I have always wondered how the IBD 50 does over the long term. It seems to be an index of stocks that have already made their move, or at least closer to their tops than their bottoms. The list changes from day to day, based on IBD’s criteria. How does investing in them work as an ongoing strategy?

I found an article at Paladin Money that reviewed the results of investing in the top 10 IBD stocks (of their top 50) and rebalancing monthly and then weekly, to whatever the changes are at the end of the period. For example, at the close on the last trading day of the month or at the close on Friday, rebalance equally into the top 10 IBD stocks.

Talk about the strength of the bull market in 2013! The portfolio has a gain of 55.4% for the year. This compares to our weekly model which had a gain of 67% last Friday night.

That’s pretty good, right? Of course, the rebalancing weekly or monthly is the tricky part due to commissions and taxes. The taxes can be postponed via implementing this strategy in an IRA, but there are still commissions for every stock trade.

Motif Investing allows investors to construct a portfolio of up to 30 stocks, and then a single trade into the entire portfolio costs $9.95 and is automatically allocated per your portfolio. One could implement this strategy of the Top 10 IBD stocks using Motif. Motif also has the top IDB Top 25 portfolio already available right now, with an option to rebalance weekly. (I believe their is a fee for rebalancing, equal to the trade price).

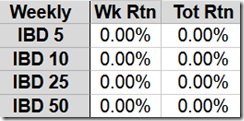

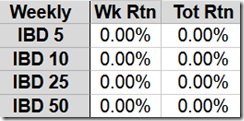

For fun, I constructed the IBD top 5, 10, 25 and 50 stocks in a Google Docs spreadsheet as of today (02/08/2014) and will track the strategy of rebalancing weekly and monthly. For fun. LOL. So every week, I will post something like this to check performance and to provide pithy comments:

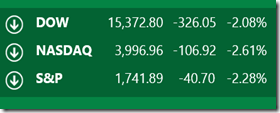

For the week, the IBD Weekly Strategy had a … [comments]

For the week, the IBD Weekly Strategy had a … [comments]

The IBD Monthly Strategy had a … [comments]

This is the IBD portfolio performance for the week and since 2/8/2014. Each portfolio begins with $10,000 and then invests an equal amount in the top 5, 10, 25 and 50 IBD stocks at the closing prices on Friday for the weekly model, and at the closing prices on the last trading day of the month for the monthly model. Since IBD changes the make up of their top stocks daily, this will only rebalance on Fridays or end of month. Daily changes in the IBD 50 or stock rankings are not considered. Changes in IBD’s overall market views are not considered. Stop loss orders are not considered.

Based on a blog entry from Paladin Money. See Investors Business Daily for more information on the IBD 50. See Motif Investing for their IBD Top 25 portfolio, and the ability to construct your own portfolio of stocks.

Something like that. You get the idea.

Going forward, I will also talk about this strategy on the Audioboos / Podcasts.