- $SPY $QQQ – Still long the market but did book a few gains. Looking to buy back any weakness. I’m bullish on 2015. Yes, there will be pullbacks and scary parts along the way.

- As kids we get Christmas vacation. Why does that end as adults? Not fair - so I took it back! Been on vacation for a couple weeks.

- Security stocks… Should make a ton of money. But could be acquisition plays from companies that need the growth into that market. Just thinking out loud.

- Knowing history, do you think oil prices go lower and lower and lower? I think prices go higher someday because cars still run on gasoline and economies are growing. Meanwhile, environmentalists have declared war on fracking, pipelines, etc.

- Commodity plays are tough with a rising US dollar, too. Watching banks around the world for easing and tightening kinds of moves. Also tough to hold foreign market ETFs when the US dollar goes up as those markets are denominated in foreign currencies. We are also seeing countries that basically have no economy other than exporting oil having a rough go of it. I’m looking at you $RSX and $EWW.

- I think there is a biotech stock bubble. Similar to internet and business-to-business stock bubble of 1999-2000. It won’t end well.

- Back to blogging and audioboos and podcasts in 2015. I think having this as part of my market review routine helps to keep touch on what’s going on. I have been more active on Twitter. Blogging is so 2006 they say.

- By the way, I like the negativity on TWTR. Don’t own shares yet, but it is on my watch list.

- Heading home today. I’ve watched a $NFLX movie via streaming everyday. WOW! But I don’t find myself watching many DVDs anymore, so thinking about canceling that part. Anyone else?

- I wanted to spend some time this month clearing the backlog of recorded shows on the DVR. Uh, haven’t made much progress.

Tuesday, December 30, 2014

Market Thoughts

Sunday, December 07, 2014

Disney, McDonalds, Market Thoughts and Sci Fi

Still long stocks heading into year end. While it seems like many are talking about high valuations and the aging bull market, many are also talking about upbeat economic news such as Friday’s jobs report. Jobs do tend to pick up later in an economic recovery, but that isn’t the same as ringing the bell at the top tick of the market.

Still long stocks heading into year end. While it seems like many are talking about high valuations and the aging bull market, many are also talking about upbeat economic news such as Friday’s jobs report. Jobs do tend to pick up later in an economic recovery, but that isn’t the same as ringing the bell at the top tick of the market.- Assessing the fallout from the fall in oil prices. Energy earnings expectations have continued to crater. On Monday, the fourth-quarter estimate was for a year-over-year decline of 11.2 percent for S&P energy stocks. By Friday, that had dropped to 14.7 percent decline. I think a lot of people are trying to pick the bottom in oil stocks. Be careful!

- Anyway, while I am long stocks I was hoping for a pullback to get more aggressive in high flying names. That hasn’t happened.

- Which Was a Better Sci-Fi Film: Big Hero 6 or Interstellar? Hmm… (I haven’t watched either film). But it’s hard not to like Disney stock - $DIS. I do own that one. Heck, they just raised their dividend by 34%! "Disney delivered the highest results in its history in Fiscal 2014, reflecting the extraordinary quality of our creative content and the unparalleled strength of our brands," said CEO Robert Iger.

- I do like Sci-Fi films. I saw “Man of Steel” over the weekend on cable, and thought the combination of superhero and spaceships was cool. Now, I did go in with low expectations, and that helps, too.

- The Dow and SP500 made new highs last week, by the way. The bull market marches forward. Do you see a reason to sell before year end? I don’t. Heck, the Fed speaks on the 17th and at some point folks will worry about rising interest rates. But I don’t think the Fed will ruin Christmas.

- $MCD – McDonalds trying a “Create Your Taste” program, where customers can order and customize their burgers from tablet-like kiosks instead of ordering from the counter. Hmm… Well, facing competition and declining sales, the company was bound to try something. (Long $MCD).

- I saw that some firm updated their price target on Facebook $FB to $105. Heck, I’m still targeting $1000! (It will just take a bit longer).

Thursday, December 04, 2014

$TSLA vs Cheap Gas

Will Cheaper Oil Burn Tesla?

Anthony Mirhaydari

Fiscal Times - Fiscal Times - Wednesday, December 3, 2014

Some things are simply immutable. It doesn't matter how much we wish things were different. Or how h...

If you have Windows 8, open this in Finance. Otherwise, open in the browser.

More Thoughts on Stocks and Stuff Randomosity

- The US is #2 economy! The Chinese economy just overtook the United States economy to become the largest in the world. For the first time since Ulysses S. Grant was president, America is no longer the leading economic power on the planet.

- I'm still long the market and believe that there will be a continued uptrend into the end of the year. I believe the rally will be concentrated in the winners, and that the losers will continue to face tax loss selling. That being said, I was hoping for a pullback this week to provide a chance to get long some winners but they keep running!

- Did you see that The Biggest Loser's Damien Gurganious died at 38 after suffering from a sudden onset of a rare autoimmune disorder that caused bleeding in his brain.

- Jim Cramer blesses Kinder Morgan Inc. - $KMI. The energy sector has taken a hit. I wonder if once tax loss selling eases up in some of the names - and that's soon, it could be time to buy a few names. (Disclosure - long $XOM).

- Job report tomorrow. Don't sleep in! You know, this is the recurring monthly event where the government makes the employment rate look better by decreasing the labor participation rate.

- I'm not sure what to think about the white cop - black victim news in recent headlines. It seems that if someone commits a crime and then resists the police, there is an increase risk of something unfortunate happening. Anyway, more protests going on as I type.

