- Seasonality: The first 5 trading days of May during the third year of the election cycle. Bullish!

- The check's not in the mail! Social Security goes Direct Deposit starting May 1st. That means no more paper checks. That seems to be the trend with everything. Who write checks anymore? The next thing you know, paper currency will be gone.

- Warren Buffett says not raising the debt ceiling would be the most asinine act ever. EVER! Even he knows the best way do deal with out of control credit card spending is more credit card spending. That's the way Main Street does it. When one credit card is topped out, you get another credit card. Problem solved. Right?

- Save $100 a week. Well, some of these things take the fun out of life. But...

- Spend it like you stole it from the bank. They say nothing stimulates the economy like a bank robbery!

- President Obama spoke today about ending tax breaks for Big Oil. Of course, that would cause companies to pass along their increased costs to you. Companies don't pay taxes, they collect taxes.

- 30mph wind gusts here in Sacramento. But the temperature is about 72.

Saturday, April 30, 2011

Saturday Randomosity (and Pippa Middleton!)

Warren Buffett's Thoughts on Gold

Warren Buffett says he is not chasing gold. $$

Warren Buffett says he is not chasing gold. $$

He says all you can do is admire it and fondle it.

The Oracle of Omaha has a point.

I remember back in the late 1990's when he said he didn't own any tech stocks. That sure turned out to outshine the wisdom of the masses back then. Although, it's never obvious until it's in the rear-view mirror.

Erin Burnett Leaves CNBC for CNN

Erin Burnett leaves CNBC and joins CNN.

Erin Burnett leaves CNBC and joins CNN.

Biggest story of the week alert!

Well, I think Erin should strike while the iron is hot. The stock market is at bull market highs, and investors are getting more excited about equities. CNN wants to tap into this renewed enthusiasm by launching a TV show.

Why not cash in?

I have had ATT U-verse since January, and I have no idea where CNN is on the channel line-up. That probably won't change. While I will miss Erin on CNBC, I'm sure the top brass are combing college campuses for a hot coed to replace Erin on Squawk Box.

Good luck, Erin!

Friday, April 29, 2011

$DTV vs. $NFLX vs. $T

$NFLX vs. $DTV? DirecTV was a great service for me. But once I decided to ditch the NFL, it became unnecessary for me. I dropped it and went to ATT U-Verse.

$NFLX vs. $DTV? DirecTV was a great service for me. But once I decided to ditch the NFL, it became unnecessary for me. I dropped it and went to ATT U-Verse.

So here is an article where DirecTV is asking customers if they'd like streaming content for an additional fee. Yeah. Additional.

Don't they know they're expensive? Don't they know Netflix already does this?

Good read.

Not switching back to DTV anytime soon...

And say, those worried about ATT's growth, what about U-Verse growth into cable TV?

Gold vs. Gold Miners

Notice the divergence between $GLD and $GDX? That’s Gold vs. Gold Miners.

It could be investors surging into Gold over anything else. It could be a sign that the mania for the metal is surging. Even so, who knows how long the mania can last? It could go on for awhile. We are certainly seeing wild projections for the rise in precious metals.

Of course, we’ve seen that recently with tech stocks in 2000 and real estate in the mid-2000s. And we know how it ended.

But that may not be today’s business. People want, no, must have, gold.

Thursday, April 28, 2011

Would you like Fries with that New $MCD Job?

McDonalds hired 62,000 in their goal to hire 50,000.

McDonalds hired 62,000 in their goal to hire 50,000.

That adds up to 12,000 burger flippers McDonalds just couldn't say "no" to. Couldn't pass 'em up.

Over one million people applied.

The article mentions it's easier to get into Harvard. Well, on the surface. I think the turnover rates at the Golden Arches is a bit higher, though. So one's chances of working at the drive-thru window is probably good if one is patient and persistent.

Thursday Randomosity

Big day for GDP, $XOM earnings, white $APPL iPhone, and the NFL draft!

Big day for GDP, $XOM earnings, white $APPL iPhone, and the NFL draft!

- GDP came in at 1.8%, much lower than expected. High fuel prices and the continuing slide in real estate getting the blame.

- First-time filings for unemployment claims jumped last week, coming in above the key 400,000 level for the third straight week. It just seems like the recovery can't get any firm traction. This explains why the Fed continues easy money policies.

