Friday, December 30, 2011

Thursday, December 29, 2011

Wednesday, December 28, 2011

#133: Audioboo/Podcast on Top News of the Day

Show Notes!

- Stocks up for the year - barely!

- Gold down 5 days in a row

- Europe, Europe, Europe!

- Online gambling!

- Netflix!

- Iran threatens Strait of Hormuz

- Oil prices and the US Economy, how to invest in oil

- Companies reluctant to hire!

- Sears!

- Android activations soar!

- Movie theaters lagging

- Must read financial blogs

- Most admired list includes Obama and Bush

Friday, December 23, 2011

#132: Undead Elves! Payroll Tax Cut, Keystone Oil Pipeline, Matt Barkley, Santa Claus Rally

Posted by muckdog at 11:49 AM View Comments

Labels: AudioBoo, democrats, keystone, matt barkley, payroll tax, pipeline, republicans, undead elves

Thursday, December 22, 2011

SP500 on the Brink of Breaking Even

I know we entered 2011 with higher expectations than breaking even. Considering the wild volatility you would think we would have turned decisively in either direction.

I know we entered 2011 with higher expectations than breaking even. Considering the wild volatility you would think we would have turned decisively in either direction.

But maybe this is stock market gridlock. Europe can't break into the clear. The US debt situation grows exponentially as our politicians dither. The US economy slithers along at a 2% growth rate while the employment situation remains stagnant.

But if it took the NBA until christmas to get going, maybe the same is true for stocks.

Hopefully the market doesn't tear a ligament these last few days, Kobe.

Tuesday, December 20, 2011

It's the Oil Prices, Stupid

I still think high energy prices are a big reason for the economic malaise.

When holiday travel is over, the typical American household will have spent about $4,155 filling up this year, a record. That is 8.4 percent of what the median family takes in, the highest share since 1981.

Gas averaged more than $3.50 a gallon this year, another unfortunate record.

Link

That is a big dent in folks' disposable income.

Monday, December 19, 2011

Blame it on the EU

Move along! Nothing to see here! Just another late day market collapse.

Move along! Nothing to see here! Just another late day market collapse.

And this is Santa Claus rally season. It's like getting a lump of coal in your stocking. Thanks, Santa.

So the debt and deficits and ... No new news, just the inability to deal with and wrap up the old news. The US economy continues to grind higher while the market is stuck.

Saturday, December 17, 2011

Is the Gold Bull Market Dead?

Is the gold bull market dead? Are those who own gold in for huge losses? Forced liquidation?

Gold bull is dead, says GartmanPublished on Investment Postcards from Cape Town | shared via feedly mobileArticle written by Prieur du Plessis, editor of the Investment Postcards from Cape Town blog.Calling the death of gold’s bull run, and the beginning of a gold bear market, with Dennis Gartman, The Gartman Letter. He said in latest newsletter: “We have the beginnings of a real bear market, and the death of a bull … So much damage has been done to the psychology of the market in the past week and so many late longs caught off guard that forced liquidation shall be the outcome.”

Source: CNBC, December 14, 2011.

Obama Wants to Extend Payroll Tax Cut for Year

Here we go. Just as the Senate passes a WHOLE TWO MONTHS extension to the payroll tax cut, the politics begin! The President says "Extend it for a year!"

Obama wants payroll tax extended for entire yearPublished on MiamiHerald.com: Business | shared via feedly mobilePresident Barack Obama, rebuffed by Congress on a yearlong extension of a Social Security payroll tax cut, said Saturday that it would be "inexcusable" for lawmakers not to lengthen the short-term deal when they return from their holiday break.

#131: Europe! Payroll Tax Cut and TAX HIKE! Gold Bear Market, CA Jobs, Auto Bailout, Movies, Tebow

Posted by muckdog at 12:47 PM View Comments

Labels: AudioBoo, auto bailout, europe, payroll tax cut, tax hike, tebow, tim

Friday, December 16, 2011

Google TV?