- Today is my 2 year anniversary since my $AAPL iPhone 5 purchase. And I didn't go buy the 6 plus! (Thought about it!) Ah, tomorrow's another day.

- So the US deficit ballooned past $18 trillion. But, they say there's nothing to worry about because as a percentage of GDP, the deficit is shrinking. Ya. Uh-huh. Fuzzy math still alive and well - brought to you buy the brain trust at the East Anglia CRU.

Wednesday, December 03, 2014

Oil Prices

Filling up at the gas pump is about to get even cheaper

By Claudia Assis, MarketWatch

MarketWatch - MarketWatch - Wed Dec 3 21:40:14 UTC 2014

SAN FRANCISCO (MarketWatch) — Fill'er up! The good times at the gas pump will continue to roll. ...

If you have Windows 8, open this in Finance. Otherwise, open in the browser.

Thoughts on McDonald's - $MCD

McDonald's Menu Problem: It's Supersized

Julie Jargon

The Wall Street Journal. - The Wall Street Journal. - Wednesday, December 3, 2014

McDonald's Corp.'s menu may have grown too big to succeed. The fast-food giant has added oatmeal,...

Monday, December 01, 2014

OMG - Stocks Have Down Day

- OMG! Stocks had a down day! PANIC!

- Oil prices dropping puts money in consumers wallets. Consumers spend more at malls. Inflation coming?

- So I am a big believer of a little pullback and then a big end of year uptrend - especially in the stock leaders.

- Stock pullback could be due to tax loss selling of some losers or a news headline, but money will want to rally in the leaders into the year end. IMHO.

- The Miami Dolphins are usually fantastic at blowing must win games against lousy teams.

- Minimum wages increasing, which will end up pushing up other wages. Many wages are based in formulas and salary surveys of other wages. Raising the floor pushes everything else up. Inflation coming?

- I didn't go to the malls or do any online shopping. None! Might take a vacation for Christmas and avoid the gift giving nonsense!

- Spoiler alert: I was sad Beth died last night in The Walking Dead. Just saying.

- The Jets have over 200 yards rushing IN THE FIRST HALF!

- One reason for the drop in oil and other commodities is the strong dollar. Oil is denominated in dollars.

- Hey, the strong dollar means that goods produced overseas should cost less. Including imported oil. Hey, that should be good for the trade imbalance! That could put downward pressure on inflation but we tend to spend all we have, so probably not.

Sunday, November 23, 2014

IBD Top 50 Stocks Strategy – 11/23/2014

Here is the latest on the IBD 50 stocks investing strategies vs. $SPY

Since the last update near the October lows, the market has raced ahead of the IBD 50 stocks. For the week, there were 25 stocks up and 25 stocks down for the IBD 50.

VRX led the IBD 50, up 8.32% for the week. The biggest loser for the IBD 50 was VIPS, down 7.32%.

The IBD 50 portfolios total return since 2/8/2014 are underperforming the SP500. None of the strategies are beating the simple SP500 at this point. I would have expected to see the leading stocks lead, but there has been more volatility in some of the top stocks as measured by IBD.

The portfolio is sold at the closing price Friday night, and rebalanced into the make-up of the IBD top 50. Dividends are excluded from total returns.

Trading costs $805.95.

The IBD monthly strategy is also underperforming the SP500.

All of the portfolios have a positive return for the month, but have a positive total return.

The IBD 50 has 28 gainers and 22 losers in November.

AFSI is the top performer for the IBD 50, returning 13.91%. The weakest stock in the IBD 50 so far is SLXP, losing 28.47%.

Trading costs $169.15

I will assume a $9.95 trading cost to sell last week’s or last month’s portfolio, and $9.95 to buy the new weekly or monthly portfolio. (Imagine the costs of doing this with individual stocks, compared to using Motif. Note that Motif limits the size of portfolios to 30 stocks).

The Top 25 holdings are listed at at Motif Investing. (A check as of 3/31/2014 shows that the ability to view all holdings is limited to Motif members and IBD subscribers).

None of the above strategies are a recommendation to buy or sell stocks. These are model portfolios constructed for entertainment only.

This is the IBD portfolio performance since 2/8/2014. Each portfolio begins with $10,000 and then invests an equal amount in the top 5, 10, 25 and 50 IBD stocks at the closing prices on Friday for the weekly model, and at the closing prices on the last trading day of the month for the monthly model. Since IBD changes the make up of their top stocks daily, this will only rebalance on Fridays or end of month. It is assumed that trading costs are $9.95 to “buy” a model portfolio, and $9.95 to “sell” a model portfolio. Thus, each weekly or monthly rebalance out of the previous portfolio and into the new portfolio costs $19.90. Daily changes in the IBD 50 or stock rankings are not considered. Changes in IBD’s overall market views are not considered. Stop loss orders or other market timing strategies are not considered. The value for SPY is based on buying 2/8/2014.

Based on a blog entry from Paladin Money. See Investors Business Daily for more information on the IBD 50. See Motif Investing for their IBD Top 25 portfolio, and the ability to construct your own portfolio of stocks.

Sunday Randomosity and Kim Kardashian

I am still long stocks since the Oct 15 buys. I haven’t seen a reason to sell and believe that the trend into year end will be up. Yes, the market is overbought and maybe the run into the end of the year won’t be straight up. But I think winners will continue to run as folks won’t want to sell them and will want to own them. In addition, there isn’t another place to put money right now.

I am still long stocks since the Oct 15 buys. I haven’t seen a reason to sell and believe that the trend into year end will be up. Yes, the market is overbought and maybe the run into the end of the year won’t be straight up. But I think winners will continue to run as folks won’t want to sell them and will want to own them. In addition, there isn’t another place to put money right now.- Kim Kardashian’s butt is pretty unreal. It’s like an anime butt, where the artist can exaggerate features. There seems to be a fan club of folks who love that butt. Not that there is anything wrong with that.

