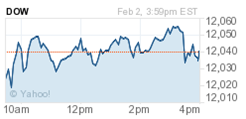

- The first of the month has been a great day for the stock market recently. $$ From the first of February:

CNBC mentioned how strong the first trading day of the month has been recently. It's been up six months in a row and thirteen of the last fifteen. It looks to tack on another win today

(It did on 2/1, so that makes 14 of the last 16 months)…

So, lackluster volume today. But, this makes six straight monthly gains for the Nasdaq and SP500.

So, lackluster volume today. But, this makes six straight monthly gains for the Nasdaq and SP500.- Amazon to start selling the Kindle at ATT stores. So, that was somewhat unexpected.

- What? A new deep water drilling permit in the Gulf of Mexico? The Bureau of Ocean Energy Management, Regulation and Enforcement announced Monday that it issued a permit to Noble Energy Inc. to continue work on its Santiago well about 70 miles southeast of Venice, La. Drilling will resume nearly one year after BP's blowout created the worst offshore spill in U.S. history.

- Governor Walker to release his vision for Wisconsin’s future tomorrow. …that will include major cuts to schools and local governments to help close a projected $3.6 billion budget shortfall. Shocker, Walker.

- Watching Clippers-Kings. Really. Well, I picked up Jason Thompson (Kings Forward) for tonight’s game. Why not?

- Charlie Sheen (not pictured): “I’m tired of pretending like I’m not special.” Er, well. LOL.

- Dancing With the Stars cast announced.

***

Finished watching Stargate: Atlantis via NFLX streaming. I liked the series. Now on to Sanctuary, which seems a little rough at the start. But the picture is of Emilie Ullerup. Just saying….