Whoa - $BAC is at a new 52-week low, but still about double the price of the February 2009 low. This is the stock that Warren Buffett bought! How could it be going down?

Tuesday, November 29, 2011

Bank of America at 52-week Low!

The Day After the Rally

I don't like to see the Dow leading and the Nasdaq in the red. To me, this indicates risk avoidance and a desire of investors to be in the highly liquid, dividend paying, large caps of the Dow.

The Nasdaq leads the market.

Of course, today's moves aren't that dramatic. And maybe it's healthy to consolidate yesterday's gains before moving higher.

Still have almost three hours to go today. And this is still a jumpy market. We have seen lots of mid-day news releases send stocks in one direction or the other.

Monday, November 28, 2011

Fiscal Integration Monday

Why the rally? The NBA lockout ending? The reason du jour is a combination of good retail sales and a European "fiscal integration" plan. Basically, consumers are out spending and Europe may have a plan to deal with their fiscal issues.

Heck, in one day the market gained half of last week's losses.

Of course we know that the biggest rallies happen in down trends, so there is no reason to get out on the dance floor. Tomorrow is another day.

I remain 100% long.

Link

Sunday, November 27, 2011

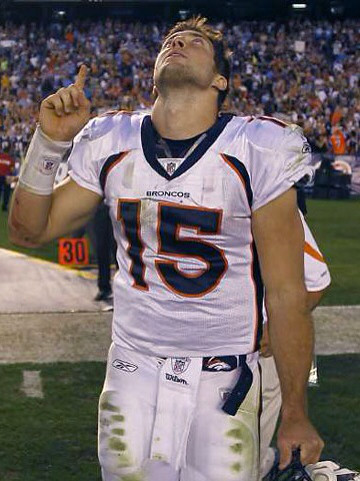

I Want Tim Tebow to Pick My Stocks!

Market Futures are Up! Let 'er rip!

As I type, the market futures are up over 1%. Of course, we have a whole lotta Europe between now and tomorrow, so there is no reason to think that the market will close that way by the closing bell. Yes, the market is waaaaay oversold and the pessimism is overwhelming. But we are steaming to the end of month and end of year, and that should be bullish.

Sunday Randomosity and the NFL!

- The Occupy Wall Streeters are raising a ruckus, but here is a column on the 1%. I agree that the so-called 99%-ers are purveying a bunch of nonsense. Maybe the cause for banking reform is just, but who knows what that OWS movement has turned into at this point. It seems to be about violence and mayhem. Who wants that?

- Some good games early. Bills almost did it against the Jets.

- Zero Hedge comments that folks went out spending on Black Friday like there's no tomorrow! Maybe. The Mayan calendar does end in 2012, uncannily predicting the financial collapse of the Eurozone -- and maybe the USA, too.

- I was watching Fox's Bulls and Bears yesterday, and noticed two completely different opinions by Gary Kaltbaum and Gary B. Smith. Kaltbaum is bearish, citing the technicals and the big sell off over the past week. Smith said everyone is a bear and we're in the bullish period of the year. Who do I agree with? They're both technical guys. I'd go with Smith. Kaltbaum is Mr. Whipsaw. The time to be bearish isn't when the market is so oversold heading into month-end and year-end. I know we keep getting smoked by Euro news. But we're running out of European countries to worry about!

- Hey, will there be a payroll tax deal by the end of the year? People kind of forget that there was a payroll tax cut that puts about $1000 a year in folks' pockets. They'll notice if the payroll tax comes back, eh?

Saturday, November 26, 2011

Saturday Randomosity!

- What is the market technical outlook? Mike Burk has a bunch-o-charts up. I like the comment that technical indicators haven't been of much use lately. Yeah. They're getting taken out by European news releases.

- Are there signs that the ECB may bail out the Eurozone? So what does that mean, ECB stimulus packages? Buying debt? Operation Le Twist?