- “China’s central bank surprised markets by slashing its one-year benchmark lending rate 0.40 percentage points to 5.6%. China last cut interest rates in 2012. The move follows a disappointing growth rate in the latest quarter. The nation’s economy expanded 7.3%, marking a five-year low.” – The markets love stimulus. It seems like whenever a central bank announces free money, stocks rip. How long can this go on, though?

NFL Sunday means 7 hours of the Red Zone Channel! Gee, no wonder I can’t get any work done on the weekends.

NFL Sunday means 7 hours of the Red Zone Channel! Gee, no wonder I can’t get any work done on the weekends.- Josh Gordon back in the Cleveland Browns lineup!

- Obama goes commando with the Immigration executive order. I think he was just playing the race card and trying to incite enthusiasm in minority voters by pitting them against what is seen as a “White GOP.” Although in the election, Whites and Asians voted GOP, and an increasing number of Hispanics also voted Republican. Hey, maybe folks don’t like to get “Grubered.”

- Remember when stocks were selling off a few months ago, and the Wall of Worry included things like Ebola, Russia in Ukraine, Middle East ISIS turmoil, and the Green Bay Packers off to a slow start? Only one of those things has resolved itself, yet the market storms higher.

Tuesday, November 04, 2014

Republicans Take Senate!

$SPY – The GOP takes the Senate, and gridlock will continue. The stock market tends to like it when each side cancels each other out. The difference will be that instead of Harry Reid stopping legislation, President Obama will have to use his veto pen.

The only way legislation gets enacted is if there is compromise. There are a lot of pro-growth ideas coming from the Republicans, from the Keystone Pipeline to corporate tax reform. But it will be hard to push those through the mighty veto pen of the President.

Still bullish on stocks, though.

Thursday, October 30, 2014

Monday, October 27, 2014

$TWTR - Twitter Crash!

$TWTR - Twitter stock crashing after earnings this afternoon. I follow this one and facebook as they both seem to take a lot of my online time.

Sunday, October 19, 2014

IBD Top 50 Stocks Strategy – 10/19/2014

Here is the latest on the IBD 50 stocks investing strategies vs. $SPY

Despite the crazy hair-pulling volatility, the IBD 50 portfolios outperformed the broad index this week. For the week, there were 32 stocks up and 18 stocks down for the IBD 50.

ATHM led the IBD 50, up 18.19% for the week. The biggest loser for the IBD 50 was LAD, down 12.84%.

The IBD 50 portfolios total return since 2/8/2014 are underperforming the SP500. For anyone expecting a bounce or a rally into the end of the year, what outperforms from here? Will the strategies continue to lead the way in the direction the market is heading?

The portfolio is sold at the closing price Friday night, and rebalanced into the make-up of the IBD top 50. Dividends are excluded from total returns.

Trading costs $706.45.

The IBD monthly strategy is mixed versus the SP500.

The portfolios concentrated in fewer holdings are performing better than the more diversified portfolios. Only the IBD 5 has a positive return at this time.

The IBD 50 has 7 gainers and 43 losers.

ATHM is the top performer for the IBD 50, returning 12.31%. The weakest stock in the IBD 50 so far is SLCA, losing 24.28%.

Trading costs $149.25

I will assume a $9.95 trading cost to sell last week’s or last month’s portfolio, and $9.95 to buy the new weekly or monthly portfolio. (Imagine the costs of doing this with individual stocks, compared to using Motif. Note that Motif limits the size of portfolios to 30 stocks).

The Top 25 holdings are listed at at Motif Investing. (A check as of 3/31/2014 shows that the ability to view all holdings is limited to Motif members and IBD subscribers).

None of the above strategies are a recommendation to buy or sell stocks. These are model portfolios constructed for entertainment only.

This is the IBD portfolio performance since 2/8/2014. Each portfolio begins with $10,000 and then invests an equal amount in the top 5, 10, 25 and 50 IBD stocks at the closing prices on Friday for the weekly model, and at the closing prices on the last trading day of the month for the monthly model. Since IBD changes the make up of their top stocks daily, this will only rebalance on Fridays or end of month. It is assumed that trading costs are $9.95 to “buy” a model portfolio, and $9.95 to “sell” a model portfolio. Thus, each weekly or monthly rebalance out of the previous portfolio and into the new portfolio costs $19.90. Daily changes in the IBD 50 or stock rankings are not considered. Changes in IBD’s overall market views are not considered. Stop loss orders or other market timing strategies are not considered. The value for SPY is based on buying 2/8/2014.

Based on a blog entry from Paladin Money. See Investors Business Daily for more information on the IBD 50. See Motif Investing for their IBD Top 25 portfolio, and the ability to construct your own portfolio of stocks.

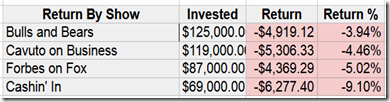

Fox Business Block Gurus Update – 10/19/2014

Here is an update on how the Fox Business Block gurus are doing year to date compared to the indices (excluding dividends). This return is based on investing $1000 per weekly stock pick at the closing price Friday night.

Here is an update on how the Fox Business Block gurus are doing year to date compared to the indices (excluding dividends). This return is based on investing $1000 per weekly stock pick at the closing price Friday night.

Larry Glazer has only made one pick, F (Ford). He lead the league for awhile, but that company has taken a hit lately.

Rich Karlgard has also made just one pick, INTC (Intel).