- Exxon Profits up 69%. That makes us feel good, right? The stock is down, though.

- Buyers line up for white iPhone. (Racists!). Well, it took Apple long enough to produce it. Wonder what it all means for the iPhone 5 release date?

- Sony Playstation Network breach leads Sony to shut it down for now. Online security is a huge issue. Be careful.

- No, I am not following the Royal Wedding.

- But I am following the NFL draft! Starts tonight!

Wednesday, April 27, 2011

And the Crowd (and Gold) Goes Wild!

Gold soared to $4000 an oz. after Ben Bernanke announced continued easy money policies from the Fed.

Gold soared to $4000 an oz. after Ben Bernanke announced continued easy money policies from the Fed.

"I could give a rat's ass what happens to the dollar," Bernanke said, and then laughed as he left the building.

(He didn't really say that, as far as I know. I'm just making that up. And gold isn't at $4000 an ounce. Not yet, anyway.)

So interest rates remain the same and the Fed continues QE-something or other. The punch bowl remains on the table for now.

Stocks are rallying. Gold is rallying. Silver is going hyperbolic.

Netflix is up. And maybe DVDs by mail and streaming content will replace the US dollar down the road. "I will trade you a sack of rice for season 2 of Californication."

The bull market is alive and well.

Don't fight the Fed!

***

Silliness aside, things look good, right? The Wall of Worry seems to be the silly side of things.

I remain long in low beta stuff and some oil. No changes for awhile.

The double-top idea looks like it's toast. Onward and upward.

Obama's Birth Certificate, Bernanke, and You

President Obama showed his birth certificate and Ben Bernanke speaks. Shouldn't it be a holiday or something?

President Obama showed his birth certificate and Ben Bernanke speaks. Shouldn't it be a holiday or something?

Well, the market started up but now is in the hidden dragon crouching tiger position, ready to pounce either direction based on what the Fed says about inflation, Growth, stimulus, interest rates, and Obama's birth certificate.

Everyone knows the President Photoshopped it, right?

;)

Anyway, at some point the Fed is going to have to acknowledge economic growth and inflationary pressures, along with the declining dollar, and hike rates.

Maybe not this time, but soon...

Tuesday, April 26, 2011

Meanwhile, in Real Estate

Home prices continue lower.

Home prices continue lower.

Real estate is the forgotten man, as it were. Maybe because most of those who have lost their homes have moved on. The banks have received their bailouts, and life goes on.

Meanwhile, the speculators have moved on to Silver, Oil, or NFLX.

But here's a reminder that the real estate market is still struggling.

Too much inventory. Unemployment is too high and wages are stagnant.

Stocks Rally! $$

The wall of worry is for losers! Stocks rally on better than expected consumer confidence and earnings.

The wall of worry is for losers! Stocks rally on better than expected consumer confidence and earnings.

"The gain over the last month, while not substantial, is nonetheless encouraging given the recent spike in food and fuel prices," said Jim Baird, partner and chief investment strategist for Plante Moran Financial Advisors in a recent note. "The survey suggested that inflation expectations actually eased a bit, while consumers viewed current broad economic conditions more favorably for the seventh consecutive month."

The bottom line is that we should expect some inflationary pressures as the economy improves and people are finding jobs. Overall, it's a good thing. We don't want to see a boom or a bubble, but manageable sustained growth.

Still, the Fed can't keep interest rates near zero forever and the QE (quantitative easing) will have to end.

Bottom line is that despite the wall of worry stuff, stocks keep moving up. CNBC had a guy on talking about a double top, but we should be moving up and beyond that today.

Monday, April 25, 2011

The Grocery Delivery Business Model

$WMT is getting into the grocery delivery business. Does this make any sense whatsoever?

$WMT is getting into the grocery delivery business. Does this make any sense whatsoever?

I remember back in the 1990's when some of the grocery chains tried the grocery delivery business. It didn't last long. Has anything changed to make it successful for Wal-mart? It works for books and bike parts, but groceries?

I want to thump on the watermelon myself. I want the bananas that aren't overripe, but have enough green on them to last a few days on the counter. When I pick the loaf of bread, I look at the expiration date and try to get the newest bread.

You know what I mean?

