I didn't make any year-end changes to the portfolio. I remain nearly 100% long and slightly overweighted in small caps. I also have some cash on the sidelines that has grown due to dividends, distributions and what not, that I have been debating what to do with.

Friday, December 30, 2016

No Changes to Portfolio

Sunday, December 18, 2016

Electoral College Votes Randomosity

The Electors vote tomorrow. FYI. Should be an interesting day, Many of the electors have been emailed, stalked, threatened, etc., to NOT vote for Trump.

The Electors vote tomorrow. FYI. Should be an interesting day, Many of the electors have been emailed, stalked, threatened, etc., to NOT vote for Trump.- Small cap stocks have been down 2 of the last 3 weeks. FYI.

- I think the electors should do the will of their states voters. California electors should cast their votes for Hillary. Texas electors should cast their votes for Trump. Etc.

- Entering the last 2 weeks of the year, you would think a slow period in the market. Don’t short a dull tape and all. And many folks may want to postpone selling stocks until next year when we may have a new tax code.

- One of the new personal income tax proposals is to increase the standard deduction to the point where most people wouldn’t use the home mortgage deduction. Thus, for all intents and purposes eliminating the mortgage deduction for homeowners. How would that sell?

- Can you imagine the life of the Texas elector, Christopher Suprun, who says he won’t vote for Trump?

- Football. Brock benched in Houston! And the Texans rally under Tom Savage to win. Hmm.

- Fake news… There is a difference between real news, fake news, and opinion pieces. I think Facebook trying to filter stories by relying on sources many consider liberal will have some fallout. Lots of those sources tend to be full of opinions. (As we all are).

#272: Market Thoughts, Star Wars, and Electric Cars!

Market thoughts... 2017 investing theme and ideas... Disney's Star Wars Rogue One storms box office... Nissan considering an EV... Tesla to charge a fee at supercharger stations for laggards... China returns drone... And more! (From Saturday, 12/17/2016)

Saturday, December 17, 2016

The Last Few Podcasts

The last three podcasts where I talk about China, Russia, Trump and my market thoughts. Available on iTunes (Muck), Audioboom, Spreaker and Soundcloud.

| Market worried about China today... Dow 20,000 will have to wait. Obama press conference today. Russia... Nintendo... New York Times... Rexnord... And more! #china,#russia,#nintendo,#SuperMarioRun | |

| My market thoughts... The stock market bounced back today but fell short of Dow 20,000. Yahoo email gets hacked… in 2013. Russia denies Russian hacking. Strong dollar... More fake news... And more! #fakenews,#russia,$FB,$YHOO | |

| The Federal Reserve raised rates today, and made statements about the future. Stocks drop! Credit card debt booms... More fake news... Gold... Smith and Wesson... And more! #fakenews,#russia,#creditcards,$SWHC |

Wednesday, December 14, 2016

Are Stocks in a Bubble?

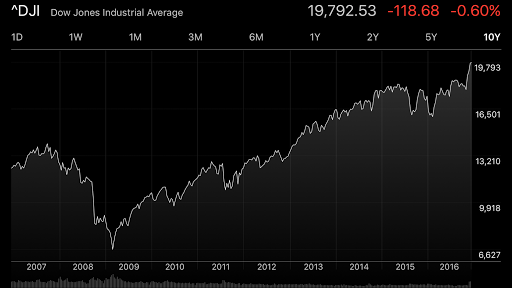

I posted a 10-yr chart of the Dow on Twitter but here it is again. $DIA

Tuesday, December 13, 2016

268: Stock Records, Russia and Trump

Market rally continues as Nasdaq 100 makes first new high since March 2000. New highs across Dow, SP500, and Nasdaq. Trump announces appointments for Energy and Secretary of State... Apple iOS 10.2 includes new TV app... Tesla... IBM... fake news... And more!

Friday, December 09, 2016

#266: Stocks Rally Again and MI Recount!

Market rally continues. New highs in the Dow, S&P 500, Nasdaq, and small-cap stocks. Michigan recount halted... Macau gaming stocks... Michael Moore...John Glenn... Fitbit... Costco... And more! (From 12/8/2016)

Thursday, December 08, 2016

#265: Trump Stock Market Rally Soars!

Market rally continues. New highs in the Dow, S&P 500 and small-cap stocks. Dow Theory transports make new highs. Trump bashes drug prices... Pearl Harbor... Tessa... Amazon... And more! This is from yesterday...

Tuesday, December 06, 2016

#264: Small Caps Rally, Recounts, and Trump!

Small Cap stocks continue to rally. The recounts in Wisconsin, Pennsylvania and Michigan. And Nevada. And Florida. Any changes? Trump... Portland... McDonalds... Nike... Amazon... And more! A little gap between posting podcasts here. Always available in iTunes under "Muck" or in the right sidebar here!

Tuesday Randomosity

For buy and holders, the Nasdaq is up 6.5% for the year. Not horrible. Not a lot. Like having Low T. Not as much fun as you’d like it to be.

For buy and holders, the Nasdaq is up 6.5% for the year. Not horrible. Not a lot. Like having Low T. Not as much fun as you’d like it to be.- I’m still long the stock market. Always wary of tax loss selling in early December, but as Christmas draws near I’d expect some year-end and 2017 positioning. Like in some of the strong-stock losers of 2016. Nike. Disney. For example. Maybe. No promises of course.

- UCLA Bruins are 9-0? Is Lew Alcindor playing?

- It was just last week when OPEC couldn’t get their act together, and then got their act together, and decided to make oil production cuts. Oil went up on that, but today back down -2.03% to $50.74. And that’s with oil inventories drawn down 2.2 million barrels.

- Maybe the Michigan recount ends tomorrow. Looks like the MI Attorney General got a favorable ruling in the Court of Appeals today, and now can file a case to stop the recount. I just want it over. Move on.

- An inequality tax? The city council of Portland will vote on Wednesday whether to impose a tax on companies whose CEO’s pay exceeds the median salary of their workers by a ratio of more than 100-to-one.