Ben Stein makes a rare appearance near the top of the list. The index trackers seem to be holding up better than individual stocks, and Ben tends to stick to picks that track a market index or are at least widely diversified.

It doesn't surprise me to see Gary B. Smith and Gary Kaltbaum near the top of the list. I've often thought that those two seem to be the most consistent. Maybe this kind of study is confirming my gut feeling.

Charles Payne "tends to" pick volatile stocks. As the market trends strongly in one direction or another, his picks have a little extra beta to the upside or downside. One of his picks in April, $GTAT, went bankrupt. That’s a -100% return for this study.

At some point, I will go over each guru's best and worst picks. Maybe during a lopsided Thursday Night Football game. (As if we haven't had enough of those...)

Nothing shocking here. My suspicion was that the Cashin' In gurus would underperform the other gurus, and that most all of the gurus would underperform the SP500 (SPY).

Wednesday, October 15, 2014

Panic at the Disco

$SPY $QQQ - buying some stuff near the lows. Did some this morning already.

Tuesday, October 14, 2014

Market Thoughts!

$SPY - The stock market has been in correction mode the last couple of weeks, and where the heck have I been! I am partially in cash and waiting for someone to ring a bell at the bottom of the correction.

$SPY - The stock market has been in correction mode the last couple of weeks, and where the heck have I been! I am partially in cash and waiting for someone to ring a bell at the bottom of the correction.

BEST STRATEGY EVER!

But seriously, I have had a watch list ready for the last few weeks with stocks I have been wanting to buy. I may have missed a few at yesterday’s lows. But I do think that the bull market is still on. I started adding to some positions Thursday and Friday, and plan to continue here and there. I would love to see a big gap down early in the morning and a reversal through the day.

Here are a few bullet points.

- The Federal Reserve: Tapering ends soon and the Fed flooding the country with cash ends! I believe this has made the rich richer, going into stocks and real estate. Of course, this has also helped the economy as a whole. Today, a Fed Head said that the Fed would be willing to revisit Quantitative Easing if the economic numbers stalled out. “Data Dependent” is the new phrase that pays.

- Ebola: We don’t know how bad that is or will be down the road. It is scary. I think this impacts travel stocks. So things like airlines, cruise ships, and travel related companies are going to struggle. Folks are buying out Hazmat suits! Every sneeze seems to halt an airline. With a long incubation period, this could continue to keep folks scared for a while.

- Russia: The Ukraine crisis is on Page 2 these days, but the impacts from Russian mischief are impacting Europe and world economies. Heck, i remember early on when I tried to play Russian stocks for a bounce and hoped there would be a quick resolution. It drags on and on. I’m out of those stocks, by the way.

- Europe: See above. Germany is tanking, for goodness sakes.

- Goofy Stocks: I’m looking at you, $GPRO and $MBLY. But there are also biotechs and other companies that either have IPO or ramped up without much if any earnings.

- Oil: Falling oil prices are a positive impact on all of us. The less we spend on gasoline, the more money we have to spend on other things. (Like hazmat suits). The oil boom in the US is having a huge impact on world oil markets. Combine that with declining demand due to slowing world economies, and prices have been falling.

- US Election: Every four years, there seems to be a stock market correction and then a powerful rally into the next year, that coincides with the US mid-term election. The reasons for the correction differ from cycle to cycle, but it seems to happen no matter what.

Posted by muckdog at 10:03 PM View Comments

Labels: Dallas Cowboys Cheerleader, ebola, federal reserve, spy

Saturday, October 11, 2014

Update – The IBD Top 50 Stocks Strategy

Here is the latest on the IBD 50 stocks investing strategies vs. $SPY

Another bad week for the IBD 50 portfolios. Yuck!

When the stock market is in an uptrend, the IBD 50 portfolios outperform. When the stock market is heading south, the IBD 50 portfolios do much worse. There is no surprise what happened here this week. For the week, there were 0 stocks up and 50 stocks down for the IBD 50.

XRS led the IBD 50, declining 1.17 for the week. The biggest loser for the IBD 50 was EMES, down 21.89%.

The IBD 50 portfolios total return since 2/8/2014 are now underperforming the SP500. For anyone expecting a bounce or a rally into the end of the year, what outperforms from here?

The portfolio is sold at the closing price Friday night, and rebalanced into the make-up of the IBD top 50. Dividends are excluded from total returns.

Trading costs $686.55.

The IBD monthly strategy is underperforming the SP500.

The portfolios concentrated in fewer holdings are performing better than the more diversified portfolios. Only the IBD 5 has a positive return at this time.

The IBD 50 has 2 gainers and 48 losers.

AAP was the top performer for the IBD 50, returning 1.93%. The weakest stock in the IBD 50 so far is SLCA, losing 27.02%.

Trading costs $149.25

I will assume a $9.95 trading cost to sell last week’s or last month’s portfolio, and $9.95 to buy the new weekly or monthly portfolio. (Imagine the costs of doing this with individual stocks, compared to using Motif. Note that Motif limits the size of portfolios to 30 stocks).

The Top 25 holdings are listed at at Motif Investing. (A check as of 3/31/2014 shows that the ability to view all holdings is limited to Motif members and IBD subscribers).

None of the above strategies are a recommendation to buy or sell stocks. These are model portfolios constructed for entertainment only.

