Heading in to the week, 401k additions could help keep a bid under the market in the month-end seasonal thing. I still feel a correction is coming sooner rather than later, but have held on to my longs as the bears haven't been able to gain any traction. Yet.

Here's a good commentary on the deficit and taxes. Nobody seems to care about all the red ink being produced in Washington DC these days. But it does matter.

***

If feels sad that August is ending and we head into September. I think that's a psychological hangover from childhood. As an adult, work is 52 weeks a year! Plus, football season is starting! ... Went to a barbeque/pool party yesterday in the 104 degree heat. Lots of shady spots and a pool made it nice outside. ... Watching Little League World Series.

Sunday, August 30, 2009

The Last Weekend in August

Friday, August 28, 2009

TGIF!

The week ended with the same sort of choppiness that has been the norm lately. I still have this feeling that a whoosh down is coming sooner rather than later, but remain 100% long at this time. If I had to make a guess, it'd be that we'd see the market stay afloat this next week heading into Labor Day but then run into trouble after the holiday.

The week ended with the same sort of choppiness that has been the norm lately. I still have this feeling that a whoosh down is coming sooner rather than later, but remain 100% long at this time. If I had to make a guess, it'd be that we'd see the market stay afloat this next week heading into Labor Day but then run into trouble after the holiday.

That's just a guess. I've heard and read similar guesses elsewhere, which makes the guess suspect. LOL.

I'm still long, concentrated in tech and small caps. It's tempting to rotate into lower beta holdings and maybe take some of the amazing gains off the table. Again, haven't done that yet.

**** * I'm in three fantasy football leagues! Good grief! Drafts over the next 2 weeks.

* I'm in three fantasy football leagues! Good grief! Drafts over the next 2 weeks.

* I was looking for NFL gear on the NFL site today, and adding things like gym shorts, pajamas, and jersies to my shopping cart. But when it came to check out and pay, I thought "$300 for a bunch of crap? Nah." Then closed the window. A cyber version of filling up the grocery cart, then abandoning it in the aisle.

Wednesday, August 26, 2009

Here Comes Month-End

The bears have had chances to take the market down, but the market has held up. Now we are approaching month end, with 401k adds coming. Folks are more upbeat about the economy, too.

I remain 100% long.

I'm wondering what will happen to interest rates and the bond market down the road. Not today's worry. But soon.

****

On my way back from a local Indian casino. Not nearly as many folks out gambling. I know it's a Wednesday night, but it used to be more crowded. Maybe folks are dealing with new car payments after getting cash for their clunkers!

Tuesday, August 25, 2009

Market Feels Squishy

It feels as if the market is getting a bit squishy on us. For quite a while, the market showed us softness in the mornings only to close strong. But now, we're starting to see a bit of the opposite. In the mornings, we're getting a pop and then the selling begins. We seem to be forming some resistance. I remain long, but for the short term, I'm wondering how much higher we can go.

***

I see the Post Office is offering $15K buyouts to encourage folks to retire. ... Beer prices going up? Bastards. Right ahead of football season, too. Forget cash for clunkers, we need cash for cerveza...

Monday, August 24, 2009

Reversal Monday

Financials reversed today and the market went with them. Early on, it looked like it was another day in the park.

Financials reversed today and the market went with them. Early on, it looked like it was another day in the park.

IBD's summary tonight says that Nouriel Roubini warned about a double-dip recession in Sunday's Financial Times. Seems like I've read that before, so not sure that's exactly new news.

Rumor out tonight that Presidnet Obama will nominate Ben Bernanke to a 2nd-term.

Month-end coming up, and I wonder if we'll get some tape painting? Hard to get a feel. The market has done opposite of what I expected this summer. I've been long and looking for a reason to get out, but haven't seen one. I know it's coming, and I hope I'm not asleep with a preseason NFL game on when it happens.

****

Other stuff... Audrina Patridge's Carl's Jr. commercial doesn't exactly make me want a hamburger... Up to 50% of us with the Swine Flu this year? Now we'll all be wondering if we have it with that first sneeze. Remember when it was called H1N1? That didn't last long... Do you watch Psych? LOL... The secret in Fantasy Baseball for pitching stats is to start pitchers at home, not on the road. At least that's my secret. Don't tell anyone!