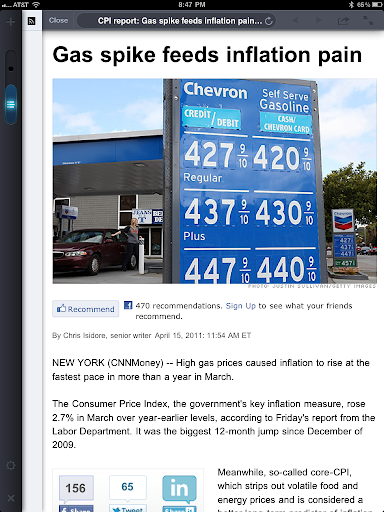

Gas Prices and the World Demand for Oil

It seems President Obama has finally noticed that gas prices are higher. Back in 2008, he urged Americans to inflate their tires to get better gas mileage. Not the worst advice ever, but it did seem to lack a bit of compassion for those trying to make ends meet from month to month.

In the meantime, we have unrest in the Middle East. Oil production in the Gulf is down about 13% since the BP oil spill. Most of the US is off-limits to new oil drilling. All of this is happening as the world economies are improving and the demand for oil is increasing.

Rather than blaming the voters for keeping their tire pressure too low, President Obama has found a new scapegoat: Evil Oil Speculators. Yes, another synonym for rich, Wall Street types, who steal from the poor to line their pockets.

The problem with the new scapegoat is that oil is a world commodity that is traded every day. This is not something that the US controls the price of. Oil prices are determined by supply and demand; they depend on how much a buyer is willing to spend on the next barrel of crude.

The reality is that the world runs on oil. The price of oil is going up. This directly affects people's ability to spend. If people are spending money at the pump and sending their cash overseas, that's money that doesn't get spent at the malls, restaurants and coffee shops. It affects company earnings.

And on the other hand, Exxon reports this week. I bet their earnings have been affected, too.

Disclosure: Long XOM.

Netflix Reports, Drops Afterhours

I love Netflix, but don't own $NFLX. They reported earnings and now 7% of Americans subscribe to Netflix. Including me!

I missed the stock. Afraid of competition with the low barrier of entry to streaming content over the internet. But the stock has been a huge winner so far. I still don't want it no matter what happens on the charts. I'm still thinking Amazon, Google, Apple, Comcast, ATT... Lots of players out there trying to get eyeballs.

Netflix taking a hit after-hours on future projections.

Sunday, April 24, 2011

Billy, Don't be a Hero

Perusing the skygrid app for market timing, I found this one from Seeking Alpha.

Bottom line, it's a look at some of the market leaders.

Just sharing...

The Week Ahead

Exxon, Coke, Bernanke, and the GDP: It's the last trading week of April, and we will see more earnings, the Fed, and economic data keeping things lively.

Last year, the market topped out during the last week of April and began a correction that lasted until August 30th.

Just a reminder.

The last few days of the week is when paychecks come out and that means money flowing into mutual funds, and especially "what's been working lately."

All the guessing on market tops and the next correction have been futile. The trend is up, interest rates are near 0%, and now we have signs of employers hiring folks.

***

Happy Easter to all!

Saturday, April 23, 2011

Consensus: The Rich Need to Pony Up!

If you make $200,000, or you and your wife make $250,000, congratulations! The people have been polled. You have been selected to participate in paying more taxes.

But is raising taxes on the rich the best way to cut the deficit? Not really. It could be part of a larger set of measures, but on its own, wouldn't raise all that much revenue.

Why? There just aren't that many rich people out there.

That’s right. The Congressional Budget Office calculated that raising taxes on the top two rates by 1% point would yield $115 billion.

And we currently have a $1.6 trillion deficit.

It seems to me we are simply living beyond our means. We’re borrowing money to enhance our standard of living. Many Americans tried that over the past decade, and ended up bankrupt. How will the nation fare any better?

***

“The problem with socialism is that you eventually, run out of other people’s money.”

- Margaret Thatcher

Friday, April 22, 2011

US Debt Ceiling: Worst Case Scenario?

Here is a column by Slate on the worst case scenario for the US should Congress and the President fail to agree on raising the debt ceiling.

Buy it?

Basically, it's the 3AM call scenario when the money runs out and Treasuries get dumped. The bottom line is that there's a last minute Hail Mary that resolves the crisis, but the world ditches the US greenback as the world's default currency.

