts!)

- Good looking woman plus charts on $SMH and $AAPL. $$

- Looks like a pretty good snack idea in this picture somewhere. Just saying.

- Is there a bond bubble? And what to do about it. My take? I think there’s a case to be made for buying CDs or individual bonds with maturity dates over owning bond mutual funds and ETFs.

- Toying with the idea of moving the blog to a real domain, over blogspot. But I do like free. Then there’s the whole “all the domains are taken” thing.

- President Obama’s version of Health Care Reform expected Monday. The White House was expected to post a version of PresidentBarack Obama's plan for overhauling health care on its Web site on Monday, ahead of his critical and daring summit at Blair Houseon Thursday.

- I haven’t watched that much of the Olympics. I’ve been recording it, but it just sits there on the DVR.

- Nevada in budget squeeze. Nevada has been hit hard by both the foreclosure crisis and a sharp drop in gambling and tourism spending. The unemployment rate was nearly 13% in December, up from 8.4% a year earlier. Housing prices dropped 25% in the third quarter of 2009 from a year earlier, when they were already down 26%.

- I mention the Black Box from time to time. I normally don’t do charts or recommendations, as I certainly don’t want folks base their decisions on my programming skills or lack thereof. I often don’t follow the Black Box. It’s just another opinion.

- Here is a pic of the weekly on SMH. One of the best barometers (IMHO) on where the market is headed. I still believe tech leads the market up or down. (The QQQQ chart looks the same, FWIW).

- While I remain 100% long at this time, the Black Box is not in an uptrend at this time. The chart includes the price, volume, and MACD. Neither of the last two are components (directly) of the Black Box, but I like to see what’s going on when the Black Box gives a signal.

- Here’s how AAPL looks on the same weekly Black Box view:

- So you can see why I don’t follow the Black Box hook, line and sinker. It will tend to give multiple signals over a few days or weeks, and there is usually time to check out other things.

- And sometimes the Black Box is just plain wrong!

Thursday, February 18, 2010

The End of the Low Interest Rate Era?

Uh oh, is it the end of the Low Interest Rate Era? $$

We all knew it would end eventually. Plus, this probably confirms that the economy is recovering. But where there is one rate hike, there are usually more to follow.

The Fed raised the rate it charges banks for emergency loans by a quarter percentage point, but emphasized that the step didn't represent a broader tightening of credit.

Link

Tuesday, February 16, 2010

IBD: Not a Follow-Through Day

Advance was strong enough, but volume was lacking. Market remains in a correction according to the IBD gurus.

Caveat is, IMHO, they'll change from correction to uptrend sometime *after* the market has hit its inflection point and bounced up.

BusinessWeek on Small Caps

BW wonders if small caps' reign is over. $$ Contrarian sign to load up on small caps?

Small-cap stocks' reign over larger rivals may be ending, done in by a weak earnings season and worries about a slow economic recovery. Small-cap stocks dominated large-cap stocks during the last decade.

... with exactly half the S&P 600 reporting, small-cap stocks have shown slower-than-expected earnings growth and flat revenues.

Link

Good column with numbers and stats from BW (via their iPhone app). Yes, small caps have come out of a rougher stretch than the bigger names. But I still believe that smaller companies will outperform and outgrow larger companies.

Pic is of Moon Bloodgood!

I Wonder What Warren Buffett is Doing?

Warren Buffett selling energy? Why? Stronger $$ ahead? Hmm...

Warren Buffett continued to pare his investments in energy companies during the fourth quarter, while boosting his stake in a waste management provider, a regulatory filing showed Tuesday.

Link

Sunday, February 14, 2010

Valentine’s Day Lingerie Randomosity

Yes, more Valentine’s Day lingerie pics. A good reason to spend $$ today, IMHO.

Yes, more Valentine’s Day lingerie pics. A good reason to spend $$ today, IMHO.- The “real genius” of Google Buzz. I have an account, but I’m not sure I understand how this revolutionizes how we interact. Okay, I have another thing to click below my inbox in Gmail. But I rarely go to the gmail site, as I tend to email from the iPhone or Thunderbird.

- Japan’s economy beats expectations.

- First bike ride of 2010 in the books. Only 15 miles, and my hands were very uncomfortable. Got back and raised the handlebars a bit. Went out another few miles, and I think that helped out a bit. But it was a nice ride in upper-60’s weather. Lots of folks out throwing baseballs, cycling, and jogging. I love to see folks taking their dogs for a run. Happy-happy dogs.

- 24 shutting down production while Kiefer Sutherland has surgery. Hey, I like that show.

- Is Sarah Palin cunning? You had to wonder if Palin, who is nothing if not cunning, had sprung a trap. She knows all too well that the more the so-called elites lampoon her, the more she cements her cred with the third of the country that is her base. Her hand hieroglyphics may not have been speaking aids but bait. Uh-huh. I’m not buying it. I don’t believe she thinks beyond the current chess move. Er, checkers.