Google Chairman Eric Schmidt caused some raised eyebrows last week when he claimed that by next summer "the majority of the televisions you see in stores" will come with Google TV. Few took his claim seriously, some even called him insane. It's easy to see why people wouldn't believe Schmidt. After all, Google TV's first iteration tanked miserably. But I'm gonna come out the lone dissenter here and say: Schmidt's got it right.

Google Chairman Eric Schmidt caused some raised eyebrows last week when he claimed that by next summer "the majority of the televisions you see in stores" will come with Google TV. Few took his claim seriously, some even called him insane. It's easy to see why people wouldn't believe Schmidt. After all, Google TV's first iteration tanked miserably. But I'm gonna come out the lone dissenter here and say: Schmidt's got it right.

TGIF Randomosity! And $ZNGA!

Many folks are talking about a New Bear Market as stock leaders struggle and moving averages are sliced through. In addition, this SHOULD be a bullish time of year and the market is struggling. Gee, what happens in January? Honestly, I’m not that worried at this point. I think the sentiment and consensus is for the economic woes to continue, and despite the strong emotional tug to go in that direction, I remain 100% long.

Many folks are talking about a New Bear Market as stock leaders struggle and moving averages are sliced through. In addition, this SHOULD be a bullish time of year and the market is struggling. Gee, what happens in January? Honestly, I’m not that worried at this point. I think the sentiment and consensus is for the economic woes to continue, and despite the strong emotional tug to go in that direction, I remain 100% long.- Zynga priced at $10, trading at $11. As I type. Zynga charges small amounts of money _ a few cents, sometimes a couple of dollars _ for virtual items in online games. The games are free to play. Players can aquire items that range from crops in ``Farmville'' to buildings in ``CityVille,'' its most popular Facebook game. No pesky permits or environmental restrictions for virtual crops and buildings.

- Is it just me or does it seem that the latest Hollywood movie offerings, uh, suck?

- Hey, consumer prices show little change in November. The cost of living in the US was little changed in November as gasoline prices dropped and food expenses cooled, supporting the Federal Reserve's view that inflation will remain in check. Don’t THEY normally leave out food and energy when they’re rising in price? Yet, they’re front and center when declining? Hmm… Seems like a little editorializing going on. We will probably see more of that during the election year. EVERYTHING IS FANTASTIC!

- RIM shares tumble. Yeah. Nobody wants a Blackberry anymore. I saw some article recommending RIM as a 2012 comeback stock. Pfft. No way. They’re toast.

Thursday, December 15, 2011

Zynga!

Zynga is priced at $10 a share. Anyone have a market order to buy at the open?

Wednesday, December 14, 2011

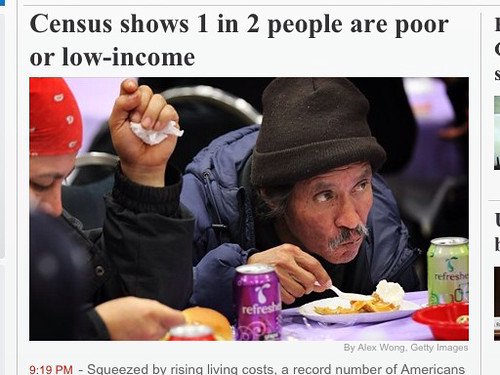

Almost Everyone is Poor!

Europe Sinks Stocks!

Today’s headlines read that the Europe sinks stocks because of debt.

Today’s headlines read that the Europe sinks stocks because of debt.

Same old. Same old.

But things don’t look that good from a technical perspective. And here we are in what is supposed to be a bullish time of year. Geez, what will January bring in this scenario?

Anyway, I remain long via the black box buy signal of November 22nd.

I still think there is a chance this is a head fake and we could rally into year end. But then again, everything is driven by what is going on in Europe. (Ignoring the big $15 trillion elephant of US debt in the room…)

Tuesday, December 13, 2011

Monday, December 12, 2011

USA TODAY: Stocks plunge on concerns euro deal isn't enough

It's always EUROPE'S fault! It seems like we can't escape the Euro Black Hole. And if we can't rally in December, what's January going to look like? Eh?