Sure. For what? The Euro? It's not like the European nations have a handle on their debt issues.

I thought it was funny that in the list of news stations flipped to in order to find the latest, Slate omitted Fox News. C'mon. Neil Cavuto is all over this story, right!?!?!?

***

I need to remember not to buy junk food at the stores. All this working out can be sabotaged with too many chips! I actually had a red pear today, though. Tastes like a normal pear. So, why the red? A marketing gimmick?

I'm typing this on the Blogsy app for the iPad. Nice little app for blogging.

Lazy Portfolio Friday

Interesting column up on Marketwatch about Lazy Portfolio investing.

Interesting column up on Marketwatch about Lazy Portfolio investing.

It’s a buzz word for passive investing over active investing. In other words, ignore the gurus and the pitchmen, ignore financial TV, and determine your portfolio allocations, then set it and forget it.

Every one of our eight Lazy Portfolios is beating the S&P 500 by as much as five percentage points on the longer-term retirement benchmarks of 3-, 5- and 10-year returns. And they’re respectably close on the more volatile one-year basis. Fabulous benefits, and no time wasted with risky stock-picking and short-term trading.

I have an Audioboo about to be uploaded where I mention Toyota stock ($TM) and efficient markets. Everything known about the stock is priced in, right? So, the Lazy Portfolio would just ignore trying to time the buys and sells, and just reset target allocations across index funds or ETFs. No more stock picking our trying to figure out where investors may be leaning the wrong way.

The bottom line is that active investors struggle to beat index funds over the long term. Should one even bother to try?

I will stick with my current strategy and the Black Box, but I think it’s always good policy to look at other means to the end.

Thursday, April 21, 2011

Near a Stock Market Top?

Is April 2011 similar to April 2010? $$

Is April 2011 similar to April 2010? $$

This is a great article from Sy Harding comparing the similarities between April this year vs. April last year. Heck, even the year.

***

I remain long in low-beta stuff. May lighten up further if we do see distribution return - but, no reason to fight the trend just yet. IMHO, anyway.

Did a lighter workout today. Still reeling a bit from the cold, but want to get a little weight work in. Ate too much, though. Is it feed a cold or feed a fever???

Good Friday Eve Randomosity

$AAPL smashed forecasts, but as Marketwatch points out, Apple does lowball their guidance.

$AAPL smashed forecasts, but as Marketwatch points out, Apple does lowball their guidance.- It really is all about the economy and earnings. Stocks finished near session highs Thursday as strong earnings from the tech sector and several Dow components helped U.S. indices finish the week higher.

- Toyota recalling 308,000 SUVs in the US due to an airbag fault …to fix problems related to unwanted airbag deployments. Now, that’s a problem. Remember when Toyotas never had problems? Are computers and technology just making things more complicated?

- iPhone 5 won’t have Verizon 4G. You know, if there’s no 4G on the next iPhone, or iPad, I’m not updating. Or I’m going to an Android. No reason to update if there’s no speed.

- American Idol lost Pia Toscano, and now she may go on Dancing with the Stars. Or, at least she wants to.

- China markets slip on financials.

- Sure, the Nissan Leaf is the 2011 World Car of the Year, but who wants to buy one? Well, for the first three months in 2011, Nissan has sold under 500 Leafs.

- The spelling of “Leafs” is just wrong. “Leaves” - right? Didn’t we learn that in grade school?

Market Ends Week with Win!

What a week for stocks.

What a week for stocks.

Despite the news headlines and fighting in Washington DC (and state houses around the land), the stock market focused on the economy this week. The economy continues to grow and expand, and companies are making money.

We should all be!

Wednesday, April 20, 2011

Big Earnings Randomosity

- $AAPL: What are the rumors for the iPhone 5? A5 and 8 megapixel camera? Well, I hope 4G network speed. The current iPhone 4 is fine, as the bottleneck seems to be the wireless data service, right? Can I get an "Amen?"

- Earnings give Wall Street a boost. Kind of like the days of old (when magic filled the air), with Intel and Yahoo... And then in the after-hours Apple, Yum and Chipotle are signs the consumer is doing much better.

- Many folks are dropping their landlines and going cell phone only. Especially the poor. And why not? How many telephone numbers do we need? The land line is slowly going away.