- Under Armor gets MLB deal. So if you want to be trendy, you’ll need some new jerseys with the UA logo on front.

- Google wants to get 100% of its energy from renewable sources by 2017. Hey, that’s pretty soon.

- Hmmmmmmmmm…. Tuesday…..

Friday, November 25, 2016

Black Friday Randomosity

The Russell 2000 is on a 15-day win streak, gaining 16% over that time. Hope everyone is participating in that!

The Russell 2000 is on a 15-day win streak, gaining 16% over that time. Hope everyone is participating in that!- The stock market rally is being called the "Trump Rally." Well, everyone thought Hillary had it locked up and the futures were down 5% when Trump looked like he'd win. Then after he won the market soared. Lower taxes. Lower regulations. Etc.

- The economy is pricing in a higher GDP. We've been stuck under 3% during Obama's presidency. Now Wall Street is anticipating 4-6%.

- Inflation?

- Higher mortgage rates would cause a drop in home prices. People can afford what they can afford. Unless wages start rising.

- Inflation?

- Trump wanted to refinance some of the short-term national debt at these historical low long-term rates. Uh, long-term rates have been rising... What will they be when he's sworn in.

- (If he is sworn in. Jill Stein leading the recount efforts in Wisconsin, Michigan and Pennsylvania. I think lawyers will make a lot, but nothing will change in the electoral college.)

- Lots of Black Friday deals on … TVs. Tablets. Games. Etc. Mall traffic down (they say) but online sales setting records. Over $3B?

- And lots of Green Friday deals at the marijuana stores…

#258: Black Friday! Election Recount!

Black Friday sales make record... Jill Stein leads recount effort... Market new highs - again! Trump transition and conflict of interest? And more!

Tuesday, November 22, 2016

#257: DOW 19,000! And Trump Trump Trump!

All four indexes make new closing highs... Trump transition and conflict of interest? Saturday Night Live... Economic growth... And more!

Posted by muckdog at 1:40 PM View Comments

Labels: #conflictofinterest, #SNL, $DIA, $IWM, $SPX

Friday, November 18, 2016

#255: Fake News Friday as Small Caps up 11 Days Straight!

College kids create chrome extension to identify fake news on Facebook... Small cap stocks up 11 days in a row... Kanye West and Paris Hilton...Gold... McDonalds... Cisco...Walmart... JD.com... And more!

Thursday, November 17, 2016

Thursday Night Randomosity

Obama Chimes in on Fake News Phenomenon, Warns It Could Weaken Democracy http://flip.it/bOJ_6k

Even President Obama has something to say about "fake news!" Hey if the guy making $120,000 a year and electing Presidents can do it, why would anyone be a $46,500 a year legit journalist?

Why Did So Many White Women Vote for Donald Trump? http://flip.it/WyH4XQ

So with the Billy Bush entertainment tonight audio, Hillary was thought to lock up the women vote. Not so fast...

3 Stocks to Buy With Dividends Yielding More Than 3% http://flip.it/NusGqS

I like the list of dividend stocks in this article. $MCD $TGT $PG

Oil prices shoot higher amid Saudi optimism over output deal http://flip.it/tH.G.9

So oil prices higher today... But wasn't one of the headlines yesterday that they found 20 billion barrels of oil in West Texas?

Trump asks Flynn, a fiery general, to be top adviser and plans Romney meeting http://flip.it/FUBJEB

Hmm... So General Michael Flynn and Mitt Romney next? Both controversial for different reasons! At least this is entertaining?

Dish Network’s subscriber losses are going to get a lot worse http://flip.it/bZjnve

Dish Network losing subscribers while DirecTV adding subscribers? Hmm. NFL?

Divorce in U.S. Plunges to 35-Year Low http://flip.it/XJuw6Z

Divorce rate at its lowest level since 1981? Good news... Keep families together!

#254: Market and Trump Transition Comments

Mitt Romney Secretary of State? Obama and Yellen blah blah blah... Precious snowflakes skipping classes... Is the selling in tech stock "dumb money?" Protests... Gold... McDonalds... Disney... Best Buy... And more!

Posted by muckdog at 1:20 PM View Comments

Labels: #mittromney, #protests, $AAPL, $AMZN, $DIS

Wednesday, November 16, 2016

Wednesday Randomosity

- The 7-day win streak for the Dow ended today. Nothing lasts forever. Nasdaq was up, though.

- I remain long stocks in a diversified sort of way. A little sad to see the selloff in some of the tech stocks I have, but not worried “over the long term.”

- $FB - More misleading stats from Facebook? Last September was the video watching stats. This time? Undercounting or overcounting of four measurements… Are they worried about fake news or fake stats?

- $AMZN – Black Friday at Amazon means TVs on sale! Anyone need a new one?

- Wolfcamp shale portion of Permian basin in Texas has up to 20 billion barrels of oil and 16 trillion cubic feet of natural gas. Seems like a lot. Going to need MORE pipelines!

- Maybe the Democrats best chance at fixing Obamacare was with a President Trump and a GOP Senate and House. Now the GOP will be forced to keep the popular portions and tweak other parts. Dems probably couldn’t have done that with gridlock in Congress.

- I haven’t done much stock trading this year. Keep adding to the index. Month after month. Adding to some individual names when they sell off. (Some lately).

#253: Dow Ends Streak and the Electoral College

And on the eighth day the Dow rested... What will happen with the electoral college? New Balance shoes the official shoe of white nationalists? Protests...Oil...Stocks... Bonds... Bill Gross... And more!

Posted by muckdog at 1:36 PM View Comments

Labels: #newbalance, #protests, #stocks, $DIA, $fb

Tuesday, November 15, 2016

#252: Dow up 7 Straight - What an Economy!

7 day advance in Dow... What will Trump do for economy? Bond bull market over? Apple i-glasses... No more fake news! Protests... and more!

#251: More Protests as Market Makes New Highs

High school kids join Trump protest... Stocks at new highs as tech sells off... Bonds... Apple Pay ... and more!

