The Dow, SP500, and Nasdaq all finished lower last week. How did the IBD cream of the crop stocks perform?

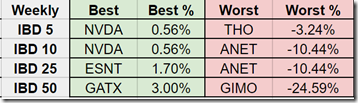

The top 50 stocks underperformed the SP500 index in the third week of 2017.

All IBD50 strategies were down more than the SP500 index.

The weekly strategies does a lot of trading in and out of the IBD50 index as the stock rankings shift, as if “chasing performance.” This could work well in an extended uptrend, but not as well in a market moving down or sideways.

There were two major disasters for the IBD50 this week: $GIMO and $ANET. $GATX led the IBD50 portfolios.

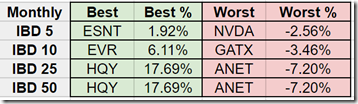

How is the monthly investing strategy for the top 50 IBD leaders do?

For the monthly strategy, all of the portfolios are now lagging the SP500 index in the second week of 2017.

It’s always interesting to compare how the changes in the monthly vs weekly IBD 50 strategies diverge as the month goes on.

$HQY is the top ranked stock in the IBD50 for the month in the top 25 and top 50 portfolios. $ESNT is at the top for the top 5 and $EVR for the top 10 portfolios.

Top 5 stock $NVDA leading to the downside for the month. $GATX struggling in top 10, and $ANET leading the loser list for the top 25 and top 50 portfolios.

All strategies exclude dividends in the calculations.

I will assume a $9.95 trading cost to sell last week’s or last month’s portfolio, and $9.95 to buy the new weekly or monthly portfolio. (Imagine the costs of doing this with individual stocks, compared to using Motif. Note that Motif limits the size of portfolios to 30 stocks).

None of the above strategies are a recommendation to buy or sell stocks. These are model portfolios constructed for entertainment only.

Each portfolio begins with $10,000 and then invests an equal amount in the top 5, 10, 25 and 50 IBD stocks at the closing prices on Friday for the weekly model, and at the closing prices on the last trading day of the month for the monthly model. Since IBD changes the make up of their top stocks daily, this will only rebalance on Fridays or end of month. It is assumed that trading costs are $9.95 to “buy” a model portfolio, and $9.95 to “sell” a model portfolio. Thus, each weekly or monthly rebalance out of the previous portfolio and into the new portfolio costs $19.90. Daily changes in the IBD 50 or stock rankings are not considered. Changes in IBD’s overall market views are not considered. Stop loss orders or other market timing strategies are not considered. The value for SPY is based on buying at the closing price the last trading day of the preceding year.

Based on a blog entry from Paladin Money. See Investors Business Daily for more information on the IBD 50. See Motif Investing for their IBD Top 25 portfolio, and the ability to construct your own portfolio of stocks.

I apologize for any spreadsheet errors!