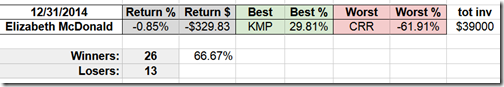

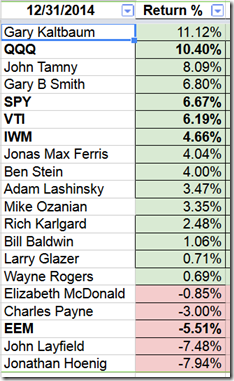

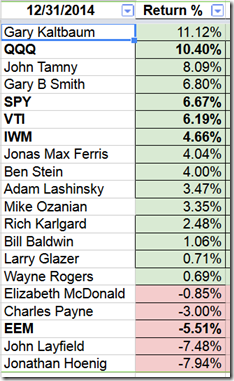

Here how the Fox Business Block gurus performed compared to the indices (excluding dividends). This return is based on investing $1000 per weekly stock pick at the closing price Friday night. The stock picks started 12/28/2013 through the 12/27/2014 picks, versus dollar cost averaging into the index ETFs during the same time period.

Here how the Fox Business Block gurus performed compared to the indices (excluding dividends). This return is based on investing $1000 per weekly stock pick at the closing price Friday night. The stock picks started 12/28/2013 through the 12/27/2014 picks, versus dollar cost averaging into the index ETFs during the same time period.

We have a winner! Gary Kaltbaum not only came out on top of the list, but he beat the index trackers! That is quite an accomplishment!

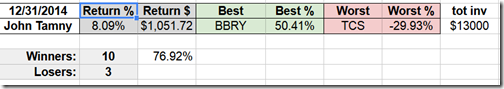

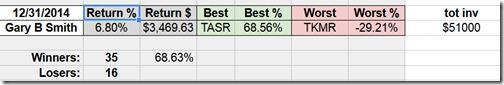

Gary K. is not a weekly participant. He made 14 stock picks for 2014. Gary B Smith actually put his picks on the line 51 times in 2014, and had a nice year. It doesn't surprise me to see Gary B. Smith and Gary Kaltbaum near the top of the list. I've often thought that those two seem to be the most consistent.

Near the bottom of the list is John Layfield, who tended to pick stocks from the oil patch. Those kinds of stocks had a rough year. Jonathan Hoenig tends to pick the kinds of investments that seem short-term focused rather than long-term focus, such as currency plays and inverse ETFs. Good luck buying and holding those kinds of things.

Ben Stein and Adam Lashinsky tend to pick stocks, ETFs, or funds that track a market index or are at least widely diversified. And they’re in the middle of the pack.

Charles Payne "tends to" pick volatile stocks. As the market trends strongly in one direction or another, his picks have a little extra beta to the upside or downside. One of his picks in April, $GTAT, went bankrupt. That’s a -100% return for this study.

That also points out that these stock picks are made without any future guidance. Once you buy, there is no advice to sell or buy more. The shows do have an occasional “follow up” show that goes over the best and worst picks for each guru, and what they’d do with that one or two picks going forward.

I will have another post shortly looking at each guru individually and how they did over the year.

How did the shows do compared to each other?

Congratulations to Forbes on Fox for coming out on top! My suspicion was that the Cashin' In gurus would underperform the other gurus – but, in the red? And this was a good year, fellas! I think what did surprise me was how collectively, the picks dramatically underperformed the SP500 (SPY). I thought such a large number of picks would closely track the index.

One final comment is regarding Cashin’ In. The show quit televising the weekly stock picks and instead directed viewers to the Fox website to find the weekly stock picks. I miss Jonathan and Wayne going over their stock thoughts. The picks and commentary on the website are lacking compared to the televised perspective. This TV segment was replaced by even more Eric Bolling commentary. I like Eric, but Cashin’ In used to be more about stocks and the market, and I miss those days.

On to 2015! Good luck to all of the Fox gurus!

The major market indices rallied up and kissed the 50dma today, as the European Central Bank did as expected and announced they were going to print and print and print. The goal being to keep interest rates low, pump up asset prices, try to avoid deflation, or just be seen as trendy and cool. After all, everyone is doing it these days!

The major market indices rallied up and kissed the 50dma today, as the European Central Bank did as expected and announced they were going to print and print and print. The goal being to keep interest rates low, pump up asset prices, try to avoid deflation, or just be seen as trendy and cool. After all, everyone is doing it these days! $MSFT - Does Microsoft still matter? Here is a preview of Windows 10 and "what's next?"

$MSFT - Does Microsoft still matter? Here is a preview of Windows 10 and "what's next?"