- Barry Ritholtz at the Big Picture with a graphical representation of the Tablet Wars. Here are my thoughts. I have the first gen iPad and decided to go play with the Xoom, Galaxy Tab, Kindle Fire, Nook something or other, and an ASUS Transformer. Oh, and an iPad 2. iPad 2 is better. It costs more. But it's better. So I'm waiting on the next gen iPad 3. Some of the smaller ones are lighter weight, but they just felt underwhelming when it came to useability and features. There. I said it.

- So the NBA has an agreement to play a shorter schedule beginning on Christmas. 66 games starting on Decmeber 25th. Isn't that all we need of an NBA season anyway?

- The market was down about 5% this past week. It has been down almost everyday since Moses parted the Red Sea. We're due for some sort of bounce, right? Unless Europe intervenes with some bad news...

- I read some blog that was blasting the Fox series Terra Nova, saying that it was a huge blow to Sci Fi. I actually have grown to like the series enough to watch it. Yes, maybe the science is off a bit -- for all we understand of the period. But at least it is Sci Fi. And it's not horrible. I'd prefer less drama and more sci-fi. But right now, it's all the sci fi we have.

- Black Box still on the buy signal, but I do have to say that VERY RARELY does the black box give a signal and the stock market immediately moves against the signal. It's not a good sign for the validity of the signal when that does happen. Yet, because the market is so oversold it would seem that any kind of bounce would bail out the buy signal. Maybe...

Black Friday Breaks Records!

Some good news: CNN is reporting that Black Friday broke records, and that online sales were up 24%. Despite the worries about a recession -- while GDP is at 2% -- or Europe, folks are willing to spend cash on stuff.

Friday, November 25, 2011

#126: Black Friday CRAZIES! Stock Market Swoons on EUROPE!

Posted by muckdog at 5:37 PM View Comments

Labels: AudioBoo, black friday, europe, pepper spray, stocks

Biggest Thanksgiving Week Stock Loss Since 1932

Wednesday, November 23, 2011

#125: Black Box Buy Signal, Stocks Down 6 in a Row, Occupy Best Buy!

Posted by muckdog at 5:47 PM View Comments

Labels: AudioBoo, black box, black friday, europe, stocks

Tuesday, November 22, 2011

#124: Audioboo/Podcast on Today's Headlines

Posted by muckdog at 8:23 PM View Comments

Labels: amazon, AudioBoo, europe, ipad, kindle fire, stocks, super committee, xbox

Black Box Buy Signal!

A buy signal on the Black Box today, just as I was suspecting yesterday. As of yesterday, long high-beta Nasdaq and Small Caps. Here is the Black Box on the $QQQ.

It’s not a perfect tool, but has done well. It missed the October 4th low, for example.

Monday, November 21, 2011

Buying Stocks!

Buying high-beta Nasdaq and small caps this morning, ditching cash and low-beta.

Maybe I'm crazy. But the super committee not reaching a deal is probably good news for the US debt picture. Plus, we are in favorable market season. The Black Box is close to a buy, too.

Maybe we will get a big reversal today.

We. Shall. See.

Sunday, November 20, 2011

The Futures are... Down!

As I type, the stock market futures are down close to 1%. Much can change overnight, but should we have a gap down in the morning, I will consider getting a bit more aggressive. Not because the Black Box says so -- although, it isn't far from a buy signal. I am just looking at oversold conditions as we are in a historically bullish time of year.

Saturday, November 19, 2011

#123: Thanksgiving Week, Warren Buffett, Oil, Social Media Stocks

Posted by muckdog at 11:27 AM View Comments

Labels: AudioBoo, oil, social media, socl, thanksgiving, Warren Buffett

Friday, November 18, 2011

TGIF Randomosity!

The stock market had a rough week. The Dow dropped 2.9%, the S&P 500 lost 3.8%, and the Nasdaq dropped 4%. Blame Europe.

- News from 1981: Christopher Walken hires laywer over Natalie Wood investigation.

- Hey, this week’s sell off is even after Warren Buffett jumped into tech stocks like IBM and Intel! I’m not a big fan of buying stocks AFTER Buffett has bought them. I’d rather buy BEFORE he does. Right? Both these stocks have dividends.