This is the IBD portfolio performance since 2/8/2014. Each portfolio begins with $10,000 and then invests an equal amount in the top 5, 10, 25 and 50 IBD stocks at the closing prices on Friday for the weekly model, and at the closing prices on the last trading day of the month for the monthly model. Since IBD changes the make up of their top stocks daily, this will only rebalance on Fridays or end of month. It is assumed that trading costs are $9.95 to “buy” a model portfolio, and $9.95 to “sell” a model portfolio. Thus, each weekly or monthly rebalance out of the previous portfolio and into the new portfolio costs $19.90. Daily changes in the IBD 50 or stock rankings are not considered. Changes in IBD’s overall market views are not considered. Stop loss orders or other market timing strategies are not considered. The value for SPY is based on buying 2/8/2014.

Based on a blog entry from Paladin Money. See Investors Business Daily for more information on the IBD 50. See Motif Investing for their IBD Top 25 portfolio, and the ability to construct your own portfolio of stocks.

The Fox Business Block Gurus Update

Here is an update on how the Fox Business Block gurus are doing year to date compared to the indices (excluding dividends). This return is based on investing $1000 per weekly stock pick at the closing price Friday night.

Rich Karlgard has also made just one pick, INTC (Intel). This should be interesting this week as the company reports earnings on Tuesday. Semiconductors had a bad week!

It doesn't surprise me to see Gary B. Smith and Gary Kaltbaum near the top of the list. I've often thought that those two seem to be the most consistent. Maybe this kind of study is confirming my gut feeling.

Ben Stein and Adam Lashinsky "tend to" (but not always) pick diversified index ETFs, large mutual funds, or Berkshire. It doesn't surprise me to see their results close to the SP500, but underperform due to expenses and fees of their holdings.

Charles Payne "tends to" pick volatile stocks. As the market trends strongly in one direction or another, his picks have a little extra beta to the upside or downside.

At some point, I will go over each guru's best and worst picks. Maybe during a lopsided Thursday Night Football game. (As if we haven't had enough of those...)

Sunday, October 05, 2014

Update – The IBD Top 50 Stocks Strategy

Here is the latest on the IBD 50 stocks investing strategies vs. $SPY

I’ve been tracking the IBD 50 stocks since February. When the stock market is in an uptrend, the IBD 50 portfolios outperform. When the stock market is heading south, the IBD 50 portfolios do much worse. This past week was a prime example of the latter. If the stock market reversed at the end of the week and is heading higher, then guess what’s going to happen to the IBD 50 stocks? Zoom! For the week, there were 20 stocks up and 30 stocks down for the IBD 50.

ALXN led the IBD 50 with a return of 6.16% for the week. The biggest loser for the IBD 50 was SLCA, down 14.31%.

The IBD 50 portfolios total return since 2/8/2014 are mixed versus the SP500. The portfolios containing a higher number of stocks tends to perform closer to the SP500, while the portfolios concentrated in fewer stocks tend to be more volatile!

The portfolio is sold at the closing price Friday night, and rebalanced into the make-up of the IBD top 50. Dividends are excluded from total returns.

Trading costs $666.65.

The IBD monthly strategy is a mixed bag compared to the SP500.

The portfolios concentrated in fewer holdings are performing better than the more diversified portfolios. Only the IBD 5 is outperforming the SPY at this time.

For the first few days of October, the IBD 50 has 21 gainers and 29 losers. The portfolios with more holdings are holding closer to the SP500, while the concentration in fewer high-flyers have taken more of a hit. But the latter has also outperformed since I started tracking the strategies.

ALXN was the top performer for the IBD 50, returning 7.33%. The weakest stock in the IBD 50 so far is SLCA, losing 13.04%.

Trading costs $149.25

As I have been reading reviews of investing and rebalancing into model portfolios, the trading costs of rebalancing weekly or monthly is often discussed. Going forward, I will list the “in and out” rebalancing costs for each strategy. I will assume a $9.95 cost to sell last week’s or last month’s portfolio, and $9.95 to buy the new weekly or monthly portfolio. (Imagine the costs of doing this with individual stocks, compared to using Motif. Note that Motif limits the size of portfolios to 30 stocks).

The Top 25 holdings are listed at at Motif Investing. (A check as of 3/31/2014 shows that the ability to view all holdings is limited to Motif members and IBD subscribers).

None of the above strategies are a recommendation to buy or sell stocks. These are model portfolios constructed for entertainment only.

This is the IBD portfolio performance since 2/8/2014. Each portfolio begins with $10,000 and then invests an equal amount in the top 5, 10, 25 and 50 IBD stocks at the closing prices on Friday for the weekly model, and at the closing prices on the last trading day of the month for the monthly model. Since IBD changes the make up of their top stocks daily, this will only rebalance on Fridays or end of month. It is assumed that trading costs are $9.95 to “buy” a model portfolio, and $9.95 to “sell” a model portfolio. Thus, each weekly or monthly rebalance out of the previous portfolio and into the new portfolio costs $19.90. Daily changes in the IBD 50 or stock rankings are not considered. Changes in IBD’s overall market views are not considered. Stop loss orders or other market timing strategies are not considered.

Based on a blog entry from Paladin Money. See Investors Business Daily for more information on the IBD 50. See Motif Investing for their IBD Top 25 portfolio, and the ability to construct your own portfolio of stocks.

Thursday, September 18, 2014

Scottish Voters Choose to Join Alibaba

EDINBURGH, Scotland — Scottish voters decided they are better off remaining part of the United Kingdom, a blow against independence that produced a huge sigh of relief in London and averted an uncertain future for the country.

Monday, September 15, 2014

Everybody Waits For One But ...

$SPY - Everyone says they want a pullback in stocks but as soon as one happens they get scared and don't buy.