Sunday, November 13, 2016

Sunday Randomosity

- A prayer for those in New Zealand. A 7.8 magnitude earthquake struck central New Zealand just after midnight, causing widespread damage and generating a tsunami.

- 20,000 people evacuated from the coastline.

- For the week, the Dow rose 5.4%, S&P 500 and Nasdaq up 3.8%.

- Which are better, growth stocks or value stocks?

- I’m bullish on the market into the new year. Won’t be a straight line up. I think if Trump is successful with cutting taxes and regulations, and allows companies to repatriate overseas cash, GDP could accelerate.

- I think SNL missed an opportunity to do what they do best: Be funny. Just dog piling on Trump voters as a bunch of idiotic, uneducated racists is tiring.

- Watching football? Marching in a protest? What say you?

- If GDP accelerates, so will inflation and interest rates. Guessing down the road that could be a negative for housing affordability. And remember that we also have to refinance $20T in national debt at the going rate as short term bonds expire. Our debt will increase.

- Started your Christmas shopping yet? You think the Amazon Echo will be a hot item?

- Donald Trump says sections of wall he pledged would be built on border with Mexico could be fencing in certain areas . Maybe just some signs “Keep off our lawn.” Or some Les Nessman tape instead of walls.

- Trump plans for immediate transfer of management, business portfolio to his kids.

- I’m long the market. Diversified. Dollar cost averaging in. Status quo for now.

Posted by muckdog at 11:30 AM View Comments

Labels: #earthquake, #Inflation, #newzealand, #protests, #Trump, $AMZN

Saturday, November 12, 2016

#250: Fallout from the Election

Protests continue in Portland, Los Angeles, New York...

Stocks rally after election but what happens next?

Bonds... Gold... Watching live streams on Facebook... and more!

Posted by muckdog at 1:52 PM View Comments

Labels: #facebook, #Inflation, #protests, #stocks, $fb

Friday, November 11, 2016

#249: Veterans Day and Big Week for Stocks!

Veterans Day - why not donate to a charity? Best week for stocks in 5 years... Trump walking back some of his campaign promises? Warren Buffett says Stocks will rally over long term... Chicago pizza tax... Grubhub CEO Matt Maloney reacts to Trump's win... Protests...and more!

Posted by muckdog at 2:31 PM View Comments

Labels: #protests, #stocks, #Trump, #WarrenBuffett, $GRUB

Thursday, November 10, 2016

#248: Election Aftermath: Stocks Rip Higher

Wednesday, November 09, 2016

Election Aftermath Randomosity

Stock futures spiked lower last night when the thought of a Hillary victory started heading south. But today… We were at new market highs before a late day pullback!

- Everyone doing the Monday Morning Quarterback routine and analyzing results. MSNBC still counting votes and not declaring some of the battleground states over yet.

- The pendulum goes back and forth. The GOP crash in the 70’s after Nixon. Rise in the 80’s under Reagan. Crash in the 90’s with Clinton. Up with George Bush after Y2K. Gone again with Obama. Now … They’re back again!

- If you don’t like the way things are, wait a few election cycles. It will go back your way soon enough. Don’t stress out.

- Cher said if Trump won, she’s moving to Jupiter.

- Alec Baldwin probably feeling good about a long term SNL gig doing Trump. Right?

- Less happy is Mexico’s Carlos Slim. They say he lost over $5B on the Trump win with the Peso slide. OUCH!

- I think everyone was hoping the market was down 700 tomorrow so that they could do the BREXIT buy buy buy and profit on the rebound. Folks were texting me about it! Didn’t get that chance.

- Alexion halted as I type $ALXN. Delaying their earnings. LOL

- $GM slashing 2000 workers due to lower demand.

- Is Renault-Nissan bringing a low-cost $8,000 electric car to market? So, one of those or one of those $100,000 things from $TSLA? Hmmm….

- So even with the Trump win and today’s rally, remember the market will start worrying about Fed rate hikes again soon… The first year or so of Trump may not be the best for the market. Not his fault. Economic growth is slow and the current expansion has been staggering along for awhile. Now facing rate hikes.

- I’m still long the market and diversified and dollar cost averaging. Hard to beat that over the long term. Short term trickier.

Posted by muckdog at 1:57 PM View Comments

#247: Election: The Day After Thoughts

Trump wins! Futures tank followed by rally in stocks. What will President Trump do? And more!

Posted by muckdog at 1:34 PM View Comments

Labels: #election2016, #MAGA, #stocks, $GPRO, $IBB

Tuesday, November 08, 2016

#246: Election Day! Stocks Rally!

Posted by muckdog at 12:50 PM View Comments

Labels: #election2016, #MAGA, #stocks, $CVS, $PCLN

#245: Election News and Market Rally

FBI done with 650,000 email review. Huge rally in stocks. Hillary and Trump crisscrossing the battleground states. Gold crashes... Jamaican lottery scam kingpin busted... And more!

(From Monday, November 7th, 2016)

Posted by muckdog at 11:30 AM View Comments

Labels: #election2016, #gold, #Jamaicanlottery, #stocks, $GLD

Sunday, November 06, 2016

Election Randomosity

Who would be better for the stock market, Hillary or Trump?

Who would be better for the stock market, Hillary or Trump?- Historically, the market does good with either party controlling the White House. Slight edge to Democrats. But the biggest edge is a Democrat in the White House and the Republicans controlling Congress. Gridlock! The markets love when the government is paralyzed and can’t pass legislation.

- We will be fine no matter who wins. Remember: The Founding Fathers put in checks and balances in the system.

- A woman voting for Trump tells her story.

- Price controls for drugs? Would that be a good thing for drug stocks? Drug prices have been in the news the past year, as price gouging and fixing are being investigated. With Obamacare price increase smacking consumer wallets, will one of the fixes be to slap on price controls on medication?

- Paid maternity leave? Looks like there is some support for this from both Hillary and Trump. Hillary Clinton wants to cover up to 12 weeks of leave for both parents, while Donald Trump has proposed six weeks of maternity leave.