I see on Yahoo Finance that Robert Kiyosaki has a financial article up about a “dead cat bounce.” Not linking to it. I read one of his books back in the day, and didn’t think much of it.

I see on Yahoo Finance that Robert Kiyosaki has a financial article up about a “dead cat bounce.” Not linking to it. I read one of his books back in the day, and didn’t think much of it.- I do like Jeremy Siegel: The Fed Must use its new Policy Tool Soon. Basically, Jeremy writes that the Fed needs to start reducing all the liquidity in the system or risk inflation. I agree with that.

- On the other hand, CNNMoney writes that we should be watching China, not the Fed.

- A friend wrote me to say that if the Vancouver Olympics had to open up with music, why not Canadian band Rush?

- I hope everyone’s Valentine’s Day has a happy ending.

Happy Valentine’s Day Randomosity

It’s Valentine’s Day, and every man is on the hook to make this “her special day.” MD 20/20 and lingerie might make it your special day, but I bet she’s expecting a little more. Agreed?

- Caught up on the Olympics opening ceremony. That was very boring. Thank goodness for FF on the DVR! The ice projections stole the show. More of that next time.

- Upcoming: Microsoft to unveil Windows Mobile 7 on Monday. Is anyone still using smart phones that run Windows Mobile?

- This summer? New Zhu Zhu pets. Man, those were the best-selling toys of 2009?

- Did you catch Mark Hulber't’s column, where he notes that the increase in corporate buyback programs is a bullish omen?

- Did you read where Fidelity is letting customers trade 25 iShares ETFs for free? Fidelity's alliance with ETF heavyweight BlackRock Inc.could mark a major milestone for the business. Fidelity is allowing customers to trade 25 iShares ETFs from BlackRock for free.

- More to come. I’ve spent the morning in the yard trimming and cutting plants and doing general pre-Spring clean-up. Spring comes early in California. Now, I think I’ll head out on a bike ride. Cheers!

Friday, February 12, 2010

Abby Joseph Cohen Update

In my 2009 review, I didn’t update Abby Joseph Cohen’s forecast! Here’s what she said in January, 2009:

Jan 1, 2009: Leading the bulls is Abby Joseph Cohen of Goldman Sachs. She's calling for a big jump in the S&P 500 index, to end the year at 1,150. Cohen expects the market leaders to be energy and technology and she thinks U.S. stocks and high-quality corporate bonds will pay off when the economy stabilizes, around midyear.

The S&P 500 ended 2009 at 1115.10. Pretty close. The economy didn’t actually “stabilize” in mid-year, and many would say that’s a goal we have yet to achieve.

What did Abby Joseph Cohen predict for 2010?

Cohen says she expects GDP growth of 4% to 4.5% in the current quarter. But she thinks that will slow in 2010 to about 2%, as the rough labor market and household balance sheet troubles will hold back growth. She also thinks corporate profits will be less than expected because inventories have already been rebuilt and the government’s stimulus programs will create less of a boost than they have in 2009. But, she adds, the average U.S. corporation is “flush” with cash right now, and she thinks the S&P 500 should get into the 1250-1300 range by the end of 2010.

Thursday, February 11, 2010

He who Hesitates

Had the $PM buy signal as I mentioned on Twitter but didn't act on it. Oops.

Smoke if you got ‘em.

Global tobacco giants are supposed to offer big dividends and even buy back their stock, but sales growth…come on.

Perhaps that’s why Philip Morris International, the world’s most valuable tobacco company, jumped 4% on Thursday.

The company, which also announced a new $12 billion buyback program over 3 years, said cigarette organic unit sales growth grew 0.4% in the fourth quarter. That was good news to investors and analysts alike.

Read more: Link

Monday, February 08, 2010

The Day After the Big Game

The market swooned on the day after the Saints beat the Colts. Getting the blame? Continued worries about Euro debt and rising US interest rates. Concerns that Greece's debt woes may spread to other nations mingled with the prospect that the Federal Reserve in the U.S. may soon begin tightening the spigot that helped fuel the markets' massive rebound. Traders cited a report in The Wall Street Journal on Monday that Fed Chairman Ben Bernanke is preparing a plan that the central bank will follow once the economy shows more signs of recovery.

- Wait – they’re preparing a plan? Now, that is scary. It’s definitely a change of course from their usual reacting to the news.

- I had a blog entry all thought out, with my next guess of what the Market Gods have in store. I was thinking that we’re likely to see a low-volume meander higher, maybe closing in on previous highs, followed by a dramatic drop that would result in a successful retest of the lows and launching the markets on to new highs. Today may have thwarted that. It seems like the market wants to go lower for now.

- More garbage coming in on global warming. At least we didn’t pass that cap and trade stuff.