***

Check out this article that I saw in USA TODAY's iPad application.

Stocks plunge on concerns euro deal isn't enough

http://usat.ly/ul5SKy

To view the story, click the link or paste it into your browser.

To learn more about USA TODAY for iPad and download, visit: http://usatoday.com/ipad/

Black Box Update!

No changes in the black box. Still on buy signal from 11/22.

Obviously, the market is Euro-centric at this point. I’m emotionally torn. The US is recovering and growing slowly – but growing. I’d expect the stock market to continue to grow. On the other hand, the debt in Europe and the US is staggering, and that does matter at some point.

Obviously, the market is Euro-centric at this point. I’m emotionally torn. The US is recovering and growing slowly – but growing. I’d expect the stock market to continue to grow. On the other hand, the debt in Europe and the US is staggering, and that does matter at some point.

So, is that “some point” now or later?

Anyway, I’m still long.

***

Back from a trip to LA, which is why the blog postings and podcasts slowed this past week. Spent time with family. Good times.

One thing I always forget is how nice SoCal is. Yes, there is traffic and tons of people, but there are also tons of things to do. And it’s a great environment. Plus, it has the Lakers.

LOL

Friday, December 09, 2011

TGIF! Stocks, Chris Paul, and David Stern

Stocks gyrated around until Dave Sternhitler voided the Chris Paul to the Lakers trade.

Saturday, December 03, 2011

Black Box Update

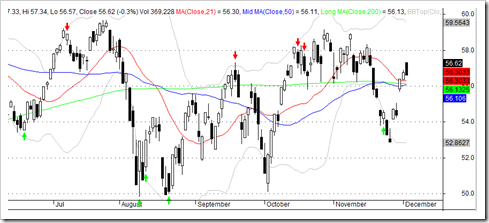

Here is the latest from the Black Box, and the buy signal at the close on November 22nd looks good.

It’s a big win so far. As you know, I bought some on Monday in anticipation of the buy signal (oops), and then more on Wednesday.

The Black Box is nowhere near a sell signal, but as you can see from August, that doesn’t mean the market won’t pullback and generate another buy signal.

This is never a recommendation to buy or sell, just a diary of what I’m doing and my experiences traveling down the learning curve. Please consult your financial advisor to determine the best way to achieve your investment objectives.

Friday, December 02, 2011

Tuesday, November 29, 2011

Bank of America at 52-week Low!

Whoa - $BAC is at a new 52-week low, but still about double the price of the February 2009 low. This is the stock that Warren Buffett bought! How could it be going down?

The Day After the Rally

I don't like to see the Dow leading and the Nasdaq in the red. To me, this indicates risk avoidance and a desire of investors to be in the highly liquid, dividend paying, large caps of the Dow.

The Nasdaq leads the market.

Of course, today's moves aren't that dramatic. And maybe it's healthy to consolidate yesterday's gains before moving higher.

Still have almost three hours to go today. And this is still a jumpy market. We have seen lots of mid-day news releases send stocks in one direction or the other.

Monday, November 28, 2011

Fiscal Integration Monday

Why the rally? The NBA lockout ending? The reason du jour is a combination of good retail sales and a European "fiscal integration" plan. Basically, consumers are out spending and Europe may have a plan to deal with their fiscal issues.

Heck, in one day the market gained half of last week's losses.

Of course we know that the biggest rallies happen in down trends, so there is no reason to get out on the dance floor. Tomorrow is another day.

I remain 100% long.

Link

Sunday, November 27, 2011

I Want Tim Tebow to Pick My Stocks!

Market Futures are Up! Let 'er rip!

As I type, the market futures are up over 1%. Of course, we have a whole lotta Europe between now and tomorrow, so there is no reason to think that the market will close that way by the closing bell. Yes, the market is waaaaay oversold and the pessimism is overwhelming. But we are steaming to the end of month and end of year, and that should be bullish.