- Hillary and Trump supporters unfriending each other on Facebook. Hey if you listened to my podcast, you heard me talk about how receiving a Facebook friend request decreases mortality. What does this do???

Posted by muckdog at 12:43 PM View Comments

Saturday, November 05, 2016

#244: More on the Election and Stocks

Is the Donald Trump surge rocking the stock market? Hillary still the favorite? Voting demographics... Stocks down 9 in a row... Facebook for a longer life? Samsung products gone wild... Venezuela... Chevy Bolt... And more!

Posted by muckdog at 12:26 PM View Comments

Labels: #election2016, #Samsung, #stocks, #Venezuela, $fb, $GM

Friday, November 04, 2016

Friday Night Randomosity

How many days in a row have stocks been down? And 3 months in a row?

How many days in a row have stocks been down? And 3 months in a row?- Charles Payne on Fox Business said he did some research, and other than the 1992 Ross Perot clusterfuck, if the market is down the three months prior to the election, the incumbent party loses. (I may have paraphrased a word in there).

- If I told you the market was going to rally 10% by April 2017, would you buy now or wait? That’s what Samuel Eisenstadt says anyway. Lets go with Sam!!!

- I have talked about the election on the podcasts. Will type and say more in the days before – and after!

- Warriors at Lakers – Lakers up at halftime. Huh? Probably thanking their lucky stars THEY didn’t sign Kevin Durant.

- One of my coworkers dressed up as Mrs. Incredible for a work site Halloween costume contest. Really? Pretty much a game changer.

- Seoul bracing for huge anti-Park rallies. Who doesn’t like parks? Bwah. Yah, I know. Just had to.

Hey I took this same picture of the Fed when I was in D.C. riding the hop-on hop-off bus.

- So yes. I have increased blogging and podcasting this week. Hope to continue it. Podcasts in the sidebar at Audioboom, but also posting at Soundcloud and Spreaker for now. Please give some feedback here, there, Twitter or wherevs.

#243: Election News and Market Update

FBI indictment not imminent? Hillary and Trump in battleground states... Stocks down 9 in a row...Jobs report...David Stockman says sell your stocks! Las Vegas Sands, GoPro and Whole Foods Markets... Jared Fogle...And more!

Posted by muckdog at 8:24 PM View Comments

Labels: #bridgegate, #election2016, #jobs, $GPRO, $LVS, $WFM, Jared Fogle

Are the FANG Stocks Dead?

Have the FANG stocks lost their bite? $FB $AMZN $NFLX $GOOGL

My thought? No. The market is selling off and those stocks that had the biggest gains are seeing the biggest pullbacks. I view all of these stocks as generational game changers. They have changed the way we live our lives.

Facebook is how we keep in touch with each other. It has replaced emails and chat. It has replaced late night phone calls. We share our lives with each other on Facebook (and the other companies owned by the social media giant). I view $FB as a stock that 10 years from now, many people will have wished they bought and held the stock.

Amazon has replaced the mall. In some cases, it has replaced the grocery store and corner drugstore. It’s where we buy stuff. Remember when you had to wait 6-8 weeks ordering merchandise from a mail order catalog? 2 days. Anything you want. Same day in some areas. Oh, and they do other things, too. The stock has already soared.

Netflix and chill! Cord cutting is for realz. Does anyone have the patience to watch a weekly episodic TV show anymore now that Netflix has introduced us to the wonders of binge watching? My greatest fear with the stock is competition. It’s still coming and growing. But $NFLX is the king of streaming. And they put out some great shows! Anyone else watch Black Mirror or binging Luke Cage?

The Google! This company is going strong with search and video. The search page is hit multiple times a day for most of us, and has settled many a game-day argument amongst buddies. “Name all the undefeated NCAA college football teams?” Anyone else wasted an evening going from YouTube video to YouTube video, watching crazy dog vs. cat videos or a news clip on a current event?

Game changers. These stocks are how we spend our time. Advertisers want to spend money where we spend our time.

Of these stocks, I believe $FB will be the strongest grower over the next 10 years. This doesn’t mean any of these stocks will go straight up for the next 10 years. All stocks are subject to moves by the Federal Reserve on interest rates, recessions, mergers/acquisitions, competition, and random acts of God.

Thursday, November 03, 2016

Election and Stock Market Update

Is Hillary or Trump better for the stock market? What the heck happened with Fitbit and Facebook earnings? Is McDonalds doing the right thing? Blue jeans... Black Mirror... And more!

Posted by muckdog at 5:30 PM View Comments

Labels: #BlackMirror, #election2016, $fb, $FIT, $mcd

My Election Prediction

My thoughts on current status of 2016 election, Hillary Clinton, Donald Trump and the impact to financial markets.

And my 2016 prediction!

Wednesday, November 02, 2016

Cubs Win!

- The Chicago Cubs have won the world series!

- Donald Trump may have passed up Hillary in some of the polls – But are the polls worth a darn? If you read Twitter, you have folks accepting polls blindly, and some saying the methodology is all hogwash. Pick and choose!

- $FB – Ugh, Facebook tanked after earnings. Yes, revenues going through the roof. But… I guess nobody cares about that right now.

- The market in general selling off. Some blame the shifting political polls. Some blame the thought of rising interest rates. I think the latter more likely than whatever happens Tuesday.

- By the way, I finished watching Black Mirror on Netflix. Wow. Bees. The Bees!

- By the way, I think Hillary is going to win. But momentum is with Trump right now. Will it be enough to win the battleground states?

- Anyway, I do have a little cash and looking for some names to buy. Everyone always wants a dip to buy. This is one. Like I said in the podcast the other day, I hate to buy stocks at the highs and now here we are. In correction mode!

Saturday, October 29, 2016

Saturday's Probing Randomosities

- The election seems to be rigging the stock market these days. Friday’s big election story was the FBI revelation about The Weiner Device. While investigating Weiner, the FBI found some new Hillary emails. While this is a “new” story, haven’t we all accepted that Hillary is a bit crooked?

