Friday, December 30, 2011

Thursday, December 29, 2011

Wednesday, December 28, 2011

#133: Audioboo/Podcast on Top News of the Day

Show Notes!

- Stocks up for the year - barely!

- Gold down 5 days in a row

- Europe, Europe, Europe!

- Online gambling!

- Netflix!

- Iran threatens Strait of Hormuz

- Oil prices and the US Economy, how to invest in oil

- Companies reluctant to hire!

- Sears!

- Android activations soar!

- Movie theaters lagging

- Must read financial blogs

- Most admired list includes Obama and Bush

Friday, December 23, 2011

#132: Undead Elves! Payroll Tax Cut, Keystone Oil Pipeline, Matt Barkley, Santa Claus Rally

Posted by muckdog at 11:49 AM View Comments

Labels: AudioBoo, democrats, keystone, matt barkley, payroll tax, pipeline, republicans, undead elves

Thursday, December 22, 2011

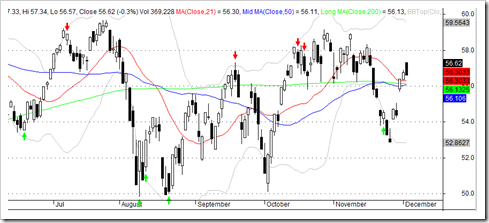

SP500 on the Brink of Breaking Even

I know we entered 2011 with higher expectations than breaking even. Considering the wild volatility you would think we would have turned decisively in either direction.

I know we entered 2011 with higher expectations than breaking even. Considering the wild volatility you would think we would have turned decisively in either direction.

But maybe this is stock market gridlock. Europe can't break into the clear. The US debt situation grows exponentially as our politicians dither. The US economy slithers along at a 2% growth rate while the employment situation remains stagnant.

But if it took the NBA until christmas to get going, maybe the same is true for stocks.

Hopefully the market doesn't tear a ligament these last few days, Kobe.

Tuesday, December 20, 2011

It's the Oil Prices, Stupid

I still think high energy prices are a big reason for the economic malaise.

When holiday travel is over, the typical American household will have spent about $4,155 filling up this year, a record. That is 8.4 percent of what the median family takes in, the highest share since 1981.

Gas averaged more than $3.50 a gallon this year, another unfortunate record.

Link

That is a big dent in folks' disposable income.

Monday, December 19, 2011

Blame it on the EU

Move along! Nothing to see here! Just another late day market collapse.

Move along! Nothing to see here! Just another late day market collapse.

And this is Santa Claus rally season. It's like getting a lump of coal in your stocking. Thanks, Santa.

So the debt and deficits and ... No new news, just the inability to deal with and wrap up the old news. The US economy continues to grind higher while the market is stuck.

Saturday, December 17, 2011

Is the Gold Bull Market Dead?

Is the gold bull market dead? Are those who own gold in for huge losses? Forced liquidation?

Gold bull is dead, says GartmanPublished on Investment Postcards from Cape Town | shared via feedly mobileArticle written by Prieur du Plessis, editor of the Investment Postcards from Cape Town blog.Calling the death of gold’s bull run, and the beginning of a gold bear market, with Dennis Gartman, The Gartman Letter. He said in latest newsletter: “We have the beginnings of a real bear market, and the death of a bull … So much damage has been done to the psychology of the market in the past week and so many late longs caught off guard that forced liquidation shall be the outcome.”

Source: CNBC, December 14, 2011.

Obama Wants to Extend Payroll Tax Cut for Year

Here we go. Just as the Senate passes a WHOLE TWO MONTHS extension to the payroll tax cut, the politics begin! The President says "Extend it for a year!"

Obama wants payroll tax extended for entire yearPublished on MiamiHerald.com: Business | shared via feedly mobilePresident Barack Obama, rebuffed by Congress on a yearlong extension of a Social Security payroll tax cut, said Saturday that it would be "inexcusable" for lawmakers not to lengthen the short-term deal when they return from their holiday break.

#131: Europe! Payroll Tax Cut and TAX HIKE! Gold Bear Market, CA Jobs, Auto Bailout, Movies, Tebow

Posted by muckdog at 12:47 PM View Comments

Labels: AudioBoo, auto bailout, europe, payroll tax cut, tax hike, tebow, tim

Friday, December 16, 2011

Google TV?

Google Chairman Eric Schmidt caused some raised eyebrows last week when he claimed that by next summer "the majority of the televisions you see in stores" will come with Google TV. Few took his claim seriously, some even called him insane. It's easy to see why people wouldn't believe Schmidt. After all, Google TV's first iteration tanked miserably. But I'm gonna come out the lone dissenter here and say: Schmidt's got it right.

Google Chairman Eric Schmidt caused some raised eyebrows last week when he claimed that by next summer "the majority of the televisions you see in stores" will come with Google TV. Few took his claim seriously, some even called him insane. It's easy to see why people wouldn't believe Schmidt. After all, Google TV's first iteration tanked miserably. But I'm gonna come out the lone dissenter here and say: Schmidt's got it right.

TGIF Randomosity! And $ZNGA!