- So, general market thoughts... Staying the course in low beta stuff. You can't deny that things are looking good. Interest rates near 0% and the stimulus continuing. We're seeing the money impact the economy. Of course, I've been mentioning the wall of worry stuff. Again, don't fight the Fed or the Trend. But we're still basically at the top of the trading range. That may go Poof tomorrow, though, if Apple drives up everything else.

- Into week 10 of bodybuilding. It's been a little rough this week with the cold. I skipped yesterday, and got the long day in today. On track to finish ahead of the weekend.

#80: $AAPL, $CMG, and $YUM Earnings, Dodgers, Weird Al Yankovic and Lady Gaga

Posted by muckdog at 4:11 PM View Comments

Labels: aapl, AudioBoo, cmg, dodgers, lady gaga, weird al yankovic, yum

$AAPL Afterhours Break–Weird Al Parody of Lady Gaga

Let’s celebrate $AAPL earnings with a Weird Al Yankovic parody of Lady Gaga’s “Born this Way” called “Perform this Way.”

Silly works for me.

$AAPL Earnings Crush Forecasts (Apple)

If you don’t own $APPL stock, you don’t own $AAPL stock. Apple crushes forecasts as revenues jump 83%

If you don’t own $APPL stock, you don’t own $AAPL stock. Apple crushes forecasts as revenues jump 83%

Whoa, Nellie.

Stock is up 3% after hours, as I type.

Earnings keep coming in, and great news for tech companies. The economy is rebounding and consumers are buying tech and companies are investing in tech.

Sometimes we (and me) spend so much time looking at the external stuff that we miss what’s right in our face. Sure, Japan is a mess, US debt and credit downgrades may be a problem someday, European debt, unfunded pensions, blah blah blah. The stimulus cash is flowing right now and interest rates are near 0%.

Don’t fight the Fed. Don’t fight the trend.

***

Came home. This cold is making me sleepy. Although it’s funny how much better one feels at home!

Miss the Gap, Miss the Move

Great earnings last night fed this morning's gap up. $$. If you missed it, you missed it. The market is flat since the gap.

Great earnings last night fed this morning's gap up. $$. If you missed it, you missed it. The market is flat since the gap.

Another reason to not fight the trend as the Dow is near a three -year high.

The only stock on the planet not participating? Wells Fargo. Beating by a penny just won't do it, Mister!

Regarding the S&P warning about the US credit situation? Who cares!

"That the U.S. dollar rallied after the negative watch status was announced, and ten-year U.S. Treasury yields declined slightly, suggests investors understand this action by S&P should force a realistic compromise plan to emerge as the U.S. approaches its debt ceiling limit in a month or so," Migliori said.

Do you really believe that? Does it seem that either side is serious about a compromise?

Anyway... Don't bother me when my portfolio is on a tear!

***

I remain long in low beta stuff and oil stuff. Maybe my whole trading range idea flew out the window but I'm not going to load back up on high beta ahead of summer. Nope.

Tuesday, April 19, 2011

$INTC: Intel Shows Up Strong Afterhours

So what happens 12 years later? Is Intel still the leader of the pack?

Intel posted great numbers after the bell.

We'll see what happens tomorrow...

***

Reposting. I have to be careful with Blogsy on the iPad. It can overwrite an existing blog entry if you're not careful on how you blog. It can also crash and wipe out your temporary work. Needs a little work it does.

Tuesday Randomosity

- Do you want to supersize that? McDonalds hiring 50,000 workers.

- Apple stock ready for the next leg up in the bull market? So normally, shares ramp up a bit heading into earnings, and sell on the news, right? At least that's my recollection. So this time, the stock has kind of been boring heading into earrings. But holding above the 50dma. Opposite? Rally afterwards? Hmm...

- I never watched The Biggest Loser until this year. Maybe because I'm being more serious with my own fitness. So, it's kind of motivational. I like to see these guys work for it. Of course, then I struggle with eating Cheez-Its while watching.... haha.

- Oh, gold over $1500. Good lord.

- The Lakers seem like they're struggling, eh? As a Lakers fan, I don't want to be greedy. But teams like these don't come along that often. Well, unless you're a Lakers fan. Bah.