- Probe. Yah… “Probe.”

- The Saturday morning Fox Business Block, aka “The Cost of Freedom,” has been derailed the last few weeks with election coverage. So instead of Gary B. Smith and Gary Kaltbaum, today we get Neil Cavuto interviewing one of the Duck Dynasty guys about the election. Really? (Sorry if I don’t know the names of the Duck Dynasty cast).

- I saw Kevin O’Leary on CNBC opining on Tesla ($TSLA), and that it’s way overvalued compared to a typical car company. I have to agree. The more I listen to that guy, the more he makes sense. Good sense? Nonsense? We will have to wait and see.

- Meanwhile, Michigan beating up on Michigan State this morning. I’m sure they’re trying to increase the point differential to be large enough to negate the impact of a blocked punt. Just thinking out loud!

- I know folks are opinionated about the election. Many saying that if the other person wins, it’s the end of the country. Just keep in mind that the government is set up with checks and balances. There are vetoes and filibusters and Supreme Court rulings that tend to filter out the extreme stuff. Tend to…

- Americans setting a record for gasoline use! “…thanks to low gas prices and an unprecedented number of drivers.” Awesome! So in the age of electric cars, hybrids, and overall better fuel economy, gasoline use surging! Something to think about as gasoline prices edge upwards.

- If you’re a fan of The Walking Dead, last Sunday’s episode was a mixed bag of intenseness, sadness, and awesomeness. Way to start a season, right? I am excited to see where this goes. Although I wish I could binge watch the season instead of dragging it out week-to-week.

- Happy Saturday, all!

Posted by muckdog at 12:28 PM View Comments

Labels: #election2016, $TSLA, tesla, The Walking Dead

Saturday, October 08, 2016

Saturday Market Thoughts

Stock market has been a little frustrating this year. Not that it has been bad, but it has been underwhelming. Stuck. But it feels like this for almost two years now!

Stock market has been a little frustrating this year. Not that it has been bad, but it has been underwhelming. Stuck. But it feels like this for almost two years now!- One in five millennials has not had a Big Mac. Hey I had my first and only one three years ago. I’m not sure its a huge problem. The few $MCD near me seem crowded all the time these days, and I think breakfast is doing it.

- Thank goodness for dividends, right? Although those have been taking a hit recently as people seem to expect rate hikes coming, and the competition from bonds will be enough to get people to switch from dividend stocks back to bonds. Are you buying that? That’s the thought pattern anyway.

- If you were thinking about buying some Disney stock, would you do it now or wait until closer to year end in case tax loss selling comes in play? Or buy half of $DIS now, and hope it goes down so you can buy some more later!!! Booyah!

- Hmm… Politics. All over the place in the news cycle. Vote early and vote often.

- Not that the Fed will really hike rates, though. GDP low. Inflation low.

- Sell in May didn’t really work this year. At least dividends were collected in stocks. I never did much selling. A little. Raised some cash waiting for a sell off that never came. Seems like it would have been a decent year to trade rips and dips. The range…

Monday, May 23, 2016

Fed Rate Hike Randomosity

I think it’s tough to raise rates in an election year. Especially the further along we get in the calendar. Would the Fed want to have an impact on the election?

I think it’s tough to raise rates in an election year. Especially the further along we get in the calendar. Would the Fed want to have an impact on the election? - If you’re weighing rates and looming data, then you’re being blamed for today’s market fluctuations!

- The economic data has mostly been soft. Maybe inflation ticking up a little. I wonder how much of that is due to wage hikes pushing up prices? We have minimum wage hikes and new overtime pay rules.

- Why is Donald Trump surging in the polls? Trump is quickly consolidating the support of his party, while Clinton's still locked in a grueling primary battle. I mostly agree with this, and when Hillary finally gets the nomination, Bernie supporters will consolidate around her.

- Does anyone like $AAPL – Apple stock? Well, here may be some good news. They have a list of things, but my point is that the company is still going to win more and more market share around the globe. Heck, I’m going to upgrade to an iPhone 7 this Fall.

- I still think Hillary wins in a LANDSLIDE in November. It won’t be close.

- I use Open Live Writer to blog. FYI. Pretty clean interface. WYSIWYG

- Who wants to fly to Hawaii? Have you heard of VietJet? Well, lets watch the video.

- Hey! Is it all day breakfast or another move that has been critical to McDonald's success: improving customer service through wage increases and training. HMM. So raising prices good for consumers? …the changes "have resulted in lower crew turnover and higher customer satisfaction scores ... and we are gaining share relative to the [fast-food] sandwich segment."

- The Freddie Gray case is over. Edward Nero – Not guilty! So that will be in the news a lot this week. Hope for peace.

- $FIT - Fitbit facing a lawsuit over highly inaccurate trackers? Hmm.

- Remember when Xiaomi was supposed to be the Apple iPhone killer?

Posted by muckdog at 11:50 AM View Comments

Labels: $AAPL, $FIT, $mcd, federal reserve, Minimum Wage

Sunday, May 22, 2016

Sunday Randomosity

Market sentiment seems bearish. Even with stock indexes not that far from all-time highs. Except for the Nasdaq, where there has been some carnage in growth. But money has rotated into “safer” names for now. And Amazon.

Market sentiment seems bearish. Even with stock indexes not that far from all-time highs. Except for the Nasdaq, where there has been some carnage in growth. But money has rotated into “safer” names for now. And Amazon.- Lets build a park, and fill it with carnivores. Now that would make for a great movie! 3 Nile crocodiles found in Florida… between 2010 and 2014, the Nile crocodile was responsible for 480 attacks on humans in Africa … officials say the swamp dwellers escaped from a facility called Predator World.

- My thoughts on minimum wage hikes and increased compensation via overtime rules reform? When companies face higher costs, they either try to reduce costs or pass along the higher costs to consumers. So, these laws will probably mean some combination of fewer employees, fewer working hours for employees, and higher prices at the stores, malls, and monthly bills for consumers. And combine this with more costs for rules and regulations, there is an unknown impact on small businesses that never get started in the first place.