- You heard the Major League Baseball news that the Houston Astros are moving to the AL West, right? And that an additional wild card team from each league will be added, with a best-of-three wildcard series added to the post-season. Cool. I suppose this means more TV money or something, but it also makes it more interesting as additional teams now have a shot at the post-season.

- You know what also happened in 1981? Greece enters the European Community (later becoming the European Union). Really.

- So, the Tennessee Valley Authority has a pay freeze for almost all of their employees. The CEO is excluded, and his compensation increased $352,000 in fiscal 2011 to $3.95 million. Well, that’s some happy news for the TVA folks, eh? Good grief.

- Hey, looking for stock market contrarian indicators? You know we’ve had (and will have) lots of social networking (internet) IPOs, right? Well, how about an Social Media ETF? Yikes, remember the B2B mutual funds of 1999-2000? How’d that turn out?

- Dodgers beat the Yankees 4 games to 2 games in the 1981 World Series. Really. Indiana beat North Carolina in men’s NCAA. Raiders beat the Eagles for the Super Bowl.

- Hillary Clinton thinks that the Syrian conflict could become a civil war. You know, we have it pretty good here.

Tuesday, November 15, 2011

Monday, November 14, 2011

The Black Box Update

At lunch, friend asked if the market was up or down. I said that the Dow was down about 100. “Oh,” he said. “Something bad happen in Greece or Italy?”

And that’s what the market is about these days. It’s about European debt and austerity measures (or the lack there of).

Well, same old, same old on the Black Box. Still on a sell signal as the market moves sideways.

Sunday, November 13, 2011

The Yo Yo Market

I can't remember a time where the market has been more volatile on news outside of the US. Sure, we've seen the market gyrate on earnings and economic numbers, but the news from Europe has been causing wild swings.

It's tough to have an asset allocation strategy when things outside of the US realm drives the gap up or the gap down.

Yet, I still persist. The Black Box has been pretty good through all this. I attribute that to the extreme readings we get on the rallies and sell offs. The charts still try to wade through the headlines.

My allocation remains the same. Cash, low beta stocks, oil, and a small caps holding.

***

Fantasy football has been rough this year. Can't blame Euro headlines for that, though...

Wednesday, November 09, 2011

Back on the Grid

The Black Box is still on a sell signal. Europe (now Italy) still driving the daily swings.

Back on the grid after a bunch of days losing money in Las Vegas. The big hurt was the Steelers losing the cover with 8 seconds to go!

More later... Market is crazy.

Friday, November 04, 2011

The Ice Cream of the Future is Dead

Dippin’ Dots has labeled itself as the ice cream of the future for as long as I can remember. It has filed for bankruptcy.

Dippin' Dots Files for Bankruptcy

Dippin' Dots Inc., the self-described "ice cream of the future," filed for Chapter 11 bankruptcy protection Thursday in U.S. Bankruptcy Court in Paducah, Ky., near its headquarters, after fighting off foreclosure efforts from Regions Bank for more than a year, according to court documents. At the time of the filing, the company owed about $11.1 million to the bank.

Public Sector vs. Private Sector

The jobs numbers keeps on showing that the private sector is adding jobs while the public sector is losing jobs.

In October, the private sector created 104,000 jobs, with gains led by professional and business services (33,000) and leisure and hospitality (22,000). Manufacturing posted a small 5,000 jobs gain. Meanwhile, governments at all levels cut 24,000 jobs. Since May 2010, government has cut one million jobs while the private sector has added 2.28 million positions.

Isn’t that the trend we want to see?

Thursday, November 03, 2011

Groupon Friday at $20 a Share!

Groupon will price at $20 on Friday, but if you click their link you buy it at $10 plus get a day spa treatment.

Tuesday, November 01, 2011

The Black Box Update for 11/1/11

Here is what the Black Box looks like tonight for the $QQQ. It’s funny how it seems to be right most of the time, even though there is no way the system can predict European headline news or company bankruptcies.

And it didn’t get the October 4th key reversal – which turned out to be a nice washout at the lows. So far, anyway.