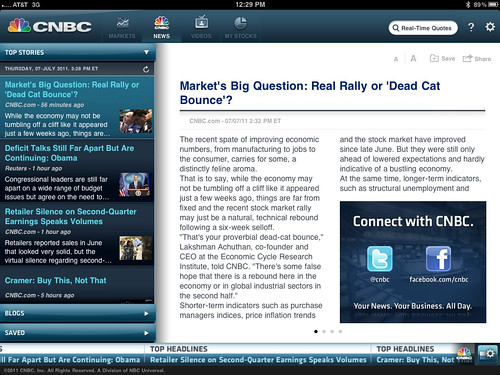

The money ball question is what the heck is this move of the past couple of weeks? Rally or dead-cat bounce?

The money ball question is what the heck is this move of the past couple of weeks? Rally or dead-cat bounce?

You know from my previous entries that I think this summer is seeing the same kind of correction that we saw last summer. Only difference for me is that this time, I tried to play the bounce in the middle. I think I caught it. Didn't get in at the lows, and didn't sell at the highs, but I think I caught enough of the trading range to put a big watermelon smile on.

Unless the correction is over and I wake up to another gap up tomorrow... and the next day... and the next day... etc. Nobody gets this stuff right all the time. And the important thing is to recognize when one has really messed up, then readjust and move forward.

The big issue that we face is high unemployment and excess capacity. I do think the economy continues to grow, but just at a slower pace than we'd like. I also believe that the market benefits from gridlock in Washington DC, as we don't really have to worry about higher taxes, cap and trade taxes, or that sort of thing. The market likes the government to just step aside and let consumers drive supply and demand.

My ultimate hope is that the market continues to just grind higher.