Sunday Randomosity and the NFL!

- The Occupy Wall Streeters are raising a ruckus, but here is a column on the 1%. I agree that the so-called 99%-ers are purveying a bunch of nonsense. Maybe the cause for banking reform is just, but who knows what that OWS movement has turned into at this point. It seems to be about violence and mayhem. Who wants that?

- Some good games early. Bills almost did it against the Jets.

- Zero Hedge comments that folks went out spending on Black Friday like there's no tomorrow! Maybe. The Mayan calendar does end in 2012, uncannily predicting the financial collapse of the Eurozone -- and maybe the USA, too.

- I was watching Fox's Bulls and Bears yesterday, and noticed two completely different opinions by Gary Kaltbaum and Gary B. Smith. Kaltbaum is bearish, citing the technicals and the big sell off over the past week. Smith said everyone is a bear and we're in the bullish period of the year. Who do I agree with? They're both technical guys. I'd go with Smith. Kaltbaum is Mr. Whipsaw. The time to be bearish isn't when the market is so oversold heading into month-end and year-end. I know we keep getting smoked by Euro news. But we're running out of European countries to worry about!

- Hey, will there be a payroll tax deal by the end of the year? People kind of forget that there was a payroll tax cut that puts about $1000 a year in folks' pockets. They'll notice if the payroll tax comes back, eh?

Saturday, November 26, 2011

Saturday Randomosity!

- What is the market technical outlook? Mike Burk has a bunch-o-charts up. I like the comment that technical indicators haven't been of much use lately. Yeah. They're getting taken out by European news releases.

- Are there signs that the ECB may bail out the Eurozone? So what does that mean, ECB stimulus packages? Buying debt? Operation Le Twist?

- Barry Ritholtz at the Big Picture with a graphical representation of the Tablet Wars. Here are my thoughts. I have the first gen iPad and decided to go play with the Xoom, Galaxy Tab, Kindle Fire, Nook something or other, and an ASUS Transformer. Oh, and an iPad 2. iPad 2 is better. It costs more. But it's better. So I'm waiting on the next gen iPad 3. Some of the smaller ones are lighter weight, but they just felt underwhelming when it came to useability and features. There. I said it.

- So the NBA has an agreement to play a shorter schedule beginning on Christmas. 66 games starting on Decmeber 25th. Isn't that all we need of an NBA season anyway?

- The market was down about 5% this past week. It has been down almost everyday since Moses parted the Red Sea. We're due for some sort of bounce, right? Unless Europe intervenes with some bad news...

- I read some blog that was blasting the Fox series Terra Nova, saying that it was a huge blow to Sci Fi. I actually have grown to like the series enough to watch it. Yes, maybe the science is off a bit -- for all we understand of the period. But at least it is Sci Fi. And it's not horrible. I'd prefer less drama and more sci-fi. But right now, it's all the sci fi we have.

- Black Box still on the buy signal, but I do have to say that VERY RARELY does the black box give a signal and the stock market immediately moves against the signal. It's not a good sign for the validity of the signal when that does happen. Yet, because the market is so oversold it would seem that any kind of bounce would bail out the buy signal. Maybe...

Black Friday Breaks Records!

Some good news: CNN is reporting that Black Friday broke records, and that online sales were up 24%. Despite the worries about a recession -- while GDP is at 2% -- or Europe, folks are willing to spend cash on stuff.

Friday, November 25, 2011

#126: Black Friday CRAZIES! Stock Market Swoons on EUROPE!

Posted by muckdog at 5:37 PM View Comments

Labels: AudioBoo, black friday, europe, pepper spray, stocks

Biggest Thanksgiving Week Stock Loss Since 1932

Wednesday, November 23, 2011

#125: Black Box Buy Signal, Stocks Down 6 in a Row, Occupy Best Buy!