- Back to stocks, I think all these liberal/progressive rules are a major factor in the slower GDP growth we’ve seen. And economic growth fuels the stock market. Which hasn’t gone anywhere in almost a year and a half!

- And throwing the first pitch today is Tiffany Hwang from the South Korean kpop group Girls Generation. Nice throw, Tiffany!

- Energy experts say oil won’t top $100. Does that make you nervous? So I suppose what that really means is that we should start to fear really high oil prices again.

- Angry Birds made $39 million this weekend? Hmm. Well, I did get an Angry Birds themed spoon at the local yogurt shop yesterday.

- Hedge funds unloaded $7 billion of Apple stock in the first quarter. Nobody likes it anymore. Should start seeing some downgrades, right? Some are comparing to Blackberry. Hmm. Well, I’m not there yet. I still own it.

Posted by muckdog at 12:46 PM View Comments

Labels: $AAPL, Girls Generation, kpop, oil, Tiffany Hwang

Sunday, May 15, 2016

Feels Like the Tide

The stock market has felt a lot like the ocean tide the last year and a half. Rolls in. Rolls out. But it seems like nothing much is going on. Cash on the sidelines is doing about as well as a diversified index fund!

Monday, April 25, 2016

Year to Date Update

Market year to date: Energy! $XLE

Market year to date: Energy! $XLE - #FearTWD - I like Fear the Walking Dead. But I am a little disappointed that they didn’t spend more time covering society’s downfall. Even this season when they show LA being blown up in the background. I would have liked to see more stories on what’s going on inside the government and military. They can still do that with character flashbacks, by the way. Where were you when… and what was happening when…

- What a difference from the last check I did at the end of February, when nobody seemed to give energy a chance. Utilities have been hanging on.

- Technology a bit frustrating, and makes up the largest sector in the SP500. Financials negative, another large weighting.

- Steph Curry… Ouch! Kind of sad to see the Warriors get the season wins record, and then get hit with a major post-season injury. It’s tough to stay on top!

- One way to think about energy, is that more demand for energy would tend to go along with a growing economy. Right? Of course, it matters if the dollar is ascending or descending, too…

- I was one who thought Donald Trump was just a sideshow, and he may take the GOP race after tomorrow’s primary. LOL. Well, I don’t want to go out on a limb here, but I can’t imagine a scenario where Hillary doesn’t just blow him out in November. The Republicans have to hope he doesn’t kill their chances of retaining both houses of Congress…

- Everyonce and awhile, sometimes, I think I should do some podcasts. Sometimes I even do one. And then never upload it. LOL.

- Overall, still bullish. But will move some to cash ahead of summer.

Sell in May via MACD Cross

#sellinmay - For anyone thinking about Sell in May, one method used an MACD cross as of Friday to get the heck out. I will be scaling out of some long positions this week in tax deferred accounts.

Thursday, February 25, 2016

Market Jitters

Year to date? The Utes! (And I don’t mean Utah).

Year to date? The Utes! (And I don’t mean Utah).- I remain long and dollar cost averaging. When I watch the Fox Business Block, Ben Stein often recommends that you buy $SPY “and hold on for dear life.”

- I also do still own a handful of tickers and $QQQ.

- It feels like a bear market, but not seeing recession signs. Sure, the economic indicators are so-so. Growth is slow. But unemployment is low. Inflation is low-ish.

- Watching the GOP debate on CNN. Who else is wondering why Carson and Kasich were even invited? They are out of it…

- (Wondering if Cruz and Rubio are also out of it!)

- I think Hillary crushes Trump in November. Won’t be close. I think Rubio is the only one who has a shot in November, but he may not have a chance in March against Trump!

- But hey, the important thing in March is March Madness…

Friday, January 15, 2016

Worst First 2-Weeks Ever

- What do we make of the stock market collapse early in 2016? Is this the beginning of a recession? Is this the end of Batman?

- Seriously, it’s not fun to watch the portfolio go down… down… down. This is the worst “first two week start” of a year ever! “The Dow and the S&P 500 are both down 8.2 percent since the beginning of the year. The Nasdaq is down 10.4 percent.”

- The opening rallies are sold off. The high-beta stocks are falling. Have you seen biotechs?

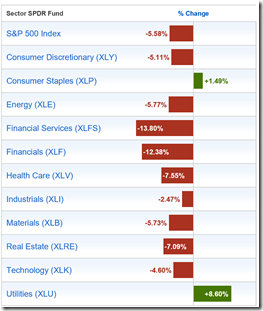

YEAR TO DATE SECTOR SPDR ETF PERFORMANCE

- Yay! Utilities!

- I’ve been caught long and flat-footed. I don’t like to sell AFTER a 10% decline (or worse in some names). I guess I just continue to add, hope, pray, and watch political debates, playoffs, and Netflix.

- (Say, Jessica Jones is very good).

- It seemed initially as if the financial folks were trying their best to pick a bottom. Now, they’re trying to get out of the way of a further decline. It seems as if we need more bearish sentiment and “get out on any move up” kind of sentiment, before a bottom shows up.

- (This is where I normally insert a picture of a bottom. You know.)

- Recession… Bear Market Fears.

- So there’s declining oil. Oil is flooding the market. Way too much supply. We always thought cheap gasoline would help consumers, but retail numbers don’t show that. Are folks saving? Paying off bills? Paying more for health care and student loan debt?

- Anyway, it’s a long weekend. More later…

Tuesday, January 05, 2016

Stock Returns During Last Year of a President

$SPY – Here are the recent historical returns of the stock market during the last year of a President.

1980 32.40% Jimmy Carter

1988 16.80% Ronald Reagan

1992 7.70% George HW Bush

2000 -9.10% Bill Clinton

2008 -37.00% George W Bush

2016 ??? Barack Obama

Nothing to do based on this. But interesting.