Wednesday, September 10, 2014

McDonalds Rallies Despite the Negativity

$MCD – So everyone is hammering McDonalds on the TV as bad news flows in. Yet, the stock rallied today. Hey, that’s sometimes a good thing when everyone is bearish and the stock rallies anyway.

$MCD – So everyone is hammering McDonalds on the TV as bad news flows in. Yet, the stock rallied today. Hey, that’s sometimes a good thing when everyone is bearish and the stock rallies anyway.

Yes, there are lots of competitors out there. Seems like there are gourmet burger places all over the place that sell food that isn’t too much more expensive than a McDonalds meal. Some fast food and casual diners are seemingly higher quality and more fashionable. Folks want to at least think they’re eating healthier, and McDonalds is associated with an unhealthy lifestyle. (Heads up: 2400 calorie burritos won’t do your body any favors, either!)

And what’s next, McBrunch?

Long $MCD

Rising Rates?

Fed Weighs Change to Rate Guidance in Quest for More Flexibility

Jeff Kearns, Christopher Condon and Steve Matthews

Bloomberg - Bloomberg - Wed Sep 10 17:00:00 UTC 2014

Federal Reserve officials are considering whether to alter their guidance on the likely path of inte...

If you have Windows 8, open this in Finance.

Tuesday, September 09, 2014

Is Las Vegas Sands Corps' Stock a Buy?

Apple Unveils New iPhones and Watch

Apple Unveils New iPhones and Watch

Daisuke Wakabayashi

The Wall Street Journal. - The Wall Street Journal. - Tue Sep 9 19:55:37 UTC 2014

In an ambitious blitz of new products, Apple Inc. unveiled a pair of larger-screen iPhones, a sleekl...

If you have Windows 8, open this in Finance. Otherwise, open in the browser.

Monday, September 08, 2014

Market Thoughts and the Arizona Cardinals Cheerleaders

$SPY - The road is littered with bad market calls in 2014. I know I’ve made some, expecting the correction that never comes. After all, it’s a mid-term election year, and we’re guaranteed a correction of gut wrenching proportions sometime during the calendar year, to be followed by a glorious rally. So far, we’re just getting the glorious rally part of the deal.

Yes, there have been a few teases to the downside. But after a few days of getting folks riled up and the TV business networks unleashing the bear market forecasts, it’s been rip city, baby. This is an amazing picture!

Now we are on the verge of a few market catalysts that one would think should alert contrarians. The first was a Barron’s cover this weekend. Uh, tempt fate much?

Tuesday is the new product announcement from everyone’s favorite fruit company, Apple! $AAPL. Okay, so the rumors are that we’re getting multiple sized iPhones, and maybe some sort of new wearable. Folks are calling this the biggest Apple Event since Moses parted the Red Sea with an App from the first gen iPhone. Is this a potential sell the news event where the heavily index weighted AAPL drags down the index trackers? Stay tuned.

Tuesday is the new product announcement from everyone’s favorite fruit company, Apple! $AAPL. Okay, so the rumors are that we’re getting multiple sized iPhones, and maybe some sort of new wearable. Folks are calling this the biggest Apple Event since Moses parted the Red Sea with an App from the first gen iPhone. Is this a potential sell the news event where the heavily index weighted AAPL drags down the index trackers? Stay tuned.

Finally, there is the Alibaba IPO, $BABA. You can’t watch five minutes of a financial news channel without someone mentioning the hot IPO and the best ways to play it. $YHOO – Yahoo stock has put on a nice rally as it will be a benefactor of the IPO feeding frenzy. I think $BABA can be a huge winner, too. But then I’ve caught the momo fever, too.

So where am I at right now? Mostly long. I still have some high flyers even though I’ve trimmed around the edges (but looking for somewhere to put that, too). I believe in the pullback that never comes, but grew tired of waiting for it. I am probably destined to suffer through it when it eventually comes. (Hopefully, that’s from much higher levels!)

This is the week before options, and if the market is going to pull back this looks like a likely spot. Although there is no reason to think that any dip won’t be bought up quickly. There are always the external headline news threats, but those haven’t done much damage so far this year.

Long and strong.

Final thoughts: Nice comeback win from Carson Palmer and the Arizona Cardinals. It’s been a great opening weekend to the NFL. My biggest surprise was the Bears losing at home to the Bills. I imagine that knocked a lot of folks out of their elimination pools in week 1.

Saturday, September 06, 2014

Update – The IBD Top 50 Stocks Strategy

Here is the latest on the IBD 50 stocks investing strategies vs. $SPY

Since I last updated the strategy, the market has been on an amazing run and the popular, high beta stocks have been outperforming. As the portfolios reallocate each Friday night to the latest IBD updates, all of the portfolios are outperforming the SPY. For the week, there were 28 stocks up and 22 stocks down for the IBD 50.

AMBA led the IBD 50 with a return of 7.74% for the week. The biggest loser for the IBD 50 was FANG, down 8.22%.

The total return since 2/8/2014 is outperforming the SP500. As the market rallies, the portfolios concentrated in fewer high-flying positions are outperforming the portfolios that are more diversified with more positions.

The portfolio is sold at the closing price Friday night, and rebalanced into the make-up of the IBD top 50. Dividends are excluded from total returns.

Trading costs $567.15.

The IBD monthly strategy has also had an amazing run for the year, after looking a little wobbly after each small pullback.

The portfolios concentrated in fewer holdings are outperforming the market as a whole. Only the IBD 50 is underperforming the SPY at this time.

Since September is just getting started, lets take a quick look back on August to see how the strategy performed compared to the SP500.

For the month of August, the IBD 50 has 44 gainers and 6 losers. Each portfolio smoked the returns of the market. And the more concentrated the portfolio in fewer stocks, the better the return.