Posted by muckdog at 5:47 PM View Comments

Labels: AudioBoo, black box, black friday, europe, stocks

Tuesday, November 22, 2011

#124: Audioboo/Podcast on Today's Headlines

Posted by muckdog at 8:23 PM View Comments

Labels: amazon, AudioBoo, europe, ipad, kindle fire, stocks, super committee, xbox

Black Box Buy Signal!

A buy signal on the Black Box today, just as I was suspecting yesterday. As of yesterday, long high-beta Nasdaq and Small Caps. Here is the Black Box on the $QQQ.

It’s not a perfect tool, but has done well. It missed the October 4th low, for example.

Monday, November 21, 2011

Buying Stocks!

Buying high-beta Nasdaq and small caps this morning, ditching cash and low-beta.

Maybe I'm crazy. But the super committee not reaching a deal is probably good news for the US debt picture. Plus, we are in favorable market season. The Black Box is close to a buy, too.

Maybe we will get a big reversal today.

We. Shall. See.

Sunday, November 20, 2011

The Futures are... Down!

As I type, the stock market futures are down close to 1%. Much can change overnight, but should we have a gap down in the morning, I will consider getting a bit more aggressive. Not because the Black Box says so -- although, it isn't far from a buy signal. I am just looking at oversold conditions as we are in a historically bullish time of year.

Saturday, November 19, 2011

#123: Thanksgiving Week, Warren Buffett, Oil, Social Media Stocks

Posted by muckdog at 11:27 AM View Comments

Labels: AudioBoo, oil, social media, socl, thanksgiving, Warren Buffett

Friday, November 18, 2011

TGIF Randomosity!

The stock market had a rough week. The Dow dropped 2.9%, the S&P 500 lost 3.8%, and the Nasdaq dropped 4%. Blame Europe.

The stock market had a rough week. The Dow dropped 2.9%, the S&P 500 lost 3.8%, and the Nasdaq dropped 4%. Blame Europe.- News from 1981: Christopher Walken hires laywer over Natalie Wood investigation.

- Hey, this week’s sell off is even after Warren Buffett jumped into tech stocks like IBM and Intel! I’m not a big fan of buying stocks AFTER Buffett has bought them. I’d rather buy BEFORE he does. Right? Both these stocks have dividends.

- You heard the Major League Baseball news that the Houston Astros are moving to the AL West, right? And that an additional wild card team from each league will be added, with a best-of-three wildcard series added to the post-season. Cool. I suppose this means more TV money or something, but it also makes it more interesting as additional teams now have a shot at the post-season.

- You know what also happened in 1981? Greece enters the European Community (later becoming the European Union). Really.

- So, the Tennessee Valley Authority has a pay freeze for almost all of their employees. The CEO is excluded, and his compensation increased $352,000 in fiscal 2011 to $3.95 million. Well, that’s some happy news for the TVA folks, eh? Good grief.

- Hey, looking for stock market contrarian indicators? You know we’ve had (and will have) lots of social networking (internet) IPOs, right? Well, how about an Social Media ETF? Yikes, remember the B2B mutual funds of 1999-2000? How’d that turn out?

- Dodgers beat the Yankees 4 games to 2 games in the 1981 World Series. Really. Indiana beat North Carolina in men’s NCAA. Raiders beat the Eagles for the Super Bowl.

- Hillary Clinton thinks that the Syrian conflict could become a civil war. You know, we have it pretty good here.

Tuesday, November 15, 2011

Monday, November 14, 2011

The Black Box Update

At lunch, friend asked if the market was up or down. I said that the Dow was down about 100. “Oh,” he said. “Something bad happen in Greece or Italy?”

And that’s what the market is about these days. It’s about European debt and austerity measures (or the lack there of).

Well, same old, same old on the Black Box. Still on a sell signal as the market moves sideways.

Sunday, November 13, 2011

The Yo Yo Market

I can't remember a time where the market has been more volatile on news outside of the US. Sure, we've seen the market gyrate on earnings and economic numbers, but the news from Europe has been causing wild swings.