There was the end of the internet bubble and subsequent recession that happened during Clinton’s last year.

George W Bush was hit with the collapse of the housing bubble, and the loans made to people who had no chance of every making monthly payments.

Are we in a bubble now? Bonds? Real estate? Stocks? All of the above?

Stay tuned!

Sunday, January 03, 2016

2015 Review-2016 Preview

I beat the market in 2015, with a 7.5% return. This is due to an overweighting in $QQQ and also some individual stocks. The biggest winners were $MCD, $FB, $JD, and $DIS.

I beat the market in 2015, with a 7.5% return. This is due to an overweighting in $QQQ and also some individual stocks. The biggest winners were $MCD, $FB, $JD, and $DIS.

I also had a few ugly ones, including $LVS, $TWTR and $XOM (then rotating into another loser, $EOG). Then I had a few names that towed the line with index, and didn’t do anything other that spit out a few dividends every quarter.

Fortunately, I was considerably overweighted in the better names.

2015 was a year where I bought and held companies I thought would beat the market. I didn’t chase the IBD hot stocks or take the hot tip of the day. I didn’t run my market timing model every day. I did raise a little cash before summer and reinvest in August, in a little nod to Sy Harding and “sell in May and go away.”

By the way, had I used my market timing system using $QQQ, I would have made 11% on 9 trades, with 8 of them winning trades.

Heading into 2016, I am fully allocated and remain in the holdings I mentioned. I think my winning stocks will continue to be winners, although I would expect $MCD to slow down and $DIS to bounce back. $FB is a big holding and I’m a believer of The Social Network growth. Of the losers, I don’t know when energy comes back, but know it will. Cheap energy never seems to last for long.

I think $TWTR makes it. I don’t know how much money they’ll make or when the stock will get hot again if ever. But I spend enough time on there to know it’s addictive and a great time waster. This is a “buy what you know” kind of stock. It’s just where people go for instant news and chat. I think the company figures it out someday. And the stock could be volatile for trading around the position.

$LVS is the ugly ducking where you just never know about the Chinese gambling market. I’m going to stick with it for now, banking on a continuing growing economy in China and the reality that people love to gamble. As the population grows, as affluence grows, the casinos will get busier. The company also continues to pay and raise the dividend, too.

Then, there’s energy. Energy. Energy! This is the amazing topic of 2015, where declining oil prices were supposed to help the economy and give consumers more money to spend. Where is that money going? Or, is the declining labor participation rate offsetting that?

Oh, the stocks. I don’t believe oil prices are going to $0. As companies cut back on production, eventually supply and demand issues work themselves out. I rotated back into $XOM and think that’s the place to be for now. Until things get better, some of the companies where R&D and investment money goes could get hit further.

Overall, I have about 10 stock tickers and mostly index ETFs. I believe my big winners of 2016 will be $FB and $DIS, with the corner of my eye peaking at $TWTR.

I haven’t bought any Dow Dogs this year, but think $IBM is interesting.

Happy New Year!

Saturday, January 02, 2016

Wayne Rogers

Wayne Rogers passed away on December 31, 2015. I have spent many weekends watching Cashin’ In on Fox, as Wayne implored Jonathan Hoening, “Jonathan, shut up and let me finish!”

Wayne Rogers passed away on December 31, 2015. I have spent many weekends watching Cashin’ In on Fox, as Wayne implored Jonathan Hoening, “Jonathan, shut up and let me finish!”

What Wayne did finish is leaving a lasting impression on me and all viewers across the country who tuned in weekly. Wayne always came across as level-headed and thoughtful, providing insights into the financial news affecting our lives. He also did so with a sense of humor and quick wit.

Many remember Wayne fondly from the early days of MASH, along with other TV shows and movies. I loved MASH!

Thank you, Wayne!

Posted by muckdog at 1:39 PM View Comments

Labels: #costoffreedom, Cashin In, Cost of Freedom, Wayne Rogers

2015 – Dollar Cost Averaging into an Index

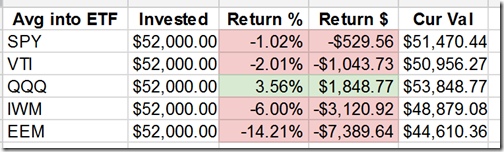

If you had invested $1000 in an index ETF every Friday (or last trading day of the week) at the closing price in 2015, how would you have done?

Excludes dividends and trading costs.

Some brokerages wave the trading cost if investing in certain index ETFs, as long as the investment is held for a certain period of time.

- $SPY – SP500

- $VTI – Total market index

- $QQQ – Nasdaq 100

- $IWM – Russell 2000

- $EEM – Emerging Markets

Posted by muckdog at 1:26 PM View Comments

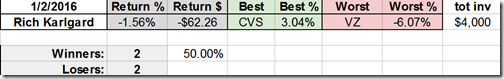

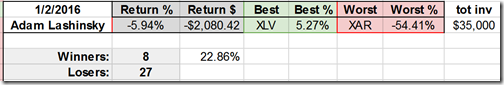

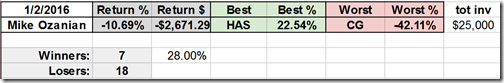

Fox Business Block Gurus Update – 2015 Final Part 2!

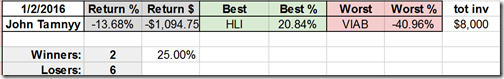

Here how the Fox Business Block gurus performed individually (excluding dividends).

This return is based on investing $1000 per weekly stock pick at the closing price Friday night.

The stock picks started 12/28/2013 through the 12/27/2014 picks. In addition to total return, I tracked the percentage of winning picks. Here is how they did, from first to worst!

Best and worst picks of 2015!

Posted by muckdog at 1:07 PM View Comments

Labels: #costoffreedom, #foxbusiness, Cost of Freedom, fox business

IBD Top 50 Stocks Strategy – 2015 Final!