- I followed the Sarah Palin weekend news from a distance. I don’t think she should try to run for President. Maybe her best career path is as a pundit. Reading about the “notes on the hand,” but who really cares? Our President meanders from teleprompter to teleprompter, and Lord help him if there is no teleprompter. What are we looking for, motivational speakers or strong leaders?

- Monday night season finale for Heroes. Lame plot line, but I’m watching anyways.

Sunday, February 07, 2010

Super Bowl: Reggie Wayne Pic

Reggie Wayne on a milk carton. Love those iPhone apps. Lol.

- Here is a Reggie Wayne on a milk carton picture for you.

- Nice job by the Saints. No turnovers. Executed well. Got the stops when they had to.

- I think the best commercial was casual Friday. The Who were okay. Halftime was snack time at the party.

Thursday, February 04, 2010

Horrible Day

Typical bear action. High volume selling on the bad days, low volume buying on the good days. No reversal today whatsoever. The down trend continues.

Typical bear action. High volume selling on the bad days, low volume buying on the good days. No reversal today whatsoever. The down trend continues.- Getting the blame? Lack of jobs and European debt. A flood of bad news, including rising debt levels in European nations and an unexpected jump in the number of Americans filing for unemployment benefits, had investors pulling money out of assets like stocks and commodities that are looking increasingly risky.

- What about American debt? President Obama and previously President Bush have not been shy about running up your deficit. The debt ceiling was just raised to over $14 trillion. President Obama’s budget has over a trillion dollars in deficits as far as the eye can see. Interest has to be paid on that every year. The amount of money paid in interest on the national debt is consuming a larger and larger percentage of the federal budget. At what point does that become a problem? Maybe that’s now.

- I don’t want to jump on the doomsday bandwagon, which many do after the market goes down a few percent. But, the deficits at the federal, state and local levels seem to be a systemic problem.

- I expect to see more government employee layoffs: Los Angeles Mayor Antonio Villaraigosa has ordered the immediate layoffs of 1,000 city employees to help to balance the city's budget.

- A guide to the Super Bowl.

- Seems to me the no brainer is the Colts and the over, so I went the other way and took the Saints and the under.

It is a Bad Day for the Markets

- “It is a bad day for the markets.” – Erin Burnett. Starting off grim this Thursday. I believe today is the first day of a potential IBD “follow-through day” for Monday’s move up, but it’s not looking good. What would be good? A reversal on high volume.

- And don’t look for Toyota’s brakes to stop this correction! Now, Toyota’s Prius hybrid brakes being looked at. Toyota’s estimated recall cost is $2B.

- President Obama calling for “civility in Washington.” Uh, isn’t this the guy who has been trash-talking the Republicans? Just last week he was talking down to the GOP. Just yesterday! In every speech, he blames every problem on “the last eight years.” He needs to amend that to “eight of the last nine years, excluding 2009.”

- The market does look forward, or sometimes has a news of the day panic attack, but looking in the rear-view mirror, we see that retailers posted strong numbers in January. So the economy is improving. Retailers continued their comeback, posting better-than-expected same-store sales in January, with long-suffering categories like department stores and apparel retailers finally showing signs that consumers are coming back.

- Thursday already!

Monday, February 01, 2010

Skimpy Monday

Okay, it WAS an up day. Volume a little skimpy, though: As seems to be the trend, Monday’s rally is coming on some pretty skimpy trading activity, which doesn’t exactly exude a whole lot of conviction on the part of traders and investors. It looks like we’ll be lucky to hit 4 billion shares in NYSE composite trading. Snoresville.

Okay, it WAS an up day. Volume a little skimpy, though: As seems to be the trend, Monday’s rally is coming on some pretty skimpy trading activity, which doesn’t exactly exude a whole lot of conviction on the part of traders and investors. It looks like we’ll be lucky to hit 4 billion shares in NYSE composite trading. Snoresville.- I suppose for the IBD folks, the next thing to look for is a follow-through day. Anyone think that’s coming at this point?

- Japan automakers rising. And this is just an excuse for me to post a race girl. Or is that racegirl, one word? Or race queen? Or racequeen? Whatever the search engines need, I suppose. In Japan, automakers were rising on short-covering, apparently triggered by Toyota Motor's announcement of plans to fix problematic accelerator pedals. The automaker's shares were heavily sold recently after it recalled vehicles in the U.S. and Europe because some gas pedals were sticking.

- Did you watch the Grammy’s last night? Usually, I skip celebrities backslapping celebrities. But for some reason, I watched and actually enjoyed most of the spectacle.

- I was in Reno over the weekend to place my Super Bowl bets. On the drive up there, I easily convinced myself that the Colts are just going to manhandle the Saints, with points falling like rain. When I arrived at the sports book to see the Colts favored by 6 and the over-under at 56.5, I just couldn’t do it. I love Peyton Manning, but I’m taking the Saints +6 and under on a 2-team parlay. Here’s hoping for a 24-21 game decided on the last play.