- Americans prefer entitlement cuts to deal with debt problem. These polls kind of make you wonder how the questions were asked. Nobody wants their entitlement cut, right? It's okay as long as it is somebody else's entitlement.

- So week 10 workout slippage. Got home late tonight from work, and still battling cold. So I just sat in front of the TV and exercised in spirit with the folks on The Biggest Loser. Will have to combine my arm workout day with my leg workout day to catch up.

Wall Street up on Tuesday

Stocks moves up today, and you have to think the bears are running out of gas.

Stocks moves up today, and you have to think the bears are running out of gas.

Nothing seems to slow down the desire to own stocks.

Not earthquakes, tsunamis or nuclear meltdowns.

Not bad debt in Europe.

Not a continuing slide in US real estate and unemployment.

Not gasoline over $4 a gallon.

Not unfunded pensions or social security.

Not a potential downgrade of US credit ratings.

Nothing but blue skies ahead.

Oh, and gold topped $1500 for the first time, by the way.

Monday, April 18, 2011

$AAPL (and Testing Blogsy on the iPad)

With the Nasdaq 100 reducing the percentage of $APPL in the index, and the stock flatlining, I just wanted to briefly say how much I love Apple's iPhone and iPad. And wasn't it Peter Lynch who said to buy what you know? (Or something like that - Should've bought NFLX!).

So, this is the other side. It has nothing to do about valuation or technicals. It's just a company that is hitting on all cylinders for the consumers.

I'm typing this blog entry on a relatively new app for the iPad called Blogsy. It's a pretty slick editor with a built in browser to include links and pictures. Drag and drop. Really. So we shall see how it really works. This is my first attempt!

The iPad has almost replaced my desktop. At least I use the iPad more than the desktop. I still use the iPad at home 99% of the time. It's not as much fun on a 3G network. While I have used the 3G here and there, and also used MyWi when I had a jail broken iPhone, the iPad shines with wifi. Same as the iPhone, right?

The iPhone is more portable and I find I prefer it during the work week. Besides, if someone in the office sees me tapping on the iPhone, it's not quite as a blatant "waste of time" as tapping on the iPad. Get caught screwing around on the iPad, the boss may not like it. On the iPhone, it's just a quick text, right?

LOL

***

In addition to testing Blogsy, I'm watching Dancing with the Stars in the background. Len's comment about Cheryl Burke "showing her Rocky Mountains" - classic.

Apple ($AAPL) From 20% to 12% of Nasdaq 100

I’m in and out of $QQQ from time to time as a method to adjust portfolio beta. One of my friends jokes, “$QQQ? You might as well just buy $APPL!”

I’m in and out of $QQQ from time to time as a method to adjust portfolio beta. One of my friends jokes, “$QQQ? You might as well just buy $APPL!”

Beginning May 2nd, the Apple weighting in the Nasdaq 100 will go from 20% to 12%. Still not the most diversified ETF on the planet, but something more reasonable than loading the basket with iPads and iPhones.

This means the QQQ will have more Microsoft and Oracle. Those stocks are the 90’s darlings, and definitely not as sexy.

The United Banana Republics of America

Deficit-Shmeficit.

The US have a $1.6 trillion hole this year, and somewhere around $14T in outstanding debt. The country makes "interest only" payments in the debt, as new debt pile up. When $30B of budget cuts, which are mostly accounting gimmicks, are the best we can do, what did everyone expect?

Then there is the local and state debt, unfunded pensions, unfunded Social Security, Medicare and Medicaid.

What could possibly go wrong?

Stocks down 1.25% as I type.

***

At work. Sick with a cold. I know I should be at home, but ...

Sunday, April 17, 2011

Sunday Randomosity

The stock market, Nicolas Cage, $AAPL and the Los Angeles Dodgers are all under a bit of scrutiny as I peruse the headlines…

- US Economy in Rough Patch with bad weather, Japan and high oil prices. Well, of those I think the oil prices are the biggest impact here. Gasoline prices affect most Americans as they need the fuel to get from here to there. When you think about it, oil shock has been in front of recessions. So let’s hope that we can somehow avoid it this time.

- Japan dealing with power shortages. (Yikes, and that’s not all, right?) Due to damage to plants operated by Tepco and Tohoku Electric Power Co., Japan’s Ministry of Economy, Trade and Industry is planning to impose a conservation directive for large-lot utility users of around 25%, and 15% for households this summer.