It's tough to have an asset allocation strategy when things outside of the US realm drives the gap up or the gap down.

Yet, I still persist. The Black Box has been pretty good through all this. I attribute that to the extreme readings we get on the rallies and sell offs. The charts still try to wade through the headlines.

My allocation remains the same. Cash, low beta stocks, oil, and a small caps holding.

***

Fantasy football has been rough this year. Can't blame Euro headlines for that, though...

Wednesday, November 09, 2011

Back on the Grid

The Black Box is still on a sell signal. Europe (now Italy) still driving the daily swings.

Back on the grid after a bunch of days losing money in Las Vegas. The big hurt was the Steelers losing the cover with 8 seconds to go!

More later... Market is crazy.

Friday, November 04, 2011

The Ice Cream of the Future is Dead

Dippin’ Dots has labeled itself as the ice cream of the future for as long as I can remember. It has filed for bankruptcy.

Dippin' Dots Files for Bankruptcy

Dippin' Dots Inc., the self-described "ice cream of the future," filed for Chapter 11 bankruptcy protection Thursday in U.S. Bankruptcy Court in Paducah, Ky., near its headquarters, after fighting off foreclosure efforts from Regions Bank for more than a year, according to court documents. At the time of the filing, the company owed about $11.1 million to the bank.

Public Sector vs. Private Sector

The jobs numbers keeps on showing that the private sector is adding jobs while the public sector is losing jobs.

In October, the private sector created 104,000 jobs, with gains led by professional and business services (33,000) and leisure and hospitality (22,000). Manufacturing posted a small 5,000 jobs gain. Meanwhile, governments at all levels cut 24,000 jobs. Since May 2010, government has cut one million jobs while the private sector has added 2.28 million positions.

Isn’t that the trend we want to see?

Thursday, November 03, 2011

Groupon Friday at $20 a Share!

Groupon will price at $20 on Friday, but if you click their link you buy it at $10 plus get a day spa treatment.

Tuesday, November 01, 2011

The Black Box Update for 11/1/11

Here is what the Black Box looks like tonight for the $QQQ. It’s funny how it seems to be right most of the time, even though there is no way the system can predict European headline news or company bankruptcies.

And it didn’t get the October 4th key reversal – which turned out to be a nice washout at the lows. So far, anyway.

Monday, October 31, 2011

Peanut Butter Prices

Peanut butter prices are skyrocketing! I knew something was wrong; Costco hasn't had salted peanuts in the shell for a long time.

Kraft is raising peanut butter prices by 40%.

Conagra is raising peanut butter prices by 20%.

The core CPI doesn't include food and energy. But, if the core CPI doesn't include peanut butter, then the core CPI is a bunch of junk. Who can live without peanut butter?

#121: Market Sells Off on Halloween! Refinancing, Spending, and More!

Posted by muckdog at 5:25 PM View Comments

Labels: AudioBoo, halloween, refinancing, spending, stocks

Wall Street Still Vulnerable to Headlines

Sunday, October 30, 2011

Black Box Update

The Black Box is on a sell signal, but that looks close to being invalidated.

It's not the first time the Black Box has given a signal a little bit ahead of the move. We are also in the favorable season and in the monthly strength period.

I still have some cash, long low-beta stuff, some oil, and some small caps.

My thoughts are that pullbacks should be bought. The Europe stuff seems to be resolved for now, and America is in gridlock through at least the 2012 election -- positives for the market!

Americans Spend More!

Here is a column that wonders how Americans can spend more while incomes are basically flat.

I have a couple of thoughts.

The payroll tax is lowered this year. That's a couple of percent.

Interest rates are lower. That means payments are down on cars, homes, equity loans, and such.

***

Wow, Chris Johnson is a Fantasy Football bust. He can't do anything. Last I saw was 5 rushes for 1 yard. Really.