Many folks are talking about a New Bear Market as stock leaders struggle and moving averages are sliced through. In addition, this SHOULD be a bullish time of year and the market is struggling. Gee, what happens in January? Honestly, I’m not that worried at this point. I think the sentiment and consensus is for the economic woes to continue, and despite the strong emotional tug to go in that direction, I remain 100% long.

Many folks are talking about a New Bear Market as stock leaders struggle and moving averages are sliced through. In addition, this SHOULD be a bullish time of year and the market is struggling. Gee, what happens in January? Honestly, I’m not that worried at this point. I think the sentiment and consensus is for the economic woes to continue, and despite the strong emotional tug to go in that direction, I remain 100% long.- Zynga priced at $10, trading at $11. As I type. Zynga charges small amounts of money _ a few cents, sometimes a couple of dollars _ for virtual items in online games. The games are free to play. Players can aquire items that range from crops in ``Farmville'' to buildings in ``CityVille,'' its most popular Facebook game. No pesky permits or environmental restrictions for virtual crops and buildings.

- Is it just me or does it seem that the latest Hollywood movie offerings, uh, suck?

- Hey, consumer prices show little change in November. The cost of living in the US was little changed in November as gasoline prices dropped and food expenses cooled, supporting the Federal Reserve's view that inflation will remain in check. Don’t THEY normally leave out food and energy when they’re rising in price? Yet, they’re front and center when declining? Hmm… Seems like a little editorializing going on. We will probably see more of that during the election year. EVERYTHING IS FANTASTIC!

- RIM shares tumble. Yeah. Nobody wants a Blackberry anymore. I saw some article recommending RIM as a 2012 comeback stock. Pfft. No way. They’re toast.

Thursday, December 15, 2011

Zynga!

Zynga is priced at $10 a share. Anyone have a market order to buy at the open?

Wednesday, December 14, 2011

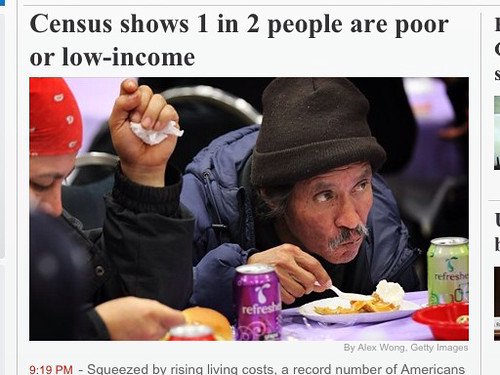

Almost Everyone is Poor!

Europe Sinks Stocks!

Today’s headlines read that the Europe sinks stocks because of debt.

Today’s headlines read that the Europe sinks stocks because of debt.

Same old. Same old.

But things don’t look that good from a technical perspective. And here we are in what is supposed to be a bullish time of year. Geez, what will January bring in this scenario?

Anyway, I remain long via the black box buy signal of November 22nd.

I still think there is a chance this is a head fake and we could rally into year end. But then again, everything is driven by what is going on in Europe. (Ignoring the big $15 trillion elephant of US debt in the room…)

Tuesday, December 13, 2011

Monday, December 12, 2011

USA TODAY: Stocks plunge on concerns euro deal isn't enough

It's always EUROPE'S fault! It seems like we can't escape the Euro Black Hole. And if we can't rally in December, what's January going to look like? Eh?

***

Check out this article that I saw in USA TODAY's iPad application.

Stocks plunge on concerns euro deal isn't enough

http://usat.ly/ul5SKy

To view the story, click the link or paste it into your browser.

To learn more about USA TODAY for iPad and download, visit: http://usatoday.com/ipad/

Black Box Update!

No changes in the black box. Still on buy signal from 11/22.

Obviously, the market is Euro-centric at this point. I’m emotionally torn. The US is recovering and growing slowly – but growing. I’d expect the stock market to continue to grow. On the other hand, the debt in Europe and the US is staggering, and that does matter at some point.

Obviously, the market is Euro-centric at this point. I’m emotionally torn. The US is recovering and growing slowly – but growing. I’d expect the stock market to continue to grow. On the other hand, the debt in Europe and the US is staggering, and that does matter at some point.

So, is that “some point” now or later?

Anyway, I’m still long.

***

Back from a trip to LA, which is why the blog postings and podcasts slowed this past week. Spent time with family. Good times.

One thing I always forget is how nice SoCal is. Yes, there is traffic and tons of people, but there are also tons of things to do. And it’s a great environment. Plus, it has the Lakers.

LOL

Friday, December 09, 2011

TGIF! Stocks, Chris Paul, and David Stern

Stocks gyrated around until Dave Sternhitler voided the Chris Paul to the Lakers trade.

Saturday, December 03, 2011

Black Box Update

Here is the latest from the Black Box, and the buy signal at the close on November 22nd looks good.

It’s a big win so far. As you know, I bought some on Monday in anticipation of the buy signal (oops), and then more on Wednesday.

The Black Box is nowhere near a sell signal, but as you can see from August, that doesn’t mean the market won’t pullback and generate another buy signal.

This is never a recommendation to buy or sell, just a diary of what I’m doing and my experiences traveling down the learning curve. Please consult your financial advisor to determine the best way to achieve your investment objectives.