BITA was the top performer for the IBD 50, returning 61.57%. It was also in each of the portfolios, so the more concentrated holding benefitted each portfolio dramatically. For example, if you own only 5 stocks and one of them is up 61%, it’s likely you’re looking at your account statement and wearing a watermelon smile. The weakest stock in the IBD 50 for August was ARRS, losing 10.42%.

Trading costs $109.45

As I have been reading reviews of investing and rebalancing into model portfolios, the trading costs of rebalancing weekly or monthly is often discussed. Going forward, I will list the “in and out” rebalancing costs for each strategy. I will assume a $9.95 cost to sell last week’s or last month’s portfolio, and $9.95 to buy the new weekly or monthly portfolio. (Imagine the costs of doing this with individual stocks, compared to using Motif. Note that Motif limits the size of portfolios to 30 stocks).

The Top 25 holdings are listed at at Motif Investing. (A check as of 3/31/2014 shows that the ability to view all holdings is limited to Motif members and IBD subscribers).

None of the above strategies are a recommendation to buy or sell stocks. These are model portfolios constructed for entertainment only.

This is the IBD portfolio performance since 2/8/2014. Each portfolio begins with $10,000 and then invests an equal amount in the top 5, 10, 25 and 50 IBD stocks at the closing prices on Friday for the weekly model, and at the closing prices on the last trading day of the month for the monthly model. Since IBD changes the make up of their top stocks daily, this will only rebalance on Fridays or end of month. It is assumed that trading costs are $9.95 to “buy” a model portfolio, and $9.95 to “sell” a model portfolio. Thus, each weekly or monthly rebalance out of the previous portfolio and into the new portfolio costs $19.90. Daily changes in the IBD 50 or stock rankings are not considered. Changes in IBD’s overall market views are not considered. Stop loss orders or other market timing strategies are not considered.

Based on a blog entry from Paladin Money. See Investors Business Daily for more information on the IBD 50. See Motif Investing for their IBD Top 25 portfolio, and the ability to construct your own portfolio of stocks.

The Fox Business Block Gurus Update

Here is an update on how the Fox Business Block gurus are doing year to date compared to the indices (excluding dividends). This return is based on investing $1000 per weekly stock pick at the closing price Friday night. (Granted, none of us have a chance to buy that pick until the Monday open, but I wanted to give each guru the closing price on the day they made the pick and not any reaction or bump that occurs at the open on Monday morning).

Larry Glazer has only made one pick, F (Ford). I may have to set a "minimum picks" eligibility requirement. But for now, having just one pick "for all the marbles" is a valid investment strategy. Some folks believe that over diversification leads to mediocre performance, and that the only way to make your fortunes is to concentrate your investments in just a few stocks. This works great if you pick the right stocks, and underperforms if you pick the wrong stocks!

One other observation is that Ben Stein and Adam Lashinsky "tend to" (but not always) pick diversified index ETFs, large mutual funds, or Berkshire. It doesn't surprise me to see their results close to the SP500, but underperform due to expenses and fees of their holdings.

Nothing shocking here. My suspicion was that the Cashin' In gurus would underperform the other gurus, and that most all of the gurus would underperform the SP500 (SPY).

Tuesday, September 02, 2014

IRS Wants to Tax Free Lunches!

Silicon Valley Meals Whet IRS Appetite

Mark Maremont

The Wall Street Journal. - The Wall Street Journal. - Tue Sep 2 17:18:29 UTC 2014

There is a grumpy new face in line at Silicon Valley's lavish freebie cafeterias: the Internal Reven...

Wednesday, August 27, 2014

Market Thoughts and Randomosity (and Christine Nguyen!)

- $SPY - Market thoughts! Wow, could the volume be any lighter? The market has had a big run lately in what is the weak month of the weak season (Summer). So throw that out the window this year. Oh, and last year, too.

- Despite the market rallying, you never know when the next headline event will derail stocks for ... oh, lets call it about 4% or so. Rounding. So far, those have been BTFD (buy the dip) opportunities. Of course, if you're long and strong and have no cash to throw at stocks then you just go for the ride. And it has been a good ride.

- I remain long, but trimmed a little last week.

- "The Islamic State runs a self-sustaining economy across territory it controls in Syria and Iraq, pirating oil while exacting tribute from a population of at least eight million, Arab and Western officials said, making it one of the world's richest terror groups and an unprecedented threat." So what's the difference between tribute and taxes? I live in CA and just found out that gas taxes are going up January 1st for AB 32, which is the CA government money transfer scheme to fight a war against the Sun God ("global warming").

- "Football stadiums will be packed this weekend for the kickoff of the college season. But many of the student sections are likely to have empty seats." So it seems that ticket prices are going up. Shocker. The article goes over some ideas on why attendance is falling off. For me personally, I would cite that I have a very nice big screen HD TV and love to watch many games at the same time rather than fight the crowds and pay the high costs at a game where I'm usually seated far away from the action. But that's just me!

- Maybe.

- Yes, that's Christine Nguyen the porn star. Oh well. I cropped it. Safe for work!

- Snapchat has a $10 billion valuation? Wow. LOL. That will end badly, right?

- So, are bonds going to keep rallying? Makes no sense to me. Is the economy really that horrible? I don't think so.

- Home prices are at a 70-month high, but folks are worried that the pace is slowing down. I think the bottom line is that home prices are largely influenced by rising wages and the ability of homeowners to make higher and higher monthly payments.

- Yes, I haven't been too active in blogging or Facebook or Twitter or Audioboo lately. You know, it's a bull market. About everything is making money. There is nowhere else to put money but in US stocks. So, I haven't felt like talking about it when it seems as if the market is just heading up until something changes.