- Well, Nicolas Cage doesn’t appear to be watching for the MACD crossover Seasonal Spring sell signal. "(Cage) and his wife (Alice Kim) were standing in front of a residence that he insisted was the property the couple was renting," Flot said in the statement. "She disagreed and Cage grabbed her by the upper arm and pulled her to what he believed was the correct address." The actor then began striking cars and tried to get into a taxi cab, Flot said.

- Apple stock seems stuck, right? Weighed down by questions, they say.

- The Los Angeles Dodgers lost their fifth straight yesterday to the Cardinals. "It's not pressure, but you definitely want to be the guy that can get your team out of it and stops the bleeding," Kershaw said. "Unfortunately, I just kind of kept it going." Yeah, well. $119 on the internet MLB.tv package WASTED! Darn Bums.

Saturday, April 16, 2011

Closing in on Another "Sell in May" Year? $$

It's close to that time of year. Time to sell stocks and hunker down for the summer!

It's close to that time of year. Time to sell stocks and hunker down for the summer!

Well, it's only been working in the even years lately. But just about the time we recognize that, something is bound to change.

It all seems set up for it. Double top in place. Gas prices up and taking folks' spare cash. A little bump in unemployment. A budget battle in DC, if not in most state houses.

Stay tuned...

***

Under the weather but still went cycling for an hour and mowed the lawn. Oh, and I'm at the Indian casino. Again. Lather, rinse, repeat...

Atlas Shrugged

Atlas Shrugged hit the box office, and if I were more engaged and cared, maybe I’d go see it.

Wait, isn’t that one of the messages from the movie?

Wait, isn’t that one of the messages from the movie?

Seriously, I do want to see this. The million-paged book was fantastic. I’m sure the big screen adaptation fails in comparison. That’s what usually happens.

This is part 1, and there is going to be a part 2, then a part 3. OMG, a trilogy. Like Lord of the Rings, without the Orcs. (Unless there’s been a last-minute rewrite).

So, the story is set in 2016. That’s 4 years after the end of the Mayan calendar and thus the end of the world, so don’t panic it many never happen in the first place.

The linked to column says: This movie is for the faithful.

My inclination is to wait for the movies to be available on Netflix.

The Odds of Winning the NBA Championship

Here are the odds of winning the NBA Championship.

Here are the odds of winning the NBA Championship.

I’m just going to tease it, but the odds of the Lakers, Bulls or Celtics winning is 56%.

As a Lakers fan, I’m hoping for another one. But, geez, I don’t know if they’re peaking at the right time. LA kind of struggled towards the end, right?

Do you take a chance on an East team this time? I think I would.

No positions. Probably will just watch ‘em.

Stock Volume in Bull Markets vs. Bear Markets

Good column up at Marketwatch on the differences in stock market volume in bull and bear markets.

Good column up at Marketwatch on the differences in stock market volume in bull and bear markets.

The writer’s point of view is hat we are in the latter half of a lengthy bear market. I think that agrees with the secular bear market point of view, and that we’re now in a cyclical bull market. I tend to agree with that.

In addition, I think it’s important to be long right now. But looking at the seasonal stuff, and since we’re right near the bull market peak, I’m wondering if we’ll see a trading range for awhile. And that’s been my position since January 18th, when I sold high beta and went into lower beta.

Yeah, I’m repeating myself a bit, but lets look at a chart of the QQQ:

The SPY:

The DIA:

So the January 18th date isn’t THE date for the market, but looks like the trading range idea was valid. And the NDX (QQQ) is below the 1/18 number for now.

Friday, April 15, 2011

Core Inflation vs. F'n Reality

I just wrote that inflation was tame. That would be ex-food and energy, or the core rate. The core rate was up 1.2%.

I just wrote that inflation was tame. That would be ex-food and energy, or the core rate. The core rate was up 1.2%.

Meanwhile, we're getting reamed at the gas pump, right? That's our pocket money. That's the money we feel because it means we have less to go to the fast food places or the movies with. It's not a large part of our budget, but it feels like it.

I'm not sure about food. It seems about the same to me, but others say food prices have gone up a lot. Maybe this is also a smaller percentage of our budgets, but since we go to the store so often this could also feel more personal.