Posted by muckdog at 8:11 PM View Comments

Labels: Audrina Patridge, ben bernanke, nouriel roubini

Sunday, August 23, 2009

IBD Whipsawed! Uptrend Resumes

I hope you weren't whipsawed by IBD this week. They went from a market in correction Tuesday morning to uptrend resumes this Monday morning. Even worse, is if someone acted on that first thing Tuesday or Wednesday morning, that was near the lows of the correction.

The market resumed the rally and closed out a strong week.

You know, I keep expecting seasonality to be a factor. But it's been the exact opposite. We're rallying this summer. I haven't sold anything and I'm looking for reasons to sell. Nothing yet. I've been close a few times to at least reallocating to a lower-beta, but haven't.

****

Blogging has been light. Work is overwhelming and I feel out of touch with current events. I assume health care is still the rage of talk shows? I did hear that the Miami Dolphins have two players with the Swine Flu. Working this weekend, but I have managed two bike rides and jumping in the pool afterwards.

Thursday, August 20, 2009

Looking for Divergences

Heck, IBD has the market in correction, and here we are near the bull market highs. IBD may be right. The correction may have started and we're just retesting previous highs. If so, then it's time to look to see if there are divergences in MACD, volume, etc. And there are.

As you can see, the MACD and volume are trending down as the market is making an attempt at the recent highs. As is the RSI. I wouldn't blame anyone, even myself, for lowering beta here. My hunch is that IBD is correct.

Tuesday, August 18, 2009

The Summer Correction… ?

IBD changed their market position after Monday’s close to “Market in correction.” After today’s positive move, IBD notes in Wednesday’s edition that the volume wasn’t great and retains the same view as yesterday.

- Just want to note that. At times, I follow a seasonal investing strategy that has me out of the market in the Summer months. Fortunately, I have remained long this summer. But the market has come up quite a ways and a correction makes too much sense. I don’t believe the bull market is over, however.

- Brett Favre signs with the Minnesota Vikings. He just can’t hang ‘em up.

- HP revenue drops. But keep in mind, that Windows 7 comes out in October. My thoughts are that will lead to a very nice upgrade cycle for PC makers.

- Sony cutting PS3 prices by $100. Not a bad deal for a gaming machine, blu-ray player, and a streaming media box for the TV. I have one!

- Inflation a no-show in July, and companies don’t have pricing power.

- Speaking of, everyone keeps looking for a bottom in the real estate market. Historically, home prices go up with inflation and wage growth. We’re not seeing either of those last two. No housing bottom until that changes.

Friday, August 14, 2009

Friday at the Clothes

- Well, even with the selloff today there was a flurry at the end of the day to close up off the lows. Enough to keep the SP500 over 1000. Market down almost 1% for the week, so the win-steak is over!

- Belichick to NFL: I’m afraid the Death Star is fully operational. Tom Brady back last night and plays the first half very nicely.

- Oil down to just over $67. Lots of talk about how if the world economies are improving, then that will increase demand and thus prices. Of course, oil has come up already from the mid-30s. Maybe some of that is priced in.

Friday Thoughts

Well, it was bound to happen eventually. The market pulling back large as I type. SP500 now under 1000 again. The last hour may be interesting, but seems like the bulls have been rescued lately by last ditch efforts in the last hour. We shall see!

Well, it was bound to happen eventually. The market pulling back large as I type. SP500 now under 1000 again. The last hour may be interesting, but seems like the bulls have been rescued lately by last ditch efforts in the last hour. We shall see!- Working from home today. Work has been very busy and stressful of late. I think one sign of economic recovery is that while companies have cut back employees, the work is increasing and existing workers are having to pick up the slack. Companies won’t rush to hire back; they just let folks go! Companies will want to see more stable signs. And those signs usually show up in the rear-view mirror as they analyze company numbers. So it could be a bit. Which means we’ll all be worked harder!

- Consumer morale down. U.S. consumers' gloom deepened in early August as worry about scarce jobs and falling income… Yeah, people are worried. It’s difficult to see the stock market advance and the financial articles talking about a recovering economy when in the real world, your wages are cut and you’re seeing people lose their jobs. While there seems to be a disconnect, the stock market is looking towards the future, while the company is looking at and reacting to the numbers from last quarter.