Thursday, October 27, 2011

Monster Rally Thoughts

Wow. So, Europe comes up with a deal for Greece. It means that bond holders get a 50% haircut, not including any inflation erosion over the years. But basically $.50 on the $1. I guess you can understand why the bond market took a hit! Consider that in some of the other struggling economies like Spain, Italy, the US, California… Hey we’re not there yet, but it is fuel for thought.

Combine that with a 2.5% GDP that was far above what the folks who are calling for a recession were thinking, and we have a huge day for the markets.

***

What a World Series game tonight.

Typing this via the iPad app Pocket Cloud, which lets you control the PC from your iPad. So this is via Windows Live Writer – on the iPad!

Wednesday, October 26, 2011

The Black Box Update

Still on a sell signal for the $QQQ

I remain in some cash, low-beta stuff, and some oil.

The market doesn’t seem to want to go down, though. I guess we can give credit to Europe!

Wednesday $AMZN Randomosity

- So, $AMZN was down today over 12%. A little panic ahead of the Amazon Kindle Fire release. I think the Kindle Fire will sell well and that Amazon will make a ton on apps. Of course, the PE multiple of Amazon is pretty high as it is.

Yes, Europe was the reason for the early selloff and for the late rally. “The market is up today because our expectation bar had been set significantly low for today’s European summit, so we were expecting a numberless communiqué, so with that being the base case, we’ve shifted our focus to better-than-expected earnings across the board,” said Art Hogan, equity strategist at Lazard Capital Markets.

Yes, Europe was the reason for the early selloff and for the late rally. “The market is up today because our expectation bar had been set significantly low for today’s European summit, so we were expecting a numberless communiqué, so with that being the base case, we’ve shifted our focus to better-than-expected earnings across the board,” said Art Hogan, equity strategist at Lazard Capital Markets. - Baseball needs to finish the World Series by October, not start it in October. Rain out and game postponed.

- The Motley Fool (remember them?) say investors are missing one thing about Amazon.

- The Democrats have a new plan: New taxes on the wealthy. Hey, isn’t that the old plan? Revenue would be raised mostly by bumping up the high-end tax bracket and limiting deductions for upper-income earners, those familiar with the talks said. I don’t see that getting by Congress.

- Actually, the Motley Fool folks have a good daily podcast that goes over the news of the day. Really!

- I can’t remember the last time I shopped on Amazon. Really.

- The NBA meeting again… Yawn. Maybe they should cancel the entire season, and then see if folks want to bargain for the 2012-3 season, and if not, cancel that, too. Eventually, I think they’d reach a deal. Maybe even in my lifetime.

- Picture is of Greek Playboy model Vasso Vilegas.

Tuesday, October 25, 2011

Monday, October 24, 2011

$NFLX: Ouch! Netflix Loses 800,000 Subscribers!

Whoa, $NFLX! Netflix losing 800,000 subscribers just as the country is embracing web streaming would seem to be a bit of a head scratcher.

Of course, when you have a company that raises prices and divides their offerings into two companies -- one for streaming and one for DVDs, then reneging but keeping prices high, is it any wonder why customers are checking out other options? There are other options available from Amazon, Hulu Plus, Blockbuster, Apple, and Google. Plus, if one wants the latest DVD, there is a Redbox vending machine just a quick drive away. And Redbox videos are $1!

Ultimately, I think it was the price increase that caused folks to look at other options. That's the feedback I've received from friends and family. (So, it must be true!)

Read the link. It is a good overview of what is going on with the company.

#119: Occupy Wall Street, Stock Market Rally, and Reno

Posted by muckdog at 2:57 PM View Comments

Labels: AudioBoo, gambling, occupy wall street, reno, stocks

Sunday, October 23, 2011

At the Casinos

Well, this weekend is kind of a last-gasp nice-weekend trip to Reno. The weather over the Sierras will soon turn ugly do I thought I'd take a trip over the hill and bet on some college and NFL games.

Should have stayed at home!

Lots of close losses.

When it comes to gambling I think it is a losing proposition and I come here planning to lose. Mission accomplished! But we all had fun...