Anyway, I believe the ex-food and energy is the right yardstick to measure inflation by. But it does seem to differ from F'n reality, right?

Slightly Negative Week for Market

Market down a little for the week.

Market down a little for the week.

If anything, we have to be somewhat positive about the tame inflation numbers but a little worried that the employment situation seems to be going the wrong way again.

I really haven't done much since I sold the high-beta holdings on January 18th and rotated into lower beta, oil, and cash. I've been researching some dividend paying ideas, but haven't acted on it.

***

On a personal note... I think I'm coming down with a cold. Feel a little funky, sore throat, etc. Hopefully, it's just allergies. Went on a bike ride tonight and just felt out of sorts. So, just relaxing.

That means no Audioboo for today...

Thursday, April 14, 2011

Joe Battipaglia Randomosity

- On a very sad note, Joe Battipaglia passed away today at the age of 55.

Long-time Wall Street analyst and media presence Joe Battipaglia died suddenly Thursday, his employer Stifel Nicolaus confirmed.

Known for his calm presence and deep institutional knowledge of Wall Street, the economy and securities markets, Battipaglia’s views were regularly sought by journalists from the most prestigious financial media outlets, and he was a frequent guest on the FOX Business Network.

- Memoriam to Joe at CNBC.

- From the Wall Street Journal: Battipaglia made a name for himself a decade ago as a consummate Wall Street optimist, remaining bullish on stocks up to and following the he bursting of the Internet bubble. His willingness to express his opinion to anyone who asked, unlimited availability and never-ending enthusiasm for the financial markets made him a media darling.

- From Reuters: The burly Wall Street veteran was a frequent presence on television, particularly during the bull market run in the 1990s, when he maintained a largely upbeat stance on the market and in some ways was an embodiment of the bullishness of the period.

- Well, I remember the latter about Joe, as he was fired up on tech stocks during the mania. And also from his recent appearances on the Fox Business Block shows on Saturday mornings.

$GOOG Misses Earnings, Off 5% Afterhours

Well, one of the big ones fell today in afterhours trading. The Mighty $GOOG.

Well, one of the big ones fell today in afterhours trading. The Mighty $GOOG.

The reason? Missed estimates. Even though, at first glance, it looks like Google is doing well. I guess it’s all about stock valuation.

(Plus, it’s just the afterhours. Things often get better, or worse, at the open the following day).

Other things weighing on the company? …the 10% salary increase awarded to all employees earlier this year also weighed on the company’s margins. Google has been widely seen as having to work hard to retain employees who might otherwise seek out jobs with younger firms specializing in social-networking services, such as Facebook Inc.

That’s actually a good sign for IT workers. If companies have to fight to retain and hire quality workers, that will push salaries up.

***

I was in two fantasy basketball leagues this year. Won the first one. In the second one, I finished second. Lost by TWO free throws. Whoa.

Econ Data Slows Stocks

Reason du jour for early stock swoon today: Data!

Reason du jour for early stock swoon today: Data!

Government data showed weekly jobless claims rose unexpectedly, climbing back above 400,000, while U.S. core producer prices rose slightly faster than expected in March, pointing to increased inflation pressures.

The thought is that gas prices and the Japanese earthquake are affecting the psyche of companies and their plans to expand and grow.

I definitely agree that gasoline above $4 is hitting consumers. As we spend more money at the pump, it means we spend less money at the malls, restaurants, and online shopping. The money has to come from somewhere and displace the money we spend on other things.

Not that this has slowed down the action at the local Indian casino or Cheesecake Factory. There’s always room for dessert, right?

Stock market has rebounded some off the initial open…

Tax, Tax, Tax

The President outlined his deficit-cutting vision yesterday: Tax, tax, tax.

The President outlined his deficit-cutting vision yesterday: Tax, tax, tax.

The bottom line was tax overhaul to take in more money from “the rich.” My issue is that it seems like the government spends about $1.30 for every dollar it receives. I’m not sure if that’s the exact ratio, but you get the idea, right?

In addition, I’m not sure raising taxes in a fragile economy is the right idea. One thing that is for certain is that the amount of interest the United States pays on the national debt grows year after year. That’s money that can’t be spent on anything else. It’s like when families run up their charge cards to the point where the minimum monthly payment impacts their ability to do anything else with their money. That’s the path the US is on.