- I created a new AudioBoo. No headset, so the audio is much better this time. Boo #2 is about Blockbuster and the DVD rental business. Blockbuster reported poor earnings yesterday in an environment where people are renting more movies. Yikes! Here’s the embed, but you can always listen via the widget in the sidebar or by visiting my AudioBoo page.

Technorati Tags: michelle wie,blockbuster,netflix,redbox

Posted by muckdog at 11:35 AM View Comments

Labels: blockbuster, coinstar, michelle wie, netflix, redbox

Thursday, August 13, 2009

Thursday Randomosity, and AudioBoo!

- The market continues to rally, despite how we’re being told that it shouldn’t continue moving up with out a pause. Yes, the Nasdaq looks a little tired, but could be regrouping. I agree that we need a pullback, but not sure how severe that would be or how quickly folks would get back in. The economy is improving, so the rally should take us higher at some point. Yes, as always, never in a straight line. Trying to time the wiggles is pretty difficult in a bull trend. I prefer to ride it out. I may shift allocations here and there, but that’s about it.

- For now. Subject to change, as always.

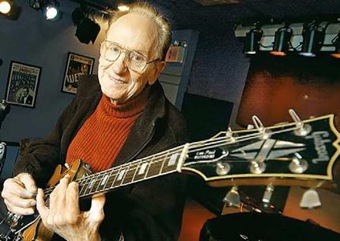

Les Paul pic today. You understand.

Les Paul pic today. You understand.- Blockbuster hit afterhours today. Who goes to Blockbuster anymore? It’s all about Netflix and Redbox now.

- I downloaded the free iPhone app AudioBoo to record up to 5 minutes of chatter, then upload to a website. Added a widget in the sidebar to listen. If you want to do this and have questions, comment or email me and I’ll give you a cheat sheet. Now the first recording didn’t go well, as I was on a headset outside. Maybe it was the wind or other background noise that fried the recording. The gist of the 3 minute talk was that Sell in May hasn’t worked out too well this year! Will try straight to the iPhone mic, indoors, next time!

- Cool AudioBoo stuff… You can subscribe to your favorite feeds in iTunes. Your favorite feeds also has an RSS feed, so you can subscribe in an iPhone app like RSS Player, too. Even better!

- Michael Vick signs with the Philadelphia Eagles. So, keep in mind that if you draft Eagles’ wide receivers for fantasy football and Donovan McNabb gets hurt, your receivers are worthless!

Cash for Clunkers Stimulus

This worked out better than any of the other auto stimulus packages. Low interest rates and a recovering economy helpng out, too.

DETROIT (Dow Jones)--Ford Motor Co. (F) boosted its production plans for the rest of the year as consumers, spurred by the "Cash for Clunkers" program, continue streaming into showrooms to buy.

http://online.wsj.com/article/BT-CO-20090813-712491.html

I know folks have pointed out that foreign car companies are selling more cars in this program. But, many of those foreign cars are built here!

-- Post From My iPhone

Monday, August 10, 2009

Looking for Catalysts!

- Note to self: The beginning of the NFL pre-season is not a stock market catalyst.

- The stock meandered around (mostly down) for the day, and closed slightly down. The market has had an amazing run and is quite extended. It would be normal to get some profit taking and sideways action until the buyers regroup. It also seems as if we're waiting for some news to react to. The Fed meets this week, so that could provide some catalyst for something.

- Sorry, Vince Young. You're just not a market mover!

- I remain 100% long, and realize that a 5% to 7% pullback is likely somewhere on the horizon. Many have been trying to front run that, and have guessed too early and missed the next bump up. I believe the market is pricing in a better economy.

- Man, granola sure is a messy snack. I need to vacuum my workspace here. Sheez.

- People are searching less for "great depression" these days. H/T to Carpe Diem.

- Weekend? Worked some, as things have been hectic at the Fun Factory. Also finished season 3 of Heroes via Netflix streaming. Got a bike ride in. Hung out with friends a couple nights. I'm kind of into the Blue Moon beer these days.

- Ted Nugent, Double-Live Gonzo, Cat Scratch Fever. LOL.

Friday, August 07, 2009

TGIF!