Thursday, October 20, 2011

#118: Occupy Wall Street; Moamer Qaddafi is Dead; Wall Street Euro-Flip

Posted by muckdog at 9:01 PM View Comments

Labels: AudioBoo, moamer qaddafi, occupy wall street, ows

Market Thoughts and the Black Box Sell Signal

The Black Box reiterated a sell signal yesterday. I remain invested in low beta stuff with some cash and oil.

What is holding me back from raising more cash is the time of year, which now has a bullish bias. Of course, we have rallied up sharply from the lows to the top of the trading range.

It seems to me that the economy will continue to grow slowly and that Europe will continue to be an issue. Do you see a way out of the trading range or reason for investor conviction at this point?

Earnings are mixed and former stock leaders are not leading. Which can be trouble.

So I'm thinking the Black Box is going to be right. Again. And that I should raise more cash!

Tuesday, October 18, 2011

Monday, October 17, 2011

Black Box Sell Signal

I’m not saying the Black Box is 100% right all the time, but check out the $QQQ:

Again, it’s just one indicator among many and it did miss the early October buy, right?

Sunday, October 16, 2011

Does the Seasonal Timing System Work?

Turns out that buy and hold has a better return.

In summary, evidence from simple tests on available data for SPY does not support belief that Sy Harding’s Seasonal Timing Strategy is a compelling improvement over a buy-and-hold strategy or that the MACD signal refinement improves seasonal entry and exit.

So, what about using your gut feeling near support or resistance during the Spring and Fall? Like the key reversal day at 1100 for a buy?

Saturday, October 15, 2011

Thursday, October 13, 2011

The Google Earnings Rock

Google ($GOOG) reported earnings today. Impressive.

…easily surpassed analysts’ expectations, reported that revenue climbed 33 percent and net income rose 26 percent.

…

“When I look back over the last quarter, the word that springs to mind is ‘gangbusters,’ “ Larry Page, Google’s chief executive, said in a call with analysts after the earnings were announced.

…

“The quantification of mobile revenues gives us an indication that Android is cementing Google’s position in mobile advertising,” said Jordan Rohan, an analyst at Stifel Nicolaus. “Google’s ability to diversify away from the parts of its businesses that are maturing is impressive.”

Here we have a company that is really growing gangbusters with the Android phones and tablets, now combined with domination in searching.

Wednesday, October 12, 2011

#114: Stock Market, Sodastream, and a Root Canal!

Posted by muckdog at 9:45 PM View Comments

Labels: AudioBoo, root canal, sodastream, stocks, top, trend

Tuesday, October 11, 2011

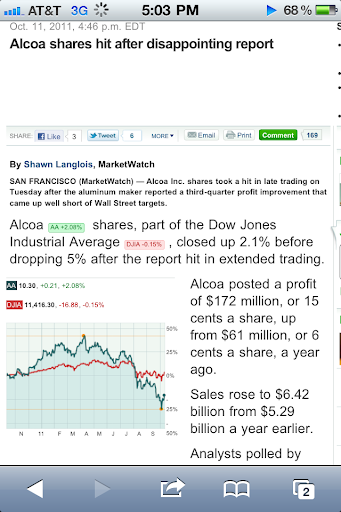

Alcoa Reports Earnings and Drops 5%

Third-quarter earnings started off with a thud as Alcoa reports. You know the drill, worry about slowing growth and earnings.

Third-quarter earnings started off with a thud as Alcoa reports. You know the drill, worry about slowing growth and earnings.

Hey, at least it wasn't Europe today!

The market was mixed. A nice pause after yesterday's fireworks.

***

Tech earnings will be interesting. Lots of money going into mobile devices.

Do Trading Ranges Last Forever?

Last week's key reversal launched the market back up towards the top of the trading range.

Now that we are here, will the market go back down or is this a resumption of the uptrend?

Is "Sell in May" over?

Seems like it, but I wouldn't rule out another headline news event from Europe that brings the market back down close to 1100 again.

My positions are the same...