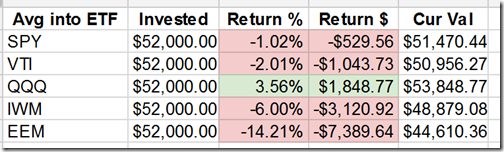

I beat the market in 2015, with a 7.5% return. This is due to an overweighting in $QQQ and also some individual stocks. The biggest winners were $MCD, $FB, $JD, and $DIS.

I beat the market in 2015, with a 7.5% return. This is due to an overweighting in $QQQ and also some individual stocks. The biggest winners were $MCD, $FB, $JD, and $DIS.

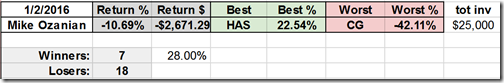

I also had a few ugly ones, including $LVS, $TWTR and $XOM (then rotating into another loser, $EOG). Then I had a few names that towed the line with index, and didn’t do anything other that spit out a few dividends every quarter.

Fortunately, I was considerably overweighted in the better names.

2015 was a year where I bought and held companies I thought would beat the market. I didn’t chase the IBD hot stocks or take the hot tip of the day. I didn’t run my market timing model every day. I did raise a little cash before summer and reinvest in August, in a little nod to Sy Harding and “sell in May and go away.”

By the way, had I used my market timing system using $QQQ, I would have made 11% on 9 trades, with 8 of them winning trades.

Heading into 2016, I am fully allocated and remain in the holdings I mentioned. I think my winning stocks will continue to be winners, although I would expect $MCD to slow down and $DIS to bounce back. $FB is a big holding and I’m a believer of The Social Network growth. Of the losers, I don’t know when energy comes back, but know it will. Cheap energy never seems to last for long.

I think $TWTR makes it. I don’t know how much money they’ll make or when the stock will get hot again if ever. But I spend enough time on there to know it’s addictive and a great time waster. This is a “buy what you know” kind of stock. It’s just where people go for instant news and chat. I think the company figures it out someday. And the stock could be volatile for trading around the position.

$LVS is the ugly ducking where you just never know about the Chinese gambling market. I’m going to stick with it for now, banking on a continuing growing economy in China and the reality that people love to gamble. As the population grows, as affluence grows, the casinos will get busier. The company also continues to pay and raise the dividend, too.

Then, there’s energy. Energy. Energy! This is the amazing topic of 2015, where declining oil prices were supposed to help the economy and give consumers more money to spend. Where is that money going? Or, is the declining labor participation rate offsetting that?

Oh, the stocks. I don’t believe oil prices are going to $0. As companies cut back on production, eventually supply and demand issues work themselves out. I rotated back into $XOM and think that’s the place to be for now. Until things get better, some of the companies where R&D and investment money goes could get hit further.

Overall, I have about 10 stock tickers and mostly index ETFs. I believe my big winners of 2016 will be $FB and $DIS, with the corner of my eye peaking at $TWTR.

I haven’t bought any Dow Dogs this year, but think $IBM is interesting.

Happy New Year!