- Hope you're having a great "last week" of summer. Seems like most kids are in school already around here, though.

Wednesday, August 20, 2014

Market Thoughts

$SPY - My latest market thoughts: This has been an amazing bull market. I am amazed that the market continues to move up without more than pulling back a few percent here and there.

I wonder how much of it is due to the fact that there just isn't anywhere else to put money to make a return? Even mediocre earnings and shaky world politics can't seem to do more than to just create a BTFD (Buy the Dip) moment.

I continue to be mostly long and trading in and out of various things here and there. It's been a good year so far. I don't know when it will all change.

It will.

Someday.

***

I know. Haven't been posting or Audioboo-ing much at all lately. Sigh.

Russia shuts four McDonald's

The One Hand vs. The Other Hand

Tuesday, August 19, 2014

Coach Ditka

Monday, August 18, 2014

Up to Our Ears in Corn

U.S. Farmers Are Up to Their Ears in Corn

Tony C. Dreibus

The Wall Street Journal. - The Wall Street Journal. - Mon Aug 18 17:30:00 UTC 2014

"We're going to drown in corn this year." The assessment, from Jeff Brown, 45 years old, a fifth-...

Thursday, August 14, 2014

Tuesday, August 12, 2014

Japanese economy contracts

Japanese economy contracts sharply

BBC News

BBC - BBC - Wed Aug 13 05:38:12 UTC 2014

Japan's economy contracted by an annualised 6.8% in the second quarter of the year, the biggest fall...

If you have Windows 8, open this in Finance. Otherwise, open in the browser.

Wage Inflation?

What will your pay raise be in 2015? Salary increases are edging higher

Diane Stafford

Kansas City Star - Kansas City Star - Tue Aug 12 17:41:05 UTC 2014

Smidgen by smidgen, employee pay raises are edging higher. Projected wage and salary increases fo...

If you have Windows 8, open this in Finance. Otherwise, open in the browser.

Wednesday, August 06, 2014

Scrap corporate income tax, and make shareholders pay

Scrap corporate income tax, and make shareholders pay

By Eric Toder and Alan D. Viard

MarketWatch - MarketWatch - Wed Aug 6 19:28:35 UTC 2014

The U.S. corporate tax system is broken. Recent efforts by major corporations such as Medtronic ...

If you have Windows 8, open this in Finance. Otherwise, open in the browser.

Russia to block US agricultural imports

Report: Russia to block US agricultural imports

JIM HEINTZ Associated Press

Associated Press - Associated Press - Thu Aug 7 01:01:10 UTC 2014

MOSCOW — Russian President Vladimir Putin on Wednesday hit back hard against countries that have imp...

If you have Windows 8, open this in Finance. Otherwise, open in the browser.

Walgreen May Be the Exception

Walgreen May Be the Exception to the Logic of Inversions

By KEVIN ALLISON

The New York Times - The New York Times - Wed Aug 6 21:05:16 UTC 2014

Walgreen has encountered a limit to the logic of inversions. The drugstore chain will keep flying th...

If you have Windows 8, open this in Finance. Otherwise, open in the browser.

Fox Business Block Gurus

'

'Thursday, July 31, 2014

Update – The IBD Top 50 Stocks Strategy

Here is the latest on the IBD 50 stocks investing strategies vs. $SPY (only monthly model today).

The IBD monthly strategy continues to lag the SP500 as July comes to a close.

The total returns for all monthly models continue to trail the SP500. It probably isn’t a shocker that trying to pick just the winning stocks lags a more diversified index. Especially since the winning stocks are often added to the IBD 50 list after a huge move is already in a stock. The idea is that stocks that have gone up will continue to go up. Hmm.

BITA led the monthly IBD 50 models with an 11.6% return. On the downside, AFOP fell 26.1%.

For the month of July, the IBD 50 had 17 gainers and 33 losers.

Trading costs $89.65.

As I have been reading reviews of investing and rebalancing into model portfolios, the trading costs of rebalancing weekly or monthly is often discussed. Going forward, I will list the “in and out” rebalancing costs for each strategy. I will assume a $9.95 cost to sell last week’s or last month’s portfolio, and $9.95 to buy the new weekly or monthly portfolio. (Imagine the costs of doing this with individual stocks, compared to using Motif. Note that Motif limits the size of portfolios to 30 stocks).

The Top 25 holdings are listed at at Motif Investing. (A check as of 3/31/2014 shows that the ability to view all holdings is limited to Motif members and IBD subscribers).

None of the above strategies are a recommendation to buy or sell stocks. These are model portfolios constructed for entertainment only.

This is the IBD portfolio performance since 2/8/2014. Each portfolio begins with $10,000 and then invests an equal amount in the top 5, 10, 25 and 50 IBD stocks at the closing prices on Friday for the weekly model, and at the closing prices on the last trading day of the month for the monthly model. Since IBD changes the make up of their top stocks daily, this will only rebalance on Fridays or end of month. It is assumed that trading costs are $9.95 to “buy” a model portfolio, and $9.95 to “sell” a model portfolio. Thus, each weekly or monthly rebalance out of the previous portfolio and into the new portfolio costs $19.90. Daily changes in the IBD 50 or stock rankings are not considered. Changes in IBD’s overall market views are not considered. Stop loss orders or other market timing strategies are not considered.

Based on a blog entry from Paladin Money. See Investors Business Daily for more information on the IBD 50. See Motif Investing for their IBD Top 25 portfolio, and the ability to construct your own portfolio of stocks.