Here is the IBD 50 stocks investing strategies vs. $SPY. We have a winner! Buying and reallocating weekly to the IBD top 10 stocks outperfomed this last year. This analysis is from 1/1/2015 through 12/31/2015.

I didn’t track and blog about these weekly or monthly in 2015, as my overall blogging activity fell off a cliff! These stocks tend to be high beta, and at times the portfolio was significantly ahead of the index, only to underperform like crazy on any market pullback. It seems like high beta gets punished the most when the market mood sours.

2015 is over, and the SP500 underperformed most of the IBD 50 investing strategies. The opposite of 2014.

The portfolio is sold at the closing price Friday night, and rebalanced into the make-up of the IBD top 50. Dividends are excluded from total returns.

I will assume a $9.95 trading cost to sell last week’s or last month’s portfolio, and $9.95 to buy the new weekly or monthly portfolio. (Imagine the costs of doing this with individual stocks, compared to using Motif. Note that Motif limits the size of portfolios to 30 stocks).The IBD monthly strategy also outperformed the SP500 in most cases. Holding and rebalancing each month into just the top 5 IBD stocks came out on top.

The more diversified portfolios were closer to the return of the SP500.

The Top 25 holdings are listed at at Motif Investing.

None of the above strategies are a recommendation to buy or sell stocks. These are model portfolios constructed for entertainment only.

Each portfolio begins with $10,000 and then invests an equal amount in the top 5, 10, 25 and 50 IBD stocks at the closing prices on Friday for the weekly model, and at the closing prices on the last trading day of the month for the monthly model. Since IBD changes the make up of their top stocks daily, this will only rebalance on Fridays or end of month. It is assumed that trading costs are $9.95 to “buy” a model portfolio, and $9.95 to “sell” a model portfolio. Thus, each weekly or monthly rebalance out of the previous portfolio and into the new portfolio costs $19.90. Daily changes in the IBD 50 or stock rankings are not considered. Changes in IBD’s overall market views are not considered. Stop loss orders or other market timing strategies are not considered. The value for SPY is based on buying at the closing price the last trading day of the preceding year.

Based on a blog entry from Paladin Money. See Investors Business Daily for more information on the IBD 50. See Motif Investing for their IBD Top 25 portfolio, and the ability to construct your own portfolio of stocks.

Fox Business Block Gurus Update – 2015 Final! UPDATED

Here how the Fox Business Block gurus performed compared to the indices (excluding dividends). This return is based on investing $1000 per weekly stock pick at the closing price Friday night. The stock picks started 01/03/2015 through the 12/26/2015 picks, versus dollar cost averaging into the index ETFs during the same time period.

Here how the Fox Business Block gurus performed compared to the indices (excluding dividends). This return is based on investing $1000 per weekly stock pick at the closing price Friday night. The stock picks started 01/03/2015 through the 12/26/2015 picks, versus dollar cost averaging into the index ETFs during the same time period.

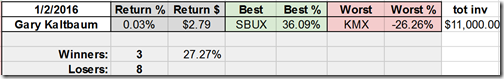

We have a back-to-back winner! Gary Kaltbaum repeats! But he barely came out in the green in a flat 2015 market. Only the QQQ index outperformed. Gary K. is not a weekly participant. He made 11 stock picks for 2015. Gary B Smith again finishes in second place. Repeating what I said last year, it doesn't surprise me to see Gary B. Smith and Gary Kaltbaum near the top of the list. I've often thought that those two seem to be the most consistent.

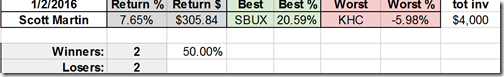

** Edit ** - Scott Martin made 4 stock picks on Bulls and Bears in 2015 and had a total return of 7.65%, as noted in the Part 2 post. He should be the winner absent a rule on minimum stock picks to be eligible. I don't want to modify this entire post, though. But kudos to Scott for beating not just the other gurus, but the index tickers as well!

Near the bottom of the list is Wayne Rogers. As you may have heard, Wayne just passed away. Wayne hadn’t made any stock picks since early November. In addition, the Cashin’ In show has relegated the picks of Rogers and Jonathan Hoenig to the Fox web site, while the show discusses non-stop politics on a weekly basis. I haven’t watched the January 2nd episode, yet. Will see what they say regarding Wayne and any changes to the show line-up.

As you can see in the graphic, most of the gurus underperformed dollar cost averaging into the major index in 2015. The index did hold up better than the majority of stocks. This is most likely because of the weightings of stocks in the index trackers. Small caps and emerging markets performed poorly in 2015.

Ben Stein and Adam Lashinsky tend to pick stocks, ETFs, or funds that track a market index or are at least widely diversified. And they’re in the middle of the pack.

Charles Payne "tends to" pick volatile stocks. As the market trends strongly in one direction or another, his picks have a little extra beta to the upside or downside. Another poor year for Charles.

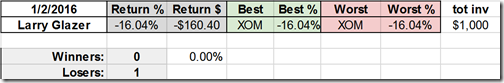

Larry Glazer made one pick: XOM. The stock was down 16% from when he picked it. I should consider deleting Larry from the list. I think last year was the same story, with Ford as his pick. LOL!

The Forbes on Fox gang also in the middle of the pack. What I do like about their stock picking segment of the show is that they give a little more analysis of why they’re picking each stock. Not that this lead to better performance, but at least you get some of the thought process.

That also points out that these stock picks are made without any future guidance. Once you buy, there is no advice to sell or buy more. The shows do have an occasional “follow up” show that goes over the best and worst picks for each guru, and what they’d do with that one or two picks going forward.

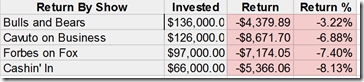

How did the shows do compared to each other?

Congratulations to Bulls and Bears for coming out on top! Collectively, the picks underperfomed the index (SPY).

On to 2016! Good luck to all of the Fox gurus!

Posted by muckdog at 12:23 PM View Comments

Labels: #costoffreedom, #foxbusiness, Cost of Freedom, fox business