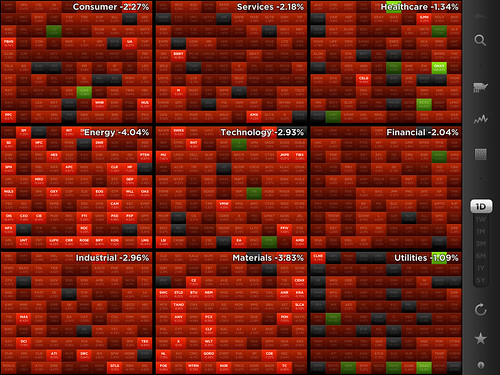

Whoa Nellie, quite the sell off on Wall Street today! Just look at the market sectors: $$

Who saw that coming?Of course, we do have a reason du jour:

Stocks posted the worst day in three weeks on Thursday on mounting evidence that slowing manufacturing growth worldwide threatened corporate profits.And if that wasn't enough, Credit Suisse decided to get some of the action:...

Stocks' slide was accelerated by a bearish call from Goldman Sachs, which recommended clients build short positions in the broad S&P 500 index on expectations of more economic weakness.

Credit Suisse Group AG's credit rating was cut three levels by Moody's Investors Service, Morgan Stanley was reduced two levels and 13 other banks were downgraded in moves that may shake up competition among Wall Street's biggest firms.So there you have it.

Haven't had time to run scans. This could be just a one-day wonder in the scheme of a summer rally, or we could just be in a summer trading range during the "unfavorable season" of the market. You know where I stand - cash and low beta stuff. I believe this is just another Spring-Summer correction, and that there will be a chance to get back in near the bottom of the trading range in Sept-Oct timeframe.