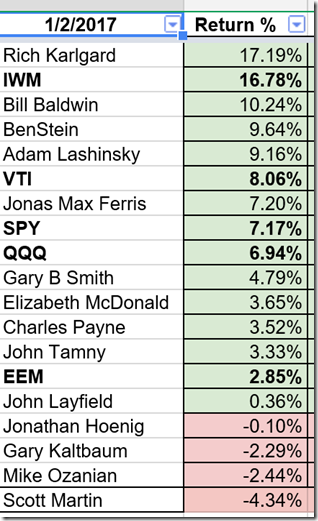

I kept pace with the market in 2016, with a 12% return.

The biggest winners were $T, $LVS, $UPS, and $XOM.

I also had a few ugly ones, including $JD and $TWTR.

Two other large concentrations held me back a little, $QQQ and $FB. Tech and biotech were a little underwhelming in 2016. The overall economy has been sluggish, and the Trump win in November has folks wondering what that means for large cap technology companies. Small caps stocks sure seem to love the results of the election.

My largest position is in $VTI – which acted like a center of gravity for my overall performance. I also have a large position in small cap index funds which helped.

Then I had a few names that towed the line with index, and didn’t do anything other that spit out a few dividends every quarter.

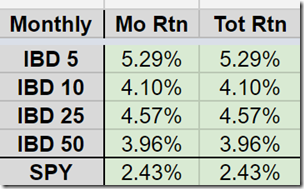

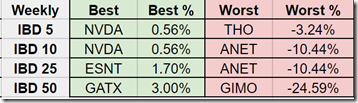

2016 was a year where I bought and held stocks and dollar cost averaged every month. I didn’t chase the IBD hot stocks or take the hot tip of the day. I did the least trading in 2016 than I ever have! I didn’t run my market timing model every day. I did not “sell in May and go away.”

By the way, had I used my market timing system using $QQQ, I would have made 8.8% on 10 trades, with 6 of them winning trades.

Heading into 2017, I am fully allocated and remain in the holdings I mentioned.

I am still a long term believer in $TWTR. I could just repeat what I said at the beginning of 2016. I truly believe this is the go-to place on the web for instant news and commentary. There was no better example of this than the 2016 election. I spend a lot of time there. (@muckdog if you want to follow – I do follow back!).

Rotating back into $XOM worked out well for me last year. I’m thinking about selling it and moving into some international dividend stock like Nestle $NSRGY.

Last year I thought my big 2016 winners would be $FB and $DIS, and maybe $TWTR. Wrong!

I think $NKE is interesting heading into 2017, but I don’t have any positions in it.

My outlook is that with the presidential transition and after 7 years of a bull market, things could get a little rough in early 2017. People may have delayed selling stocks in 2016 anticipating lower tax rates in 2017. Plus uncertainty of what Trump wants to do and what the Federal Reserve will do. I think we all assume the Fed will raise rates.

Expecting a low return 2017 and remaining long at this time. May change,.. Follow me on my podcast for more! (On the right sidebar and on iTunes –search for Muck).

Happy New Year!

Chevy says it is "closeout" time for the 2017 versions of many of its cars. Among the vehicles with the largest discounts is the 2017 Corvette Z06 which is priced $9,107 below MSRP.