- Since March, the market has been anticipating an improving economy. We could be seeing the data flow matching market expectations. The jobs numbers came in better than expected and the unemployment rate fell below 10%.

- Political ramifications? I hate to be the bearer of bad news for the Republicans, but the economic cycle seems to favor the Democrats in the mid-term election cycle in 2010 and even out to 2012. The economy may look pretty good as folks head to the election booth. Folks tend to vote their wallet ahead of any other issue.

- It's Friday. Quite a week in the market and here at work. More blogging on the weekend. I'm beat!

Wednesday, August 05, 2009

Wednesday's Rescue Randomosity

- Just when we thought the market would never go down again... It went down! The blame goes to a "generally unimpressive batch of economic data." LOL. Well, have had quite a run and any excuse for a breather, right? Even after the morning dive, the market climbed it's way back up the rest of the day before falling in the last hour. Nothing to dislike. Expect a rest at some time. We're also near the end of the monthly strength period, so the 401(k) adds are done for now.

- I remain long, overweighted in the NDX and small caps. It's been a nice run.

- (I'm getting use to the newer versions of Windows Office software and the iPhone automatically capitalizing the first word in sentences. Good Lord.)

- Euna Lee, Laura Ling, and Lana Lang released from North Korea. Er, okay, not really Lana Lang. That'd be Kristin Kreuk and I have no idea if she's anywhere near North Korea. But if she is, I hope President Clinton goes over there and gets her out, too. And speaking of, I have the Legend of Chun-Li DVD from Netflix. I know it probably is horrible, but with Kristin and Moon Bloodgood, I figurd I HAD to give it a spin.

- I do think Laura and Euna coming home is good news, by the way. I didn't want that to get lost in the shuffle of me making an excuse to put up a pic of Kristin Kreuk.

- Negotiations over extending cash for clunkers program stalls in the Senate. You know, people seem to like this program. What's a few billion more in debt at this point? It's is eventually going to turn into an episode of The Cleaner, where the addict will be forced to give up the junk. At some point Akani (Grace Park) is coming over to tie you up.

- Cisco earnings fall 46% but beat expectations. LOL. Who cares what their earnings are, as long as they can beat a low-ball estimate?

- A 53-year-old man who told police he is secretly engaged to marry Miley Cyrus has been charged with attempting to stalk the teenage "Hannah Montana" star... Good grief.

- Man, work is reallllly busy. One sign the economy is recovering despite the bad news in the rear-view mirror.

Monday, August 03, 2009

Cash for Clunkers

I took my car in for service this weekend and ended up touring the local automall. It's Cash for Clunkers mania.

The three major U.S. automakers accounted for 47 percent of the first 80,000 "Cash for Clunkers" sales, the U.S. government said Monday.

Through Saturday afternoon, the National Highway Traffic Safety Administration has processed 80,500 transactions, according to White House spokesman Robert Gibbs.

...

The Ford Focus is the top-selling vehicle in the program. Four of the top 10-selling vehicles are manufactured by Detroit's Big Three.

...

Thus far, 83 percent of trade-ins under the program are trucks, and 60 percent of new vehicle purchases are cars.

What I observed here in Sacramento around noon on Saturday was that the Toyota dealership was packed. Not just the car lot, but the tables inside where folks haggle prices and such. I saw a few folks around Ford. Virtually nobody at Chrysler or Chevy. Honda had a few folks milling around. Nissan seemed empty.

Of course, the government program isn't being run very well. Not exactly a shocker, but may create confusion for buyers and car dealers.

U.S. Senate Democrats sought a path forward on Monday to replenish the "cash for clunkers" auto sales incentive while the White House warned the program would cease at week's end without more money.

Republican doubts, potential procedural hurdles, and limited time for action muddled the outlook for supporters of a proposed $2 billion extension.

"They want to get something done this week," said a Democratic party source who was not authorized to speak for attribution about the matter. "The devil is in the details."

The first opportunity for the Senate to consider a remedy will be Tuesday after Democratic leaders huddle with President Barack Obama at the White House to discuss "clunker" prospects, health care legislation and other priorities

Stay tuned!

Of course, maybe a question is why older cars are excluded? Seems like the oldest and dirtiest cars would